Key Notes

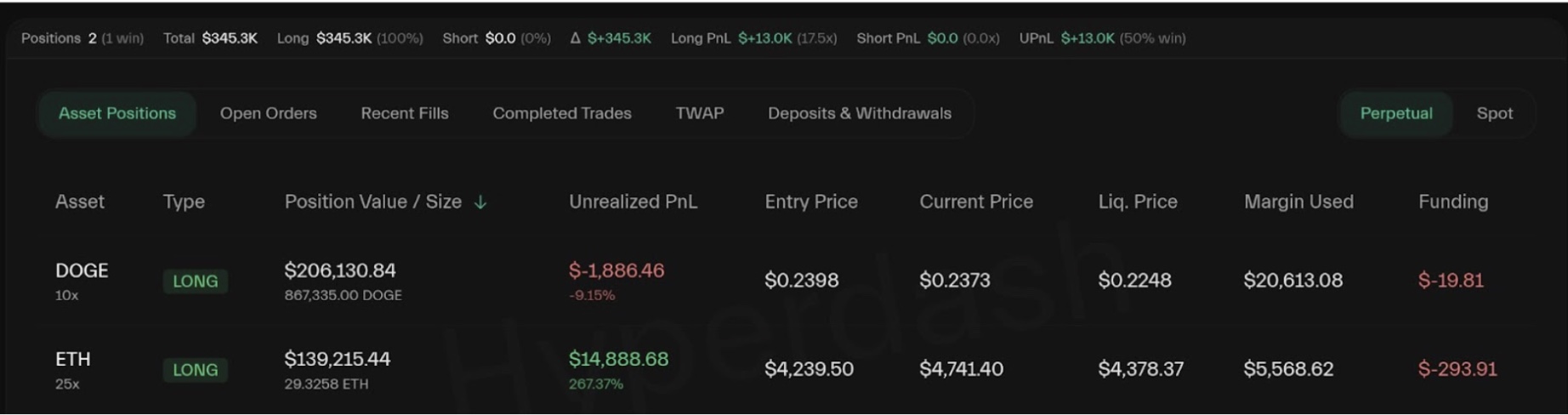

- James Wynn’s ETH commerce at the moment exhibits unrealized positive factors of $14,888, or over 267%.

- Wynn’s mixed leveraged publicity throughout ETH and DOGE is roughly $345,000, with fairness round $26,600.

- Ethereum worth surged to $4,867, its highest since November 2021, boosted by Federal Reserve Chair Powell’s potential price reduce sign.

Common crypto dealer James Wynn, well-known for initiating long-leveraged bets, has opened an enormous 25x leveraged lengthy place on Ethereum, because the ETH worth hit an all-time excessive of $4,884 earlier at present.

On-chain information exhibits that Wynn used roughly $5,568 in margin to open a 29.3 ETH place price $139,215 at a median entry of $4,239. The commerce at the moment displays unrealized positive factors of $14,888, translating to a return exceeding 267%.

Earlier this yr, in Could, James Wynn gained immense recognition for minting $100 million in leveraged lengthy bets on meme cash. Nonetheless, the notorious crypto dealer misplaced all of it in his lengthy bets on Bitcoin afterward, on decentralized trade (DEX) Hyperliquid.

James Wynn Returns to Leverage Buying and selling

Final month, Wynn reappeared following a brief hiatus from social media, throughout which he deactivated his X account after updating his bio to a single phrase: “broke.”

Together with ETH leverage wager, Wynn additionally took a 10x leveraged lengthy place in Dogecoin (DOGE), valued at roughly $206,130 for 867,335 DOGE. The place was entered at a median worth of $0.2398 and is at the moment barely within the purple, displaying an unrealized lack of about $1,886, with DOGE buying and selling close to $0.237.

In complete, Wynn’s leveraged publicity stands at roughly $345,000, whereas his fairness is round $26,600, leading to a margin utilization of roughly 110%.

Crypto dealer James Wynn takes leveraged bets on ETH, DOGE | Supply: Hyperdash

ETH Value Eyes Breakout Previous $5,000

Ethereum worth climbed to a brand new all-time excessive on Friday, August 22, reaching $4,867 on Coinbase, its highest degree since November 2021. The surge is defined by Federal Reserve Chair Jerome Powell’s Jackson Hole speech, signaling a possible rate of interest reduce in September, boosting demand for threat property.

Renewed inflows into spot ETH ETFs additional supported the bullish sentiment. On Friday, spot Ether ETFs throughout all US issuers noticed $337.6 million in internet inflows, pushing their mixed property underneath administration above $12.1 billion after 4 consecutive days of outflows, as per information from Farisde Investors.

Company adoption has added to the momentum. Over the previous month, corporations resembling BitMine, SharpLink, Bit Digital, BTCS, and GameSquare have collectively bought round $1.6 billion in ETH, bringing complete company holdings near $30 billion.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any choices based mostly on this content material.

Bhushan is a FinTech fanatic and holds a very good aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in the direction of the brand new rising Blockchain Expertise and Cryptocurrency markets. He’s repeatedly in a studying course of and retains himself motivated by sharing his acquired information. In free time he reads thriller fictions novels and typically discover his culinary expertise.