Key Notes

- Ethereum briefly reclaimed $3,900 however stays in a high-risk zone.

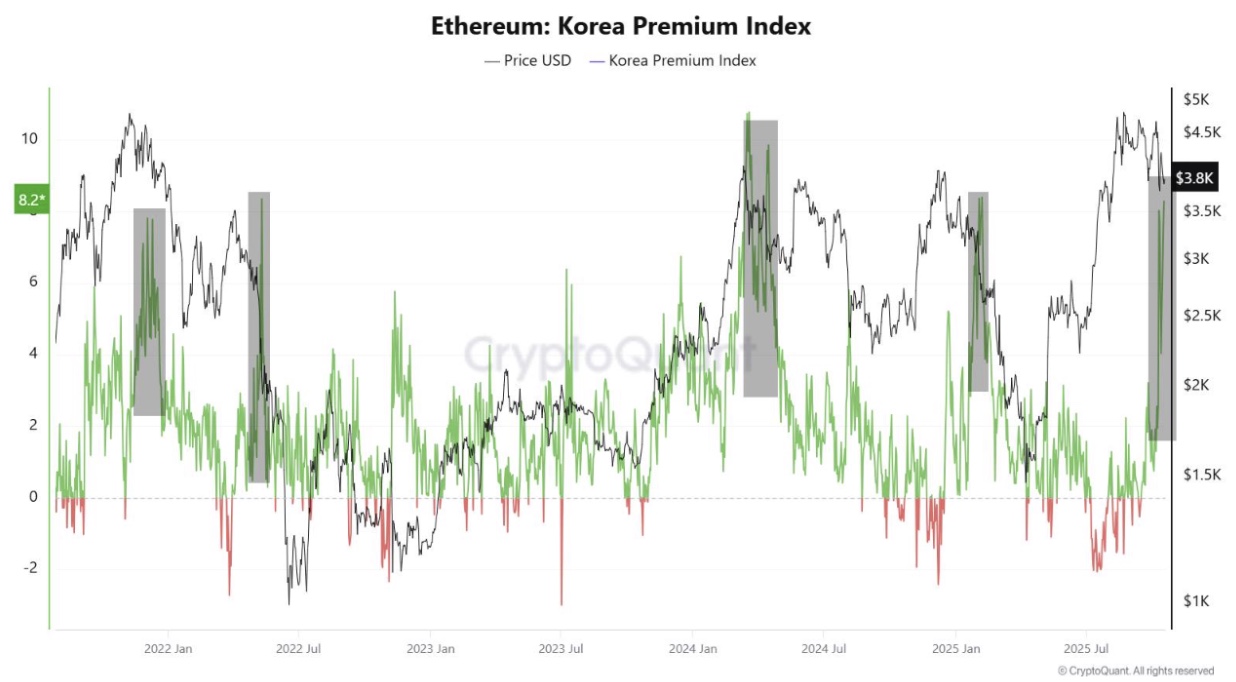

- The Korea Premium Index surged to eight.2%, traditionally signaling native tops.

- Resistance lies between $3,870 and $3,920, with breakout targets at $4,160-$4,425.

Ethereum (ETH) briefly discovered its method again above $3,900 on Saturday, a gentle rebound after a risky week that noticed value motion testing key help ranges close to $3,600. Nonetheless, ETH is down 15% month-to-month, as per CoinMarketCap.

Additionally, CryptoQuant analysts have warned that ETH now trades in a “high-risk zone” marked by overheated retail sentiment and resistance ranges.

At press time, ETH trades at $3,877.40, up 3.4% previously 24 hours and 1% over the week. The bounce got here after costs dipped to a each day low of $3,678.62 earlier than hitting $3,927, simply shy of the crucial $4,000 mark.

Buying and selling quantity, nonetheless, fell sharply by 25% in the identical interval, suggesting restricted exercise behind the transfer, i.e., the rally won’t final lengthy.

The Korea Premium Flashes Pink

On-chain knowledge from CryptoQuant reveals that the Ethereum Korea Premium Index (KPI) has surged to eight.2%, a stage traditionally linked to native market tops and imminent corrections.

The index, which measures the value hole between South Korean and world exchanges, signifies heightened FOMO amongst Korean retail merchants, a warning signal that the rally could possibly be shedding basic help.

Ethereum: Korean Premium Index | Supply: CryptoQuant

Traditionally, related spikes within the KPI have preceded sharp retracements. When the premium hit comparable highs in late 2021 and early 2024, Ethereum skilled important pullbacks within the following weeks.

Analysts state that such elevated readings usually sign extreme retail shopping for stress whereas bigger holders use the chance to take income.

$3,870–$3,920: The Key Battle Zone

In response to crypto analyst Ted Pillows, Ethereum is now making an attempt to reclaim a essential help zone between $3,870 and $3,920. His chart means that this vary will decide whether or not ETH can regain upward momentum or slip again right into a deeper correction.

$ETH is making an attempt to reclaim a key help stage.

It had a bullish bounceback from the $3,600-$3,700 stage and is now trending increased.

If Ethereum is ready to reclaim the $4,000 stage, it’s going to be the primary signal of power. pic.twitter.com/fP0KFDUmSF

— Ted (@TedPillows) October 18, 2025

A clear break above $3,920 may open the door to $4,160 and $4,425, whereas rejection from this stage may ship ETH tumbling towards $3,700 and, in a extra bearish case, $3,350.

The chart additionally reveals a number of response zones aligning with historic demand ranges, indicating that ETH is in a broad consolidation sample. Bulls want a sustained each day shut above $4,000 to re-establish a short-term uptrend.

Whale Buys the Dip

In the meantime, some deep-pocketed buyers look like quietly buying the dip. A newly activated deal with accrued over 4,300 ETH (value roughly $17 million) in simply three days, with purchases close to each $4,096 and $3,892.

🦈 A brand new whale is quietly stacking $ETH once more.

a recent deal with (0xAeA…DD5fD) has accrued 4,332 $ETH (~$17.17M) over the previous 3 days.

On Oct 15, the whale withdrew 1,506 ETH from OKX at $4,096.82, and right now added one other 2,825 ETH at $3,892.21, bringing the typical value… pic.twitter.com/vMFdrJCmaF

— Followin (@followin_io) October 18, 2025

This accumulation brings the whale’s common value to round $3,963, nearly at breakeven ranges, indicating medium-term confidence in Ethereum’s resilience.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any selections primarily based on this content material.

A crypto journalist with over 5 years of expertise within the business, Parth has labored with main media retailers within the crypto and finance world, gathering expertise and experience within the area after surviving bear and bull markets through the years. Parth can be an creator of 4 self-published books.