Dogecoin is again urgent a long-standing resistance cluster as two distinguished merchants map the subsequent pivotal steps. Cantonese Cat highlights a cussed month-to-month Fibonacci ceiling on the 0.886 retracement—marked on his chart at $0.26633—whereas prime dealer Kaleo (who’s main the Synthetix buying and selling problem) factors to a thin-liquidity pocket on decrease time frames that he believes may allow a “swift reclaim” of $0.25.

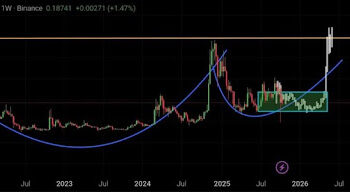

Lengthy-Time period Perspective On Dogecoin

On the month-to-month grid shared by Cantonese Cat, the important thing ranges are unambiguous. DOGE’s main resistance stays the 0.886 retracement at $0.26633, just under the cycle reference at 1.000, labeled $0.73905.

Help beneath worth traces up with the 0.786 retracement at $0.10879, adopted by 0.707 at $0.05363 and 0.618 at $0.02417. The present month-to-month candle sits close to $0.19–$0.20 with roughly ten days left on the bar, holding inside a consolidation hall bounded by $0.10879–$0.26633 after an aggressive spike that depraved into 0.786—what the analyst referred to as a “rip-off wick.”

Associated Studying

His read: DOGE “is having a tough time breaking above 0.886 for good,” as a result of a clear breach can be “incredibly bullish,” and he expects one other problem of that stage in This autumn 2025.

The degrees on the chart contextualize DOGE’s multi-quarter construction. Because the 2021 blow-off, worth has revered the Fibonacci ladder, repeatedly orbiting between the 0.707 and 0.886 bands. The failed pushes towards $0.26633 and the short rejection wicks underscore how provide continues to reload at that shelf, whereas the sharp however short-lived pierce to the $0.10879 area confirms dip demand on the 0.786 deal with with out establishing acceptance under it.

With the candle our bodies clustered mid-range and the tails testing each extremes, the pair has carved a high-time-frame equilibrium that may possible resolve on a month-to-month shut by means of both $0.26633 or a breakdown again towards $0.10879.

What Wants To Occur Brief-Time period?

Kaleo’s intraday view isolates the trail that might drive that higher-time-frame determination. His 4-hour chart plots a descending trendline from the native excessive by means of successive decrease highs, at present intersecting close to the $0.20–$0.21 zone the place DOGE is buying and selling round $0.203–$0.204.

A visual vary quantity profile reveals a distinguished node round $0.20–$0.21 and a conspicuous low-volume pocket above, working by means of the low-$0.20s towards a inexperienced provide band capped close to $0.25. He describes “A LOT of skinny air to fill from the market nuke a pair weeks again,” referencing the vertical liquidation that drove DOGE from the mid-$0.20s to sub-$0.12 in a single cascade earlier than rebounding.

Associated Studying: Is The Dogecoin Bull Run Over? Analyst Sees Echoes Of 2021

Technically, that setup is simple: reclaim the descending trendline and maintain above the point-of-control zone round $0.20–$0.21, and worth enters the low-resistance void towards the prior distribution close to $0.24–$0.25. Fail the reclaim, and the purple horizontal basing space round ~$0.19 turns into the fast pivot, with the extreme downside reference from the “nuke” nonetheless seen close to the mid-$0.15s earlier than the month-to-month 0.786 at $0.10879 re-enters view.

The interaction between these charts is the crux. On the excessive time-frame, $0.26633 is the “ultimate boss” that has repeatedly turned worth; on the low time-frame, the path to re-test that wall begins with a squeeze by means of a low-volume hall into $0.25. A decisive month-to-month shut above $0.26633 would flip the market’s most consequential resistance into assist and shift the dialog toward the 1.000 reference at $0.73905, however—per Cantonese Cat’s warning—that end result isn’t confirmed by the present construction.

At press time, DOGE traded at $0.191.

Featured picture created with DALL.E, chart from TradingView.com