XRP has struggled to keep up its momentum in latest weeks, with the token slipping almost 10% over the previous month. On the time of writing, XRP is buying and selling round $2.96, because the broader market exhibits blended indicators.

Whereas property resembling Ethereum proceed to post upward moves, establishing a brand new excessive, XRP has as an alternative confronted constant correction, main market contributors to carefully monitor whether or not the development might prolong additional or stabilize within the close to time period.

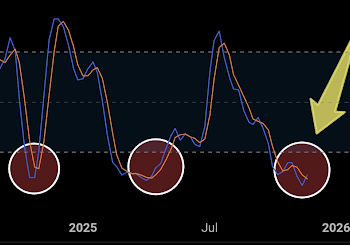

A CryptoQuant analyst has noted that XRP’s present worth motion comes after an early-2025 rally that noticed the token attain the $3.5 to $4 vary. That surge was accompanied by a spike in inflows to exchanges, significantly from giant holders, signaling important profit-taking.

The analyst argues that this influx exercise could also be exerting renewed pressure on the token’s worth, leaving buyers to weigh each the dangers and potential alternatives forward.

Associated Studying

XRP Trade Influx Information Factors to Revenue-Taking

The analyst, referred to as PelinayPA, highlighted the importance of XRP’s alternate influx transactions in a latest evaluation. The analyst defined that traditionally, intervals of heavy inflows from main holders have typically preceded cycle tops in XRP’s worth.

Notable examples included its 2018 peak above $3, the 2021 excessive close to $1.90, and the 2023 rally towards $0.90. In line with the newest information, a similar trend has emerged. PelinayPA famous:

In the beginning of 2025, XRP rallied to $3.5–$4 with huge influx waves, particularly in high-value bands (100K–1M+ XRP). This means important whale promoting stress. At present, inflows stay exceptionally excessive, pointing to short-term promoting stress.

The report outlined a number of eventualities relying on whether or not XRP can maintain help close to the $3.00 degree. Within the brief time period, continued inflows might drive prices towards the $2.8 zone.

Nevertheless, if the $3 threshold holds, the analyst believes it might function a base for a brand new upward try, with resistance ranges between $4.2 and $4.5 being key to unlocking additional features.

Over the long term, the analyst pressured that XRP stays in a stronger structural uptrend in comparison with earlier market cycles, leaving open the potential for new highs above $5 later in 2025.

Associated Studying

Technical Ranges Sign Make-or-Break Second

Complementing the on-chain outlook, merchants are additionally targeted on technical indicators. An analyst on X, posting underneath the title “XRP Replace,” emphasised the significance of the $2.95 degree, which coincides with the 0.618 Fibonacci retracement.

Of their evaluation, holding above this degree might create a pathway towards $3.33 and $3.57, whereas a breakout past $4.6–$5.2 would convey XRP into new worth discovery territory.

$XRP AT A MAKE OR BREAK LEVEL ⚡️

– Worth sits on $2.95 (Fib 0.618) a key help zone.💪🏼

– Maintain above → path to $3.33 → $3.57, then eyes on $4.6–$5.2 💥🚀

– Lose it → danger dips to $2.65 📉

The following transfer will outline the development‼️ pic.twitter.com/iYa94DyiRA

— XRP Replace (@XrpUdate) August 25, 2025

Then again, failure to keep up help might open the door to additional draw back, with $2.65 flagged as the following key degree. This aligns with the warning expressed in on-chain information, suggesting that XRP is presently at a pivotal stage the place the following transfer could decide its trajectory for the remainder of the yr.

Featured iameg created with DALL-E, Chart from TradingView