Key Notes

- MetaMask launched native stablecoin mUSD with international deployment via MetaMask Card at over 150 million service provider places worldwide.

- Bitmine expanded holdings to 2.15 million ETH valued at $9.74 billion after buying further 82,233 tokens just lately.

- Technical evaluation exhibits help at $4,399 with resistance at $4,584 forward of Federal Reserve charge choice on September 17.

MetaMask, Ethereum’s largest pockets supplier, formally launched its native stablecoin MetaMask USD (mUSD) on Monday, September 15, offering bullish momentum that helped Ethereum value stabilize close to $4,495 regardless of an earlier 3% intraday decline.

MetaMask USD ($mUSD) is now stay. 🦊

The easiest way out and in of crypto is right here. pic.twitter.com/h6zSUao7Ka

— MetaMask.eth 🦊 (@MetaMask) September 15, 2025

The brand new token introduces sturdy liquidity incentives on Linea, low-cost fiat onramps inside MetaMask, and direct integration throughout its Swap and Bridge features. Crucially, $mUSD can even be deployed globally via the MetaMask Card, accessible at over 150 million retailers.

The launch aligns Ethereum with the intensifying stablecoin adoption race that has gripped US company entities since President Trump signed the Genius Act into regulation. By launching the native mUSD, MetaMask permits traders to carry extra funds inside Ethereum’s ecosystem, eliminating the necessity to rotate into stablecoins on rival networks.

Along with anticipated on-chain worth from MetaMask card transactions, the event may additionally strengthen Ethereum’s value resilience, particularly throughout turbulent market phases when merchants rotate in the direction of stablecoins in flight to security.

🟢 SΞR NEWS: Bitmine Immersion $BMNR has acquired 82,233 ETH ($370M), elevating whole holdings to 2,151,676 ETH ($9.71B).

The corporate nonetheless holds $569M in money and turned a $20M funding in $ORBS into $214M. pic.twitter.com/lGf2lboOFD

— Strategic ETH Reserve (SΞR) (@SERdotxyz) September 15, 2025

Institutional flows additional bolstered resilient sentiment inside the Ethereum ecosystem narrative. On September 15, Bitmine reposted community comments disclosing it had elevated its holdings to 2.15 million ETH, value $9.74 billion, after including 82,233 ETH in recent purchases.

Alongside its $569 million treasury money reserve, Bitmine’s crypto Internet Asset Worth (NAV) has now reached $10.31 billion, emphasizing the agency’s long-term conviction in Ethereum regardless of macro headwinds.

Ethereum Worth Forecast: Are Bulls Aiming for $5,000 Breakout?

Regardless of the intraday decline, Ethereum

ETH

$4 487

24h volatility:

0.9%

Market cap:

$542.13 B

Vol. 24h:

$29.29 B

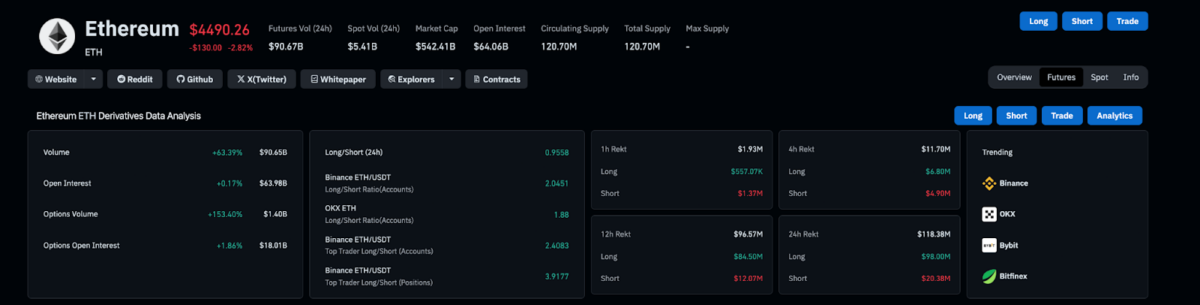

technical setup factors in the direction of consolidation relatively than capitulation. Coinglass’ latest ETH derivatives trading data exhibits that the three% spot value dip got here on the again of $98 million in ETH lengthy liquidations within the final 24 hours, towards $20 million in brief positions closed.

This bearish-leaning imbalance confirms that Ethereum’s intraday losses have been aggravated by overleveraged bull merchants caught unawares by the overheated US CPI inflation data.

Ethereum Spinoff Market Evaluation | Supply: Coinglass

Nevertheless, different buying and selling knowledge suggests ETH value rebound prospects stay intact. ETH futures buying and selling quantity surged 63.39% to $90.65 billion, whereas open curiosity rose marginally by 0.17% to $63.98 billion.

Such elevated derivatives exercise throughout a spot value decline usually displays that almost all of bull merchants who just lately misplaced liquidity are repositioning for near-term strikes after almost $100 million in losses within the final 24 hours.

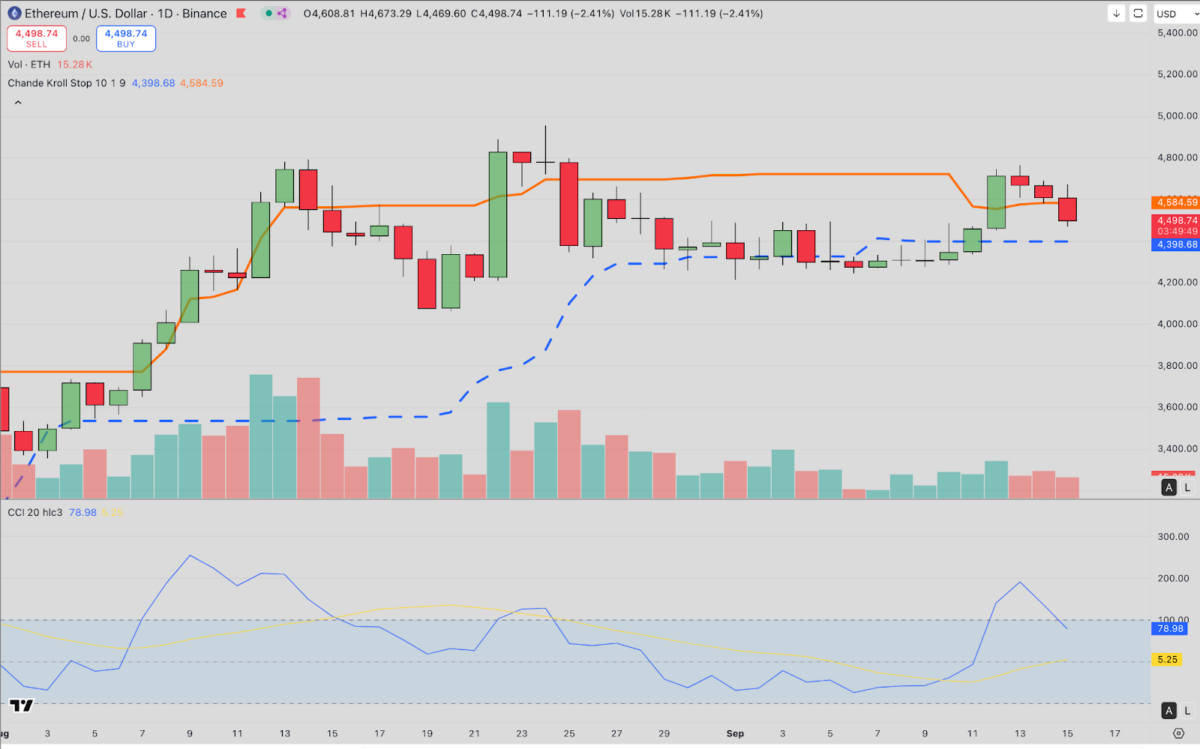

Ethereum (ETH) Technical Worth Evaluation | Supply: TradingView

Technical indicators additional help this narrative, with the Chande Kroll Cease confirming a short-term help cluster close to $4,399 and quick resistance close to $4,584. A sustained shut above $4,585 is required to re-confirm bullish dominance.

Furthermore, the Commodity Channel Index (CCI) stays at 78.53, barely elevated however nonetheless under overbought thresholds. These impartial momentum alerts could show engaging to strategic entrants seeking to enter last-minute speculative purchases earlier than the subsequent Fed charge choice slated for September 17.

A break under $4,398 may set off an Ethereum value decline towards $4,200.

Greatest Pockets Presale Positive factors Momentum Alongside Ethereum Narrative

The optimistic inner catalysts surrounding the Ethereum ecosystem forward of the US Fed charge choice are additionally driving demand in the direction of multi-chain storage tasks like Greatest Pockets. Providing safe multi-chain options with institutional-grade safety, Greatest Pockets has generated appreciable demand in current weeks.

Greatest Pockets Presale

At press time, Greatest Pockets’s presale has already raised over $15.8 million, fueled by inflows from traders rotating from stagnating prime altcoins to tasks providing increased upside potential.

Potential individuals can nonetheless go to the Best Wallet website to affix the BEST presale earlier than the worth will increase from the present $0.0256 per token.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any choices primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is presently learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.