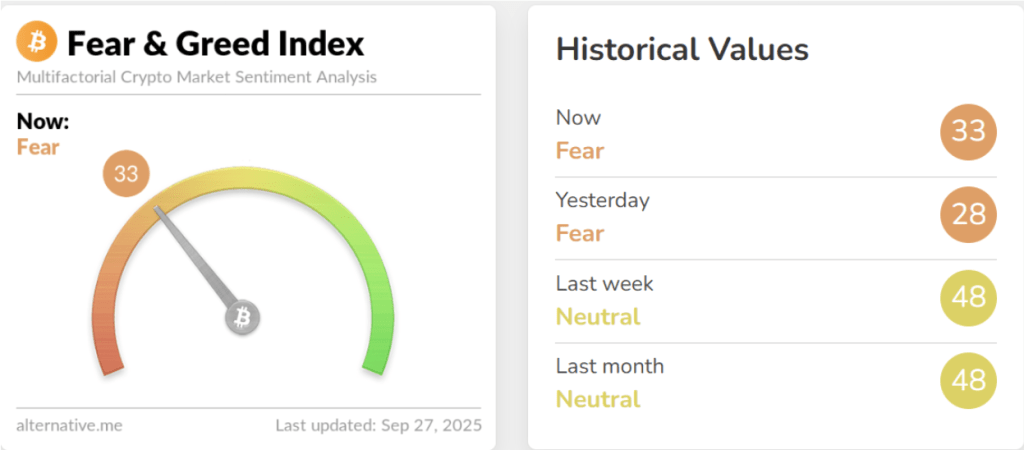

The cryptocurrency market is in a tense temper after Bitcoin misplaced necessary worth ranges this week, and investor sentiment has taken a beating. This caused the Bitcoin Fear & Greed Index to plunge by 16 factors in a single day, sinking to twenty-eight yesterday, its lowest degree since March. On the time of writing, the index has recovered barely to 33, nevertheless it nonetheless within the Worry zone. This may increasingly unsettle many buyers, however historical past reveals that fearful situations could also be blessings in disguise for Bitcoin buyers.

Associated Studying

Bitcoin Worry & Greed Index Drops To twenty-eight

This week has been powerful for a lot of cryptocurrencies, particularly Bitcoin. Bitcoin, which began the week above $115,000, entered into an prolonged decline that noticed it break under $110,000, which in flip led to liquidations of over $1 billion price of positions throughout the trade. This transfer additionally saw Ethereum break below $4,000, alongside altcoins likes XRP, Solana extending to the draw back.

Taken collectively, these moves erased the cautious optimism of final week, when the index sat at a impartial degree of 48. As a substitute, Bitcoin’s Worry and Greed Index fell to as little as 28, which is a dramatic 16 level plunge in a single day.

This crash within the Bitcoin Worry and Greed Index reveals simply how briskly sentiment can reverse when necessary worth thresholds fail to carry. Nonetheless, whereas the fearful temper would possibly look like a bearish trace, these situations may very well be a possibility for long-term merchants. The Worry and Greed Index has traditionally been a contrarian indicator, with excessive worry ranges usually showing earlier than vital rebounds.

Earlier in March, when the index final reached comparable depths, Bitcoin was buying and selling at a relative low round $83,000. Right now, even after breaking under 30 on the index once more, Bitcoin is about $27,000 larger than it was in March.

Bitcoin Fear And Greed Index. Source: Alternative.me

Constructive Outlook For The Coming Weeks

The broader takeaway from this sentiment shift is that the crypto market could also be closer to its next recovery phase than many count on. The index’s slight rebound to 33 as we speak from yesterday’s low of 28 reveals that some merchants are already positioning for a turnaround. For one, Bitcoin’s present costs might give savvy buyers the possibility to build up Bitcoin at low cost costs.

Bitcoin not often sustains rallies in situations of overwhelming greed. As a substitute, consolidations and corrections reset sentiment and make room for more healthy development. As an example, crypto analyst Michael Pizzino said in a post on X, that the latest worry may very well be the turning level Bitcoin and crypto has been ready for.

Associated Studying

On this sense, the fearful atmosphere could also be setting the stage for Bitcoin, Ethereum, and different altcoins to construct bullish momentum as soon as promoting strain eases.

Now, a very powerful factor is for the Bitcoin worth to reestablish itself above $110,000. On the time of writing, Bitcoin is buying and selling at $109,220.

Featured picture from Unsplash, chart from TradingView