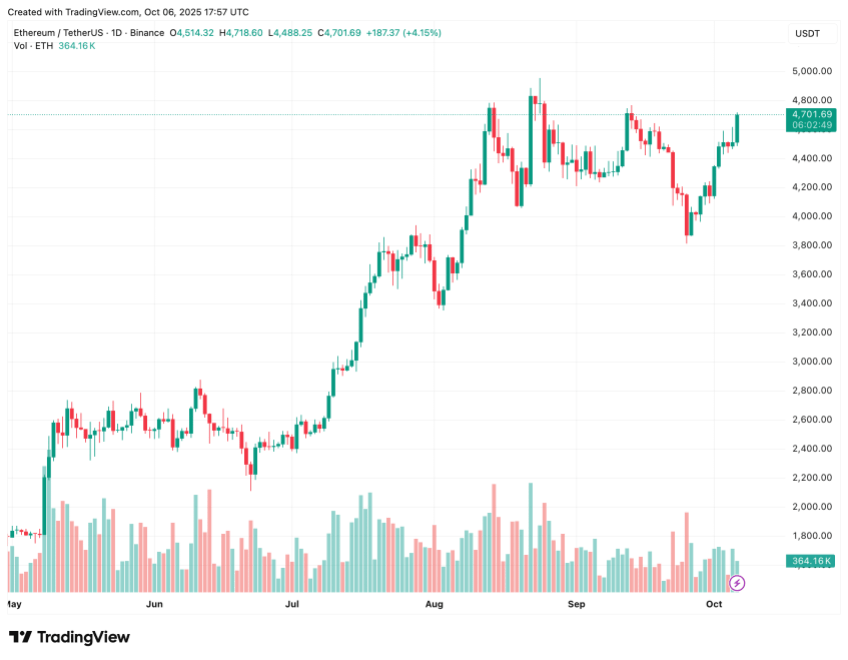

As Ethereum (ETH) steadily approaches its all-time excessive (ATH), some business leaders imagine that the second-largest cryptocurrency by market capitalization just isn’t fully benefiting from natural demand. Somewhat, it’s being “propped up” by Korean traders trying to make a fast buck.

Ethereum Being Held Up By Korean Buyers?

In an X post earlier at the moment, crypto entrepreneur Samson Mow made some attention-grabbing observations on ETH’s present worth trajectory. The crypto government attributed ETH’s present heightened worth to Korean retail traders.

Particularly, Mow said that roughly $6 billion value of Korean retail capital is supporting Ethereum costs. Mow blamed ETH influencers who’re reportedly touring to South Korea to market the digital asset to retail traders.

As well as, the founding father of AQUA Pockets stated ETH traders will not be totally conscious of the ETH/BTC chart, and are beneath the misunderstanding that they’re shopping for the “subsequent Technique.” He cautioned that it’ll not finish effectively for ETH traders.

To recall, Technique is the main public firm in the case of the quantity of Bitcoin (BTC) held on its stability sheet. In response to knowledge from Coingecko, Technique presently holds 640,031 BTC, value greater than $48 billion at prevailing market costs.

On the subject of Ethereum-based treasury companies, BitMine leads the pack, holding greater than 2.5 million ETH value roughly $12.4 billion. Different companies like SharpLink Gaming (838,728 ETH), Coinbase ((136,782 ETH), Bit Digital (120,306 ETH), and ETHZilla (102,246 ETH) spherical up the highest 5 within the listing.

There are a number of indicators that the Ethereum buying and selling market in South Korea could also be reaching overbought ranges. As an illustration, the ETH “Kimchi premium” surged to 1.93 on October 5, a big surge from -2.06 noticed in July 2025 when the cryptocurrency traded under $3,000.

For the uninitiated, the Kimchi premium refers back to the worth distinction the place cryptocurrencies commerce at increased costs on South Korean exchanges in comparison with international markets. This premium arises from sturdy native demand, restricted capital movement out of Korea, and regulatory obstacles that stop simple arbitrage between Korean and worldwide exchanges.

On-Chain Information Counsel Sturdy Demand For ETH

In distinction to Mow’s opinion, on-chain knowledge reveals that each institutional and retail demand for ETH just isn’t displaying any indicators of slowing down. BitMine continues to stack ETH regardless of it buying and selling near its ATH territory.

On the identical time, ETH-based exchange-traded funds (ETFs) proceed to draw an rising quantity of inflows. Not too long ago, US-based spot ETH ETFs attracted file inflows value $547 million. At press time, ETH trades at $4,701, up 4.4% up to now 24 hours.

Featured picture from Unsplash.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.