Blockchain evaluation platform Glassnode has shared some essential insights on Bitcoin’s liquidity ranges amid a moderately risky market interval. Notably, the main cryptocurrency has struggled to keep up its “Uptober” type after a value surge to $126,000 was adopted by a heavy correction to under $105,000. Whereas Bitcoin has proven some restoration exercise since then, it’s but to interrupt above the $115,000 resistance, whereas its complete month-to-month achieve stands at 0.47%.

Bitcoin Liquidity Rises, Testing Demand Energy

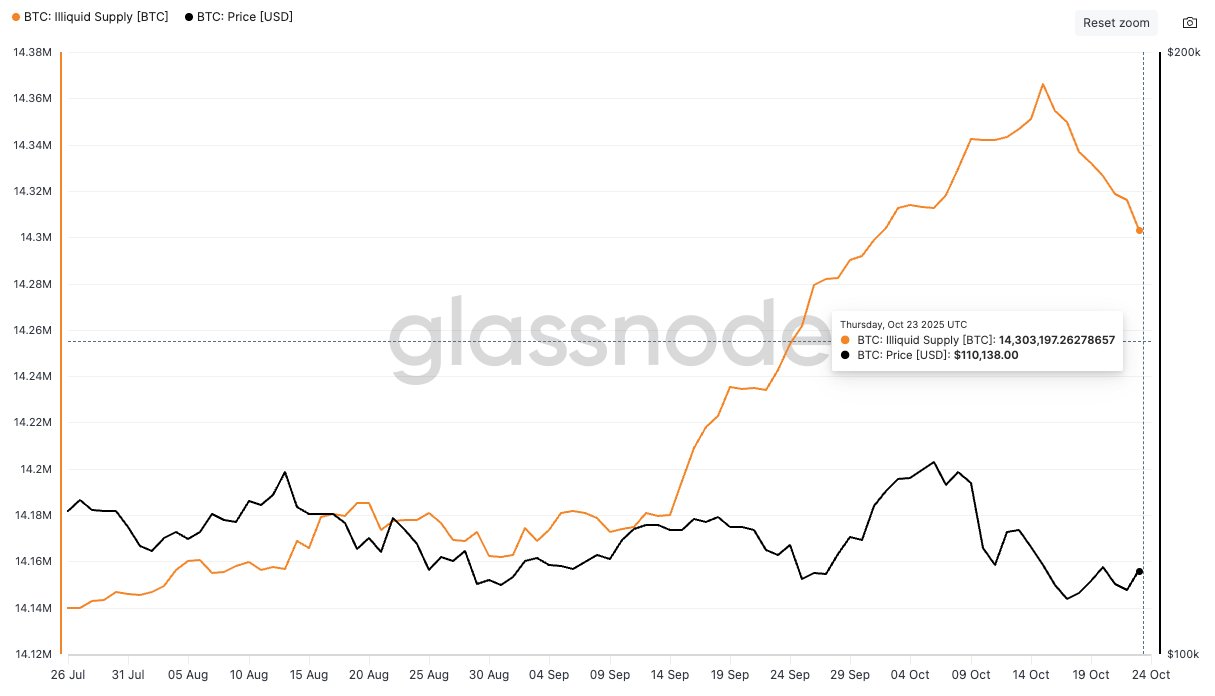

In an X post on October 25, Glassnode stories that Bitcoin’s illiquid provide has fallen by 62,000 BTC since mid-October. For context, Illiquid Bitcoin refers to BTC that’s held in wallets with little to no historical past of promoting. They’re basically cash which might be unlikely to maneuver as a result of their holders not often spend and are thought of off the market.

Subsequently, a decline in illiquid BTC means that extra cash are returning to energetic circulation, rising obtainable provide. This dynamic could make sustained value development more difficult until offset by a robust surge in demand.

Glassnode explains that illiquid provide development has been a optimistic catalyst on this market cycle earlier than this current decline occurred. Traditionally, comparable pullbacks, such because the 400,000 BTC decline in January 2024, have tended to sluggish market momentum by rising the quantity of Bitcoin in energetic circulation.

Who’s Behind The Sale?

In analyzing this fall in illiquid BTC, Glassnode additional found that Bitcoin whales’ accumulation exercise has accelerated. Particularly, BTC wallets have elevated their holdings over the previous 30 days and have but to liquidate any giant positions since October 15.

Subsequently, the rise in BTC liquidity has been pushed by retail traders. Extra information from Glassnode reveals that wallets holding between 0.1-10 BTC, i.e. $10,000 to $1,000,000, have been producing constant heavy outflows. Particularly, this set of merchants has been steadily lowering their BTC publicity since November 2024.

In relation to current value motion, Glassnode analysts observe that momentum consumers, primarily retail traders, are more and more exiting the market. Though dip consumers i.e., whales, have stepped up their exercise, their demand has not been adequate to soak up the surplus provide, resulting in the worth imbalance at the moment noticed.

On the time of writing, Bitcoin is buying and selling at $111,570, reflecting a modest 0.89% achieve over the previous 24 hours. On increased timeframes, the main cryptocurrency has recorded a 4.11% enhance over the previous week and a marginal 0.05% rise over the previous month.

Featured picture from Flickr, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.