Key Notes

- XRP value rallied above $3.50 on Fed rate-cut hints however retreated to $3.02 on Sunday Aug 24, after lacking the $3.84 goal.

- Ripple and SEC formally settle, ending appeals and affirming XRP isn’t a safety for secondary trades.

- Coinglass information exhibits $1.16 billion in XRP shorts vs $519 million longs, signaling heightened bearish stress.

Ripple (XRP) value closed strongly final week, rallying to $3.50 for the primary time since 2021. Two components drove the upside momentum. First, US Fed Chair Jerome Powell hinted at fee cuts within the upcoming Federal Open Market Committee (FOMC) assembly on September 17, immediately sparking market-wide rallies.

Second, the Securities and Trade Fee (SEC) and Ripple lastly resolved their authorized dispute, ending all appeals and clearing the best way for last enforcement actions.

The settlement consists of Ripple’s $125 million penalty and affirms the court docket’s ruling that XRP isn’t a safety in secondary market transactions.

#XRPCommunity #SECGov v. #Ripple #XRP The Second Circuit has authorized the Joint Stipulation of Dismissal. pic.twitter.com/v796dAtfiZ

— James Okay. Filan 🇺🇸🇮🇪 (@FilanLaw) August 22, 2025

On Friday, Defense lawyer James Filan confirmed that the US Court docket of Appeals for the Second Circuit formally dismissed the events’ appeals, marking the conclusion of appellate proceedings and shifting the case to the district court docket for enforcement.

Regardless of these bullish authorized and macro drivers, XRP underperformed. Fairly than be a part of rivals Bitcoin and Ethereum, which surged to contemporary all-time highs of $124,000 and $4,890, respectively, in August. XRP as a substitute fell wanting its $3.84 goal, retracing 4% to commerce at $3 on the time of publication on Sunday.

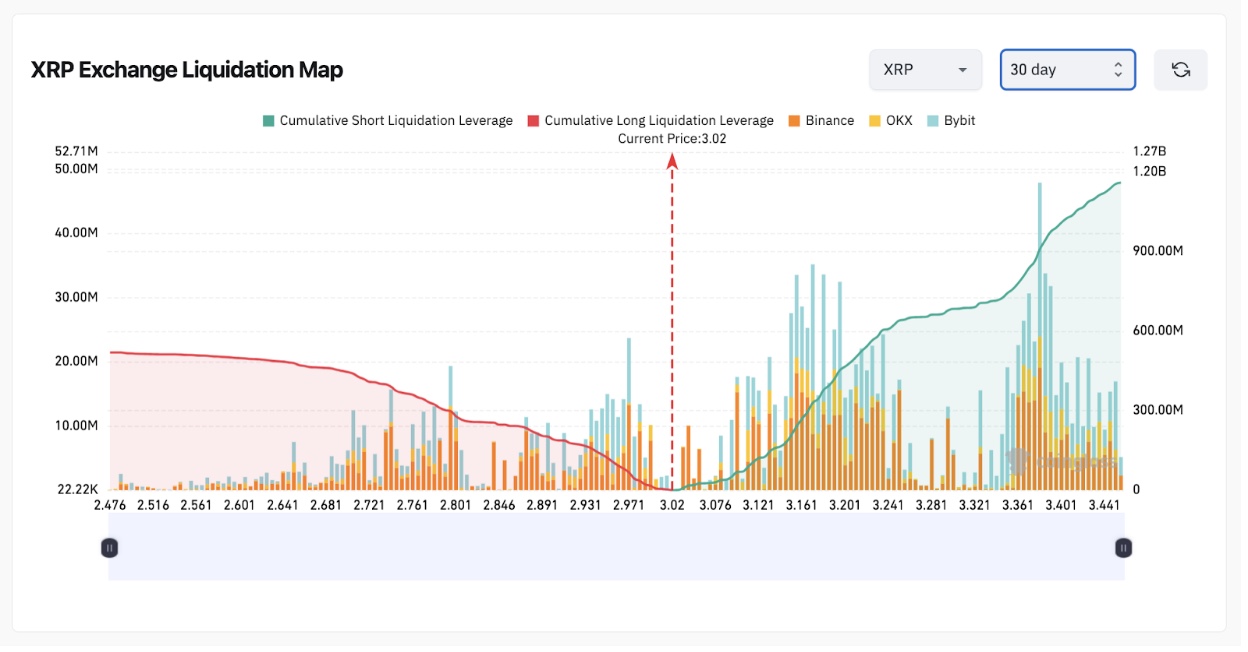

Derivatives markets information exhibits how brief merchants converged on XRP markets, after the Ripple-issued coin missed the all-time excessive goal on Friday.

Ripple (XRP) 30-Day Derivatives Liquidation Map | Supply: Coinglass, August 24, 2025

Coinglass’ 30-day Liquidation Map data reveals XRP brief positions at $1.16 billion, far outweighing longs value simply $519 million. When shorts outweigh longs after a rally, it displays profit-taking amongst bullish merchants whereas bears look to use overbought situations.

This overwhelming dominance of brief positions might maintain the XRP value below stress within the coming buying and selling periods except contemporary bullish triggers emerge

XRP Worth Forecast: Can Bulls Reclaim Momentum Above $3.50?

XRP value motion is consolidating round $3.01 at press time, with the most recent retracement reflecting each profit-taking and heavy brief positioning.

Technical indicators spotlight the indecision. The short-term transferring averages are converging, with the 5-day SMA ($2.99) and 13-day SMA ($3.05) making a slender zone of resistance. The MACD stays in adverse territory, exhibiting weak bullish momentum and signaling warning for consumers.

Ripple (XRP) Worth Forecast | Supply: TradingView

On the bullish aspect, XRP should reclaim the $3.10 vary with conviction to problem $3.50 once more. A breakout above $3.50 would open the trail to $3.84, the extent rejected final week, and probably lengthen towards $4.00 if renewed institutional curiosity follows the current SEC settlement.

In a bearish state of affairs, failure to carry $3.00 might expose XRP to draw back dangers towards $2.88, with deeper losses concentrating on the $2.70 assist degree, the place a big rebound occurred in early August. Till a decisive transfer unfolds, merchants can count on range-bound motion, with brief positioning amplifying volatility in each instructions.

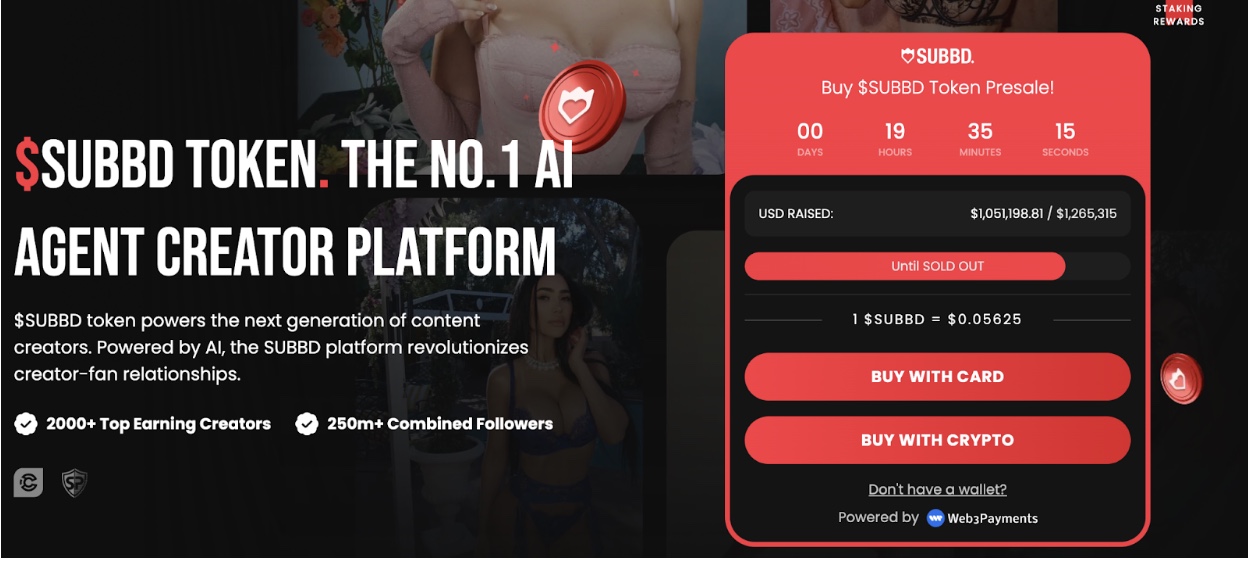

SUBBD Presale Crosses $1M as XRP Faces Bearish Strain

As XRP struggles below $3.10 with brief sellers dominating, speculative merchants are turning to high-risk tokens. The highlight has shifted towards SUBBD ($SUBBD), a platform positioned because the No.1 AI Agent Creator ecosystem.

At press time, the venture has already raised $1.05 million of its $1.26 million cap, signaling sturdy early adoption. At a presale value of $0.05625 per token, SUBBD goals to reshape creator-fan relationships by way of AI-powered experiences and tokenized engagement.

SUBBD Presale

Past speculative enchantment, the token affords sensible utilities: unique entry to AI-enhanced, influencer-approved content material, staking rewards tied to VIP livestreams and behind-the-scenes perks, in addition to platform-wide reductions. Holders additionally achieve early beta entry to new instruments, XP multipliers for rewards, and a loyalty system designed to maintain followers engaged.

Go to the official SUBBD website to safe early entry.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any choices primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.