In a current submit on X, crypto analyst Pumpius argued that the recent drop in XRP’s price shouldn’t be pure however the results of deliberate actions by Binance. In keeping with him, the change desires to guard its place as a result of the digital forex poses a risk to the system it has constructed through the years. He says the change is doing extra than simply promoting tokens; it’s working to carry XRP again.

Binance Accused Of Coordinating XRP Worth Suppression

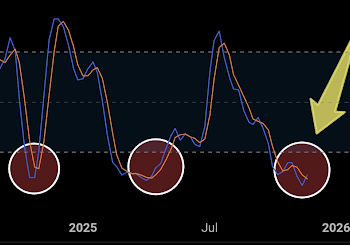

Pumpius says Binance shouldn’t be solely promoting XRP however can be actively manipulating the market round it. He factors to sudden drops in liquidity, heavy waves of promote strain, and pink flashes on charts that seem at any time when there’s an announcement of optimistic Ripple information. He claims this isn’t a coincidence however evidence of coordination and a method to maintain XRP from breaking out.

Associated Studying

The analyst stresses that the actual cause Binance targets XRP is that it’s totally different. XRP shouldn’t be a meme or speculative guess however a payment infrastructure. Pumpius argues it might change the liquidity swimming pools that Binance has used for years, and if that occurs, the change’s market-making enterprise might crumble.

He additionally warns that it’s not solely Binance that’s concerned. In keeping with him, highly effective traders, legacy monetary gamers, and offshore networks all see XRP as a risk. He says that as a result of XRP runs on clear rails, it might expose cash flows they like to maintain hidden. Due to this fact, worth suppression turns into their major instrument to slow down the process.

Why Suppression May Backfire As XRP Worth Fundamentals Strengthen

Regardless of these heavy claims, Pumpius argues that the strain on XRP might backfire. The crypto skilled factors to Ripple and its ecosystem, noting that the basics are strengthening every single day. New fee corridors are opening in Japan and the UAE. Tasks comparable to DNA Protocol are utilizing the XRP Ledger to anchor IDs and even genetic information.

Associated Studying

Pumpius believes this exhibits the suppression is synthetic. The fundamentals are exploding, he says, whereas the opposed worth motion comes from deliberate dumping. He provides that each time Binance sells, extra XRP strikes into self-custody wallets. As an alternative of weakening the group, this decentralizes the asset much more. Holders are making ready for the day when actual utility drives demand at a scale far past hypothesis.

In his view, when that switch flips, Binance’s paper video games will likely be meaningless in comparison with trillion-dollar settlement flows. He warns that the change might imagine it’s successful now, but it surely’s solely exposing the reality concerning the digital forex. XRP, he says, is not only a dealer’s coin. It’s the spine of a brand new monetary order. And in line with him, no quantity of dumping can cease already living rails.

Featured picture from Dall.E, chart from TradingView.com