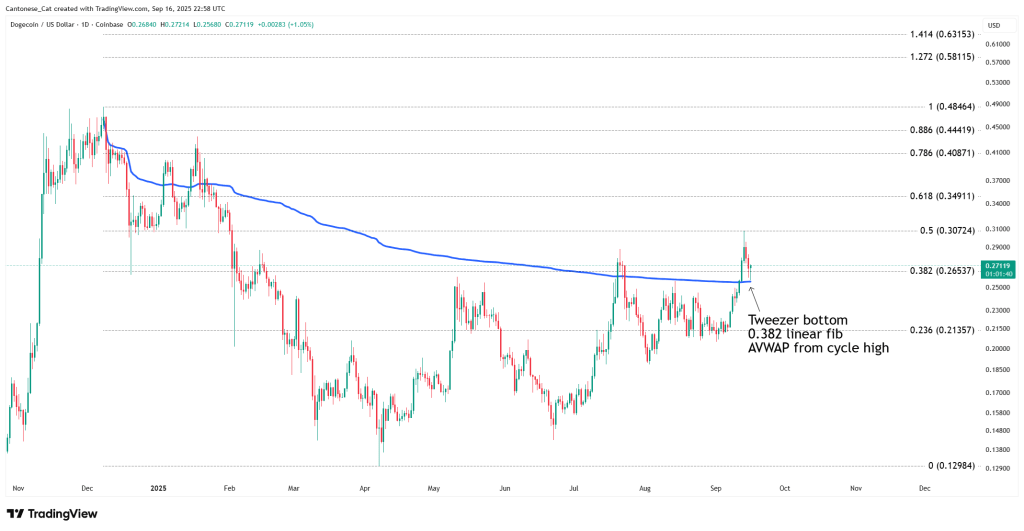

The Dogecoin every day chart is clustering a number of classical assist indicators round $0.256–$0.265, as highlighted by Cantonese Cat (@cantonmeow) through X: “DOGE discovering assist. Tweezer backside. 0.382 linear fib holding. AVWAP from cycle excessive holding.”

On the Coinbase DOGE/USD one-day view proven, worth is reclaiming the 0.382 Fibonacci retracement at $0.26537 whereas using the Anchored VWAP drawn from the cycle excessive, with yesterday’s session marked at an open of $0.26840, excessive $0.27214, low $0.25680 and final $0.27119.

What This Means For Dogecoin Value

For readers much less conversant in the phrases, a “tweezer backside” is a two-bar reversal formation by which consecutive candles print nearly similar lows after a decline. The repeated low reveals that dip patrons defended the identical worth on back-to-back periods, and the intraday wicks rejecting that degree usually point out absorption of sell pressure. Within the chart, the dual lows cluster precisely into the $0.265 space, giving a clear reference for threat.

On greater timeframes such because the every day, this sample is watched as a result of it defines a exact inflection with out requiring an extended basing course of; affirmation is often evaluated by whether or not subsequent candles maintain above these lows and push via the interim highs of the sample.

Associated Studying

The 0.382 “linear fib” refers to a 38.2% Fibonacci retracement calculated on a linear worth scale from the prior swing extremes drawn on the chart. In sensible phrases, it marks a shallow retracement degree the place developments regularly pause or resume. Right here, that retracement prints at $0.26537, nearly completely overlapping the tweezer lows. “Holding” within the analyst’s be aware means worth probed the extent intraday however closed again above it, preserving it as support somewhat than changing it to resistance.

AVWAP—the Anchored Quantity-Weighted Common Value—is the operating common worth of all trades since a selected place to begin, weighted by traded quantity, with that place to begin “anchored” to a selected candle. The anchor right here is the cycle excessive seen on the left aspect of the chart. Functionally, this AVWAP (drawn because the blue band) represents the composite price foundation of market members from that prime onward.

When worth is under an AVWAP anchored to a serious excessive, it usually behaves as dynamic resistance as a result of many holders are underwater; when worth reclaims it, the identical line can flip into dynamic assist as the common participant strikes again to break-even or revenue. On this chart, the AVWAP is sloping via $0.265–$0.27 and “holding,” that means successive checks have discovered patrons alongside that band, exactly the place the 0.382 retracement and tweezer lows coincide.

Associated Studying

Technically, that three-way overlay—sample, retracement, and anchored price foundation—is what merchants name confluence. It improves the standard of a degree as a result of completely different strategies, derived from completely different information (worth construction, proportional retracement, and quantity distribution over time), all argue for a similar zone.

The place Is DOGE Heading Subsequent?

The chart additionally frames the subsequent directional checkpoints. The nearest marked resistance is the 0.5 retracement at $0.30724, which capped the most recent advance earlier than the pullback into $0.265.

Above that, the Fibonacci ladder steps to $0.34911 (0.618), $0.40871 (0.786), $0.44419 (0.886), and $0.48464 (1.000), with extensions labeled at $0.58115 (1.272) and $0.63153 (1.414). If the confluence at $0.265 had been to fail on a closing foundation, the subsequent plotted draw back reference on this template is the 0.236 retracement at $0.21357, whereas the underside of the displayed vary sits at $0.12984.

Put collectively, the chart Cantonese Cat shared communicates an easy message: DOGE examined a cluster of technical helps at $0.265, produced a tweezer-style response there, and is making an attempt to stabilize above each the 0.382 retracement and the AVWAP from the cycle excessive. That’s the particular technical context behind the analyst’s “native backside” learn.

At press time, DOGE traded at $0.267.

Featured picture created with DALL.E, chart from TradingView.com