Key Notes

- Spot Ethereum ETFs noticed $248M in every day outflows, totaling $795M this week.

- Whales collected over 431,000 ETH value $1,73B in simply two days.

- Analysts be aware that steep corrections typically clear extra leverage, leading to beneficial properties.

Spot Ethereum ETFs have recorded one other day of heavy withdrawals, extending a week-long pattern that displays heightened volatility. These funds noticed cumulative web outflows of $248 million on Friday, bringing complete outflows for the week to $795 million.

These 5 consecutive days of losses coincided with a pointy decline in ETH price.

On the time of writing, ETH is trading above the $4,000 zone. Nonetheless, the cryptocurrency skilled a steep sell-off earlier within the week, plunging from close to the $4,500 degree on September 21 to as little as $3,850 on September 25.

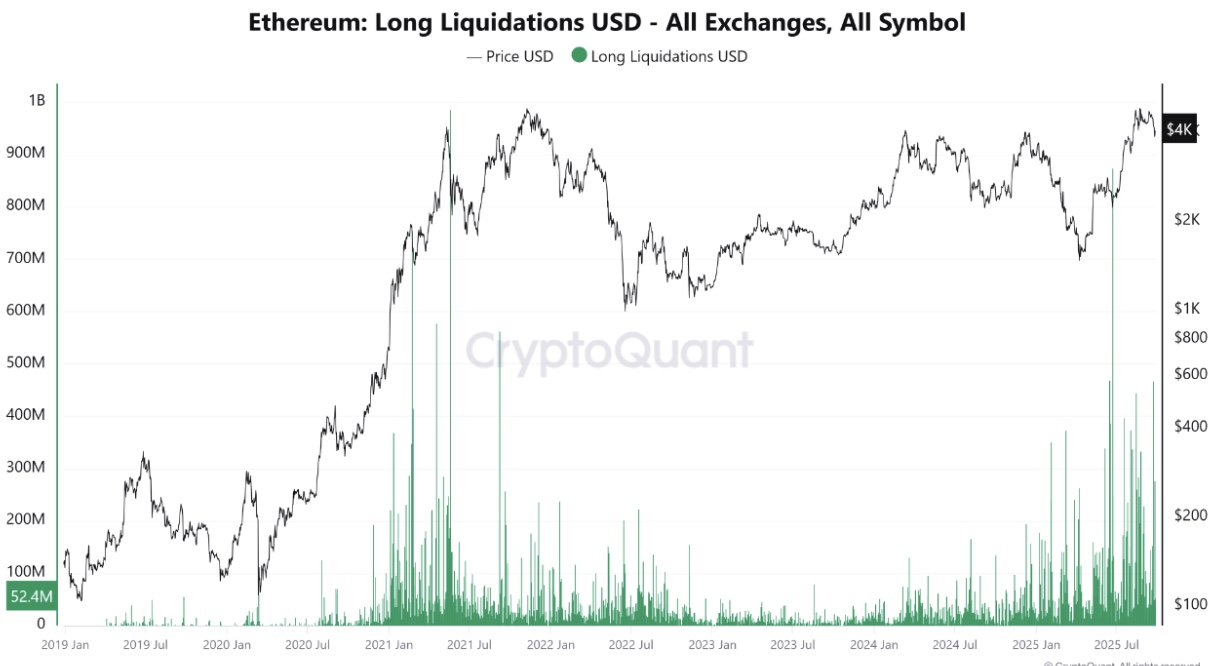

This drop additionally coincided with one of many largest derivatives market resets since 2024, based on data from CryptoQuant. Open curiosity throughout exchanges fell considerably, and lots of of tens of millions of {dollars} value of lengthy positions had been liquidated.

Ethereum lengthy liquidations throughout all exchanges | Supply: CryptoQuant

Whales Accumulate, However Why No Surge?

Amid this worth turbulence, massive traders have been taking the chance to build up ETH. LookOnChain reported that 16 wallets collectively acquired 431,018 ETH, value round $1.73 billion, from exchanges over the previous two days.

Whales preserve accumulating $ETH!

16 wallets have acquired 431,018 $ETH($1.73B) from #Kraken, #GalaxyDigital, #BitGo, #FalconX and #OKX up to now 2 days.https://t.co/0DPxgZMGN7 pic.twitter.com/ksrmcF8Z81

— Lookonchain (@lookonchain) September 27, 2025

In complete, traders have collected practically 570,000 ETH up to now week. Nonetheless, the worth has but to point out robust indicators of restoration.

A CryptoQuant analyst defined that the paradox of “shopping for however falling” stems from the construction of the derivatives market. When lengthy positions construct up too closely, the market turns into weak to pressured liquidations.

These liquidations trigger waves of promote strain, typically outpacing demand. Comparable resets occurred in 2021, 2023, and earlier this yr, every time clearing extra leverage.

As per the analyst, such steep falls typically result in more healthy, extra sustainable rallies regardless of the instant bearish results. A number of analysts, together with BitMine’s Tom Lee, have predicted a powerful ETH worth rally within the fourth quarter.

Whale Promote-off Worry Looms

Nonetheless, not all traders are bullish. Earlier immediately, one main Ethereum whale seemed to be trimming their place. This investor, who had constructed a big stake on the backside of $1,582 5 months in the past, deposited 1,000 ETH (round $4 million) into an change simply hours in the past.

If offered, the transfer would lock in a revenue of $2.42 million. The remaining 5,000 ETH within the whale’s pockets nonetheless holds an unrealized acquire of over $12 million.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any choices based mostly on this content material.

A crypto journalist with over 5 years of expertise within the trade, Parth has labored with main media shops within the crypto and finance world, gathering expertise and experience within the area after surviving bear and bull markets through the years. Parth can be an creator of 4 self-published books.