Whereas the Bitcoin worth appears to have deviated fully from the four-year cycle that dictated the earlier bull and bear markets, there are still some similarities that stay that counsel that it may nonetheless play out in the same manner. The main similarity that has emerged is the formation of a bearish crab sample again in 2021, and now, the identical sample has reappeared. Thus, looking on the route of the 2021 formation may give an insight into where the Bitcoin price is headed next from right here.

The Sample That Triggered The Bitcoin Value Explosion

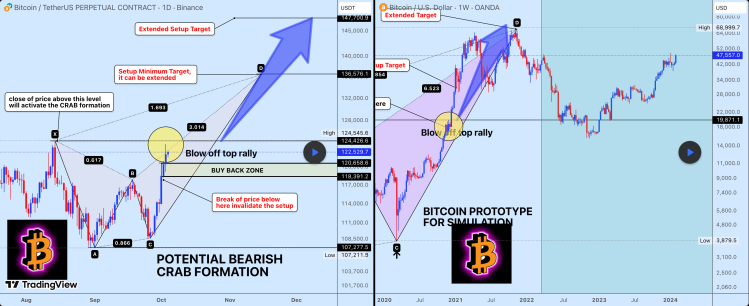

In an evaluation, crypto analyst Weslad was the one who pointed out that the Bearish Crab Sample had returned, and this was fashioned on the day by day chart as nicely. Apparently, the present formation appears eerily just like the way in which it fashioned again in 2021, suggesting that the ensuing development may play out the identical.

Associated Studying

Again in 2021, when the Bearish Crab Sample got here up, the end result was a worth explosion that despatched the Bitcoin worth towards its $69,000 all-time excessive. This “Blow-off prime” rally is normally the last rally in a bull market, and its finish typically alerts the beginning of the subsequent bear market.

With this sample, although, there are a selection of targets to be careful for that would present the place the worth is headed subsequent. The primary of those is that the Bitcoin worth would wish to finish a day by day shut above the $124,545 stage, and this is named the Activation Set off.

Subsequent in line is what Weslad refers to because the “Purchase The Dip Zone”. This may be the ideal price range to enter Bitcoin within the case of a retrace, and this lies between $118,000 and $120,000. A dip towards these ranges is nothing to fret about, because it signifies that the bulls are nonetheless in management.

Associated Studying

Each of the zones outlined above, if held, would see the Bitcoin worth proceed its bullish rally. If the ultimate, explosive leg does play out because it did again in 2017-2021, then the Crab sample means that the Bitcoin worth will no less than go to $136,000, with an prolonged goal of $147,000, and the possibility that it goes further toward $160,000.

Nevertheless, the ultimate goal is the bearish one that would send the Bitcoin price crashing back downward, and it lies at $107,000. In keeping with the crypto analyst, a break beneath this stage would invalidate the complete bullish thesis, calling it the “line within the sand.” Weslad explains that “The invalidation stage at $107K is essential. A break beneath there means the setup is damaged, and we should re-assess.”

Featured picture from Dall.E, chart from TradingView.com