Key Notes

- Rex Shares launched America’s first XRP and Dogecoin ETFs on CBOE trade, marking institutional crypto adoption milestone.

- XRP futures buying and selling volumes surged 140% to $10 billion whereas open curiosity climbed 6.7% signaling contemporary capital inflows.

- Sturdy derivatives metrics mirror Rex’s Solana ETF success which attracted $300 million in three months driving SOL up 68%.

Ripple

XRP

$3.09

24h volatility:

1.9%

Market cap:

$184.65 B

Vol. 24h:

$6.73 B

worth crossed the $3.10 mark on Thursday, Sept. 18, buying and selling at its highest for the week. The broadly anticipated Fed price minimize on Wednesday and Rex Shares’ official launch of XRP ETF merchandise type a significant bullish catalyst behind XRP’s 5% worth positive factors over the previous week. Nonetheless, the most recent developments in derivatives buying and selling metrics recommend a a lot bigger market influence might observe.

On Thursday, US-based asset supervisor Rex Osprey introduced the primary U.S.-issued ETFs to supply publicity to Spot Dogecoin and Spot XRP, listed on the CBOE trade.

According to the official press release, the first-ever Dogecoin ETF will commerce beneath the DOJE ticker, whereas the XRPR product could have the vast majority of its belongings held straight in spot XRP, with the rest invested in exchange-traded merchandise backed by XRP.

Greg King, CEO and founding father of REX Monetary and Osprey Funds emphasised institutional demand for ETFs as buying and selling automobiles for cryptocurrencies.

“Traders look to ETFs as buying and selling and entry automobiles. The digital asset revolution is already underway, and to have the ability to provide publicity to a number of the hottest digital belongings inside the protections of the U.S. ’40 Act ETF regime is one thing REX-Osprey is happy with and has labored diligently to realize,” King mentioned.

DOJE and XRPR ETFs are actually listed on the CBOE, one of many largest buying and selling platforms for monetary belongings within the US, with the trade confirming the itemizing in a put up on its official X account.

Happy to welcome two new REX-Osprey ETFs our U.S. market:

🔹REX-Osprey XRP ETF $XRPR

🔹REX-Osprey DOGE ETF $DOJEBe taught extra about REX-Osprey’s #CboeListed ETFs: https://t.co/qlimuVSdU2@REXShares @OspreyFunds pic.twitter.com/sfbHmSLICm

— Cboe (@CBOE) September 18, 2025

Because the information drew international reactions, XRP gained 4% earlier than dealing with main resistance on the $3.10 mark. XRP underperformed relative to prime altcoins like

SUI

$3.93

24h volatility:

6.1%

Market cap:

$14.03 B

Vol. 24h:

$2.07 B

and Avalanche

AVAX

$35.14

24h volatility:

16.8%

Market cap:

$14.84 B

Vol. 24h:

$2.32 B

, which posted double-digit positive factors on the Fed’s first price minimize of the 12 months.

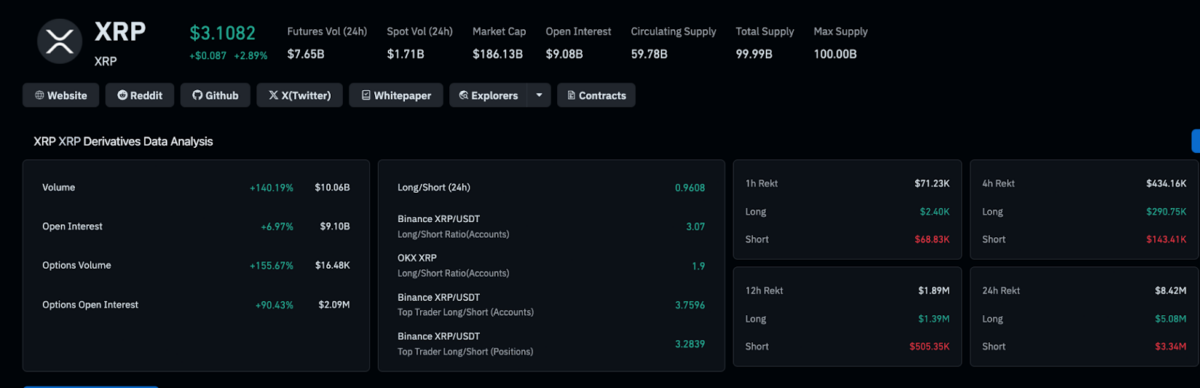

Ripple (XRP) Derivatives Markets Evaluation | Coinglass

Nonetheless, reactions within the XRP derivatives markets within the final 24 hours recommend a a lot bigger market influence might observe. Real-time data from Coinglass exhibits buying and selling volumes on XRP futures contracts rose 140% in the identical interval, crossing the $10 billion mark at publication. Open curiosity, which tracks the worth of latest XRP leveraged positions, additionally elevated by 6.7% to hit $9 billion.

This alerts a possible bullish breakout forward for 2 key causes. First, XRP open curiosity of 6.7% exceeds the spot worth improve of 4.2%, signaling the rally is supported by new capital coming into the market.

Additionally, the intraday buying and selling quantity of $10 billion exceeds open curiosity of $9 billion, exhibiting intense market turnover with bullish new entrants absorbing promoting stress from profit-takers.

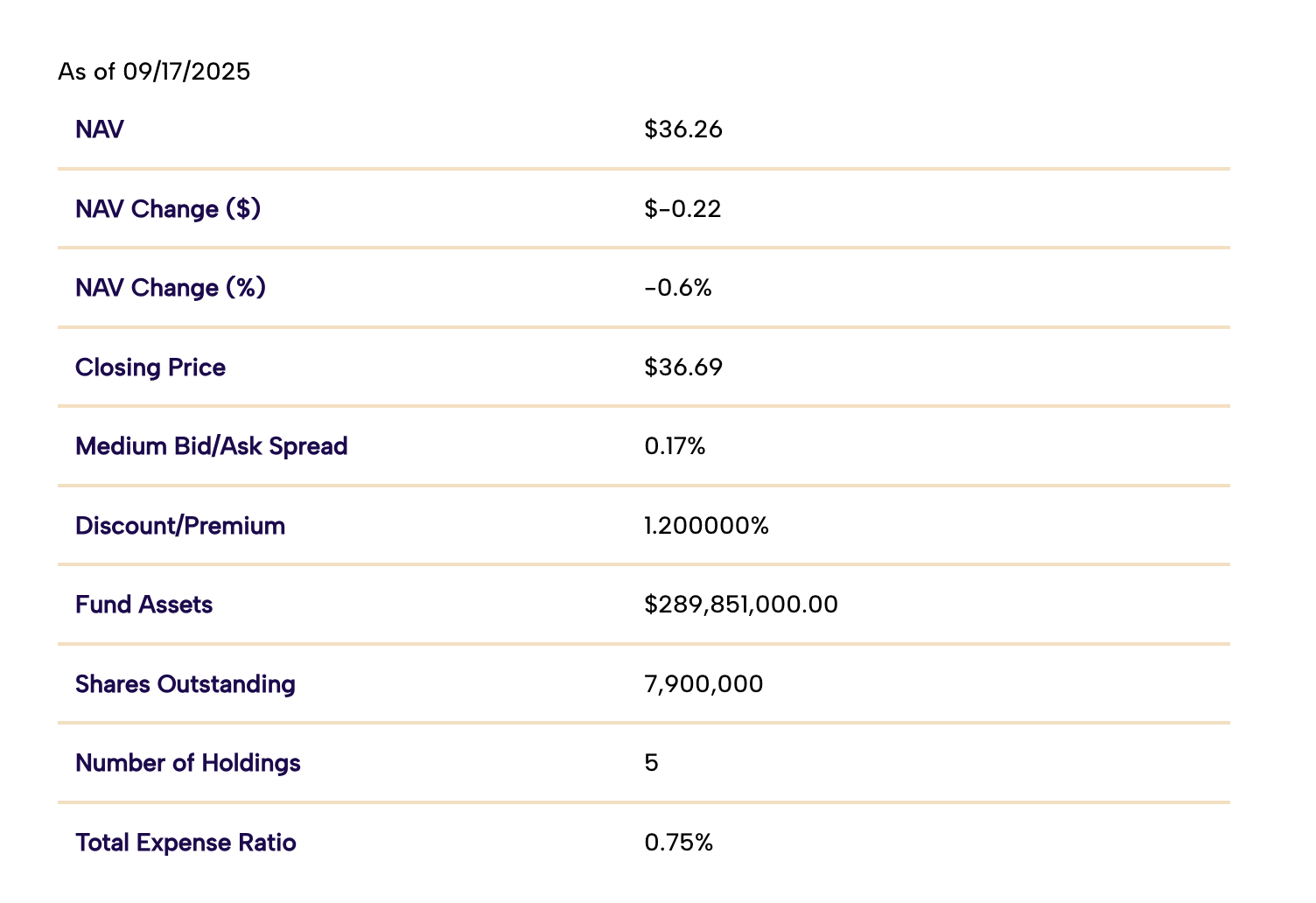

Rex Osprey’s Solana Staking ETF buying and selling information as of Sept. 17, 2025 | Supply: RexShares.com

Notably, Rex Osprey’s Solana Staking ETF (SSK) has pulled nearly $300 million in inflows in lower than three months after its launch on July 2, with Solana

SOL

$248.5

24h volatility:

3.3%

Market cap:

$134.93 B

Vol. 24h:

$10.35 B

worth climbing 68% from $148.3 to $248.7 at press time.

If XRP worth closes decisively above the $3.10 mark, an identical breakout in direction of $4 might be on the playing cards, as markets anticipate persistent ETF inflows from institutional buyers.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.