Key Notes

- OKB value soared 30% to $220 after a viral XRP airdrop marketing campaign boosted KYC sign-ups and token demand.

- Derivatives exercise exploded with $401M in buying and selling quantity and $1.21M in brief liquidations, indicating a brief squeeze.

- Regardless of bullish momentum, RSI at 93.91 flags overbought situations, with key assist at $180 and resistance close to $240.

OKB, the native token of centralized exchange OKX, rose 30% on Thursday, Aug. 21, defying broader market weak spot as Bitcoin, Ethereum and Solana booked losses between 1% and three%, respectively. The rally was linked to elevated group engagement round an XRP airdrop campaign that started Tuesday, Aug. 19, rewarding 5 winners with $2,000 in

XRP

$2.88

24h volatility:

2.7%

Market cap:

$171.04 B

Vol. 24h:

$4.54 B

every.

DROP 2 Unlocked! 🥊💥🪂

5 winners, $2000 in $XRP every!

For an opportunity to win:

☑️ RT + Comply with @OKX

☑️ Reply along with your finest crypto recommendation

☑️ Submit a screenshot right here: https://t.co/NssN0Haeh6 pic.twitter.com/k9Xvp9Ol4F— OKX (@okx) August 21, 2025

A second airdrop announcement on Thursday drew over 321,000 views on X at press time. The surge in consideration translated into heightened demand for OKB, as customers rushed to finish KYC accounts and take part within the promotional occasions, boosting on-chain exercise and token demand.

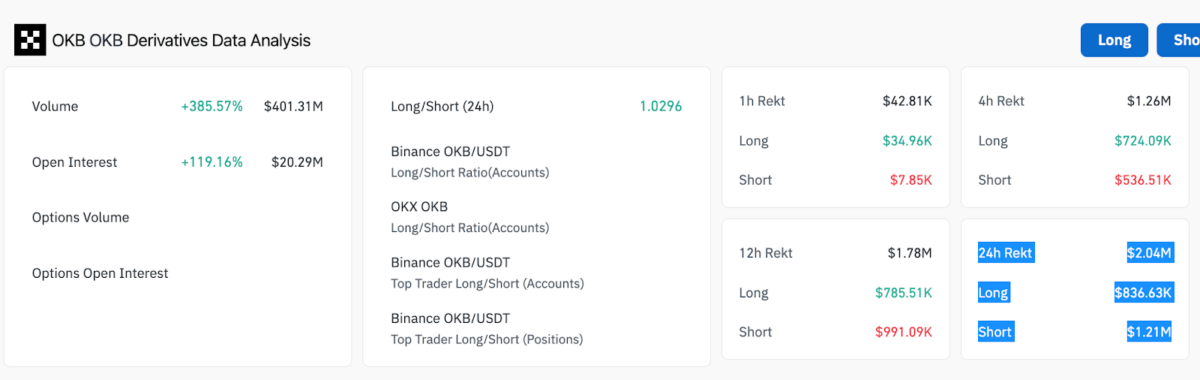

OKB Derivatives Market Evaluation, Aug. 21, 2025 | Supply: Coinglass

Derivatives market tendencies additionally mirrored this bullish narrative. According to Coinglass data, OKB buying and selling volumes surged 386% to $401.31 million, whereas open curiosity jumped 119% to $20.29 million.

Liquidations totaled $2.04 million, with $1.21 million in shorts worn out versus $836,630 in longs. The skew towards brief liquidations confirms merchants had been caught off guard by the rally’s power, whereas the sustained enhance in open curiosity signifies contemporary capital continues to enter OKB markets.

OKB Value Forecast: Bulls Eye $240 as RSI Hits Overbought Extremes

OKB’s parabolic transfer pushed the token to $220 at press time, now posting features in extra of 200% in August alone. Nevertheless, technical indicators spotlight sure danger elements forward as

OKB

$218.5

24h volatility:

25.6%

Market cap:

$4.58 B

Vol. 24h:

$12.76 B

value breaks into overbought territory.

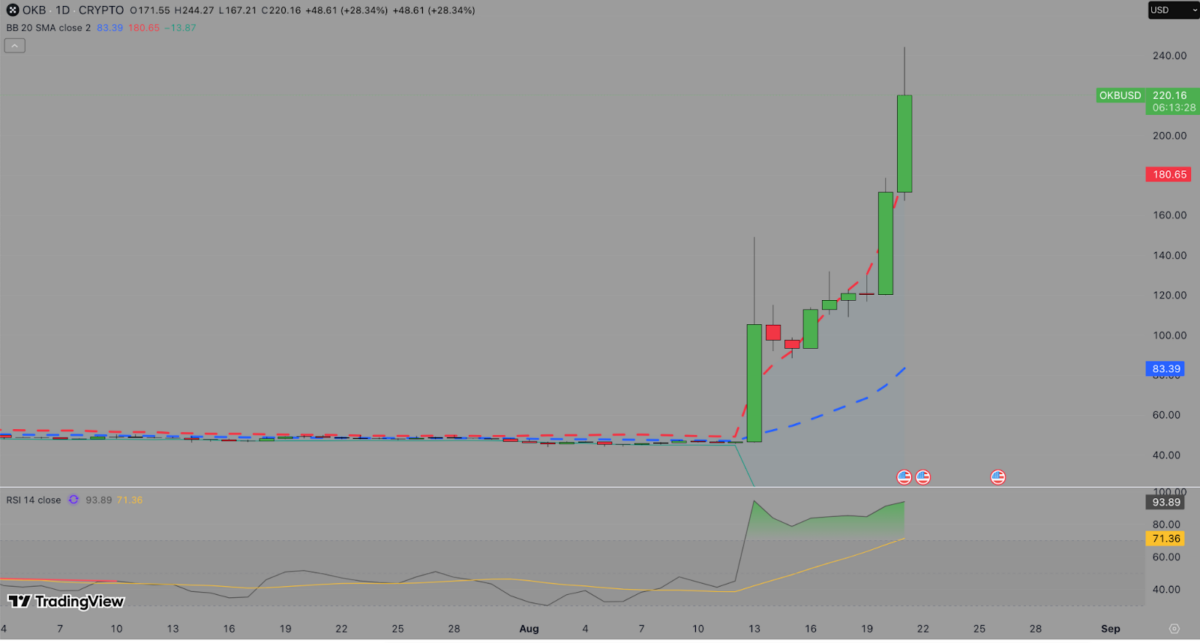

As seen under, the breakout candle on Aug. 21 carried OKB far above its 20-day Bollinger Band midpoint of $83.41, with the higher band now extending to $180.78. With the OKB value already above that threshold, momentum stays firmly in bullish fingers. If patrons maintain the rally, the following key resistance lies at $240, a psychological barrier close to the latest intraday excessive.

OKB Value Forecast | Supply: TradingView

Regardless of that, it is very important word the RSI trending at 93.91 indicators closely overbought situations and an imminent profit-taking part.

If OKB retraces, preliminary assist is predicted close to the $180 zone, akin to the higher Bollinger Band. A sharper correction may drag the value towards $150, the place bulls may discover consolidation earlier than trying one other breakout. A failure to carry above $150 may set off a deeper retracement towards the $120 assist zone.

Maxi Doge Beneficial properties Consideration Amid Cardano Market Slowdown

As OKB value features method euphoric ranges, merchants may start rotating earnings into speculative tasks like Maxi Doge. The platform markets itself as a memecoin ecosystem providing derivatives buying and selling options with out strict entry necessities.

Maxi Doge Presale

Maxi Doge advertises as much as 1000x leverage on meme property, on the spot withdrawals and buying and selling entry with out KYC. With ADA merchants exhibiting restraint, speculative capital may rotate towards testing meme tokens for bigger revenue potential.

Go to the Maxi Doge website to discover high-leverage meme buying and selling and get in early on new market narratives.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is presently finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.