Bitcoin edged larger at the moment, breaching the important thing $119,000 mark, after a string of regular classes, lifting costs above current ranges and drawing recent consideration from huge buyers.

Associated Studying

In line with Coinglass information, BTC rose about 2.50% within the final 24 hours, and is up 8% over the past seven days. Buying and selling exercise and inflows are being watched carefully as merchants measurement up the following transfer.

Institutional Flows Drive Momentum

Information exhibits the highest crypto asset registered a second straight day of sturdy inflows, placing $430 million into Bitcoin spot ETFs. That form of demand helps clarify why Bitcoin’s market worth has jumped from $870 billion to $2.34 trillion this 12 months.

Analysts say that regular institutional shopping for has been a key engine behind the rally, and continued flows might preserve momentum alive.

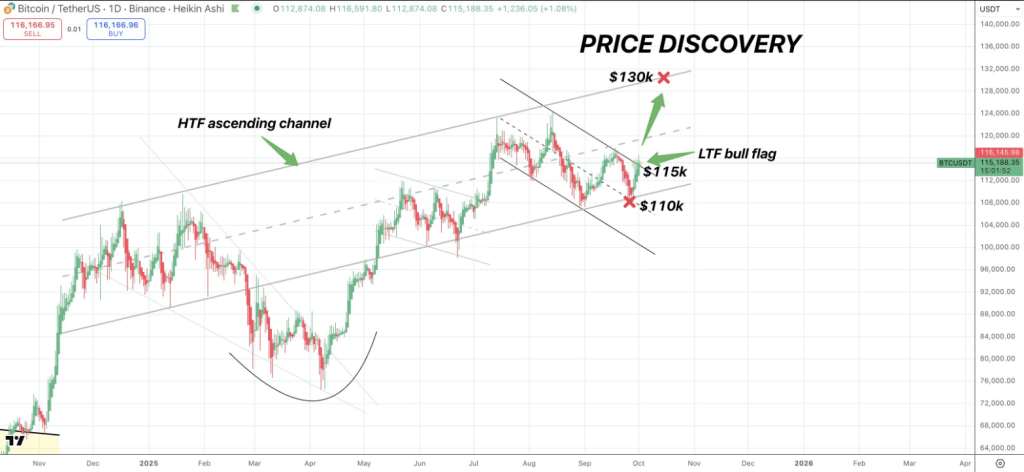

$BTC/usdt DAILY$BTC breaking out of LTF consolidation @ $115k throughout the HTF ascending channel we’ve been in all of 2025

$130k is the final word breakout level and will result in the cycle blow off prime 🎯 pic.twitter.com/1J9rSc7BJO

— Satoshi Flipper (@SatoshiFlipper) October 1, 2025

Worth Ranges And Targets In Focus

Resistance zones are being examined. Close to-term hurdles sit at $118,500 and $119,800, with a detailed goal at $120k if consumers keep in management.

Analyst Satoshi Flipper identified that BTC seems to have constructed a base above the $115,000 space and is holding the next time-frame construction, including {that a} long-term breakout goal sits close to $130,000.

Consumers prolonged the climb previous $118k, and that transfer is being cited as an indication that demand stays current above present ranges.

On-Chain Indicators And Volatility

In line with Coinglass, buying and selling quantity rose 12% to just about $95 billion for the day, whereas Open Curiosity elevated 4.46% to $84 billion.

The OI weighted funding price got here in at 0.0050%. Liquidations present the market can nonetheless transfer shortly: $157.08 million in positions have been wiped up to now day, with shorts accounting for $136 million and longs $20 million.

A bullish MACD crossover has been confirmed on some timeframes, and the RSI sits at 58% — ranges that recommend extra room to climb however not runaway overheated situations.

Seasonal Patterns Add To The Optimism

Primarily based on reviews and previous information, October has a historical past of sturdy efficiency — “Uptober” exhibits a mean acquire of 20%. September registered a 5% rise, and the third quarter closed with 6% in response to Coinglass.

The fourth quarter’s common return has traditionally been giant, at 78%, which is why some market individuals are optimistic heading into the ultimate months of the 12 months.

Consumers stay energetic, however the path up will not be clean. A transparent push above $120,000 could be a helpful sign that new highs may observe, whereas a stumble into the liquidity clusters might pressure a fast pullback.

Associated Studying

Market individuals are balancing on-chain flows, seen technical ranges, and recognized seasonal patterns as they determine their subsequent steps.

Featured picture from Unsplash, chart from TradingView