Key Notes

- CoinGlass liquidation heatmap reveals that $19.35 billion was liquidated from 1,666,361 merchants.

- Bitcoin, Ethereum, Solana, and XRP had been impacted, as their costs have dipped.

- Bitcoin worth slipped beneath $110,000, dragging most altcoins alongside.

Throughout the previous 24 hours, the broader cryptocurrency market has seen 1,666,361 merchants endure liquidations. The overall liquidations at present quantity to $19.35 billion, in accordance with information from Coinglass. This comes off as the most important liquidation that the digital asset sector has ever seen, coming proper after an thrilling market rebound.

Donald Trump Warns of 100% Tariffs on Chinese language Imports

On October 11, the crypto market recorded liquidation of roughly $19.35 billion, with lengthy merchants struggling the most important loss.

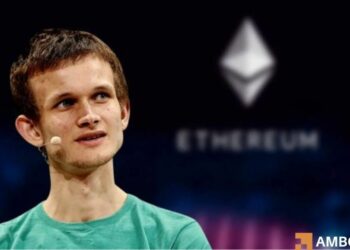

Prime digital property reminiscent of Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and even memecoins had been impacted by the state of affairs. Noteworthy, the most important single liquidation order was seen on Hyperliquid at a price of $203.36 million.

Coincidentally, the President of the US, Donald Trump, had earlier hinted at 100% tariffs on Chinese language imports.

His publish on social media warning the general public of the tariff met with blended emotions and reactions, which moved from the Conventional Finance (TradFi) sector and prolonged to crypto. There are nice issues that the US and China could also be coming into a brand new season within the commerce warfare that began earlier this 12 months.

The topic of the US authorities shutdown is one other contributor to this unlucky market situation. Up to now, it has delayed the discharge of key financial information.

Bitcoin Worth Slipped Under $110,000

The costs of most cryptocurrencies have declined considerably, beginning with the flagship coin, Bitcoin.

This crypto fell beneath $110,000 within the wake of the downtrend earlier than barely recovering. In response to CoinMarketCap information, BTC worth is at present $111,845.05 with a 24-hour dip of 8.17%. This can be a notable fall for a coin that hit a new All-time High (ATH) above $126,000, lower than per week in the past.

From a worth stage of over $4,800, Ethereum is now trading at $3,829.24, corresponding with an 11.93% dip in 24 hours. Additionally, Solana has seen a better lack of 14.87%, pushing its worth to $186.54. Binance Coin (BNB), which was the star of the season, has incurred a ten.54% loss inside the identical time to now commerce at $1,125.58.

Given how the market started the week, it’s unsurprising that lengthy merchants are essentially the most affected. They clearly believed that the optimistic momentum would proceed, however ended up disillusioned.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections primarily based on this content material.

Benjamin Godfrey is a blockchain fanatic and journalist who relishes writing about the true life functions of blockchain expertise and improvements to drive normal acceptance and worldwide integration of the rising expertise. His need to coach individuals about cryptocurrencies evokes his contributions to famend blockchain media and websites.