Key Notes

- BitMine’s huge $6.6 billion crypto treasury represents a $1.7 billion weekly enhance in digital asset holdings.

- Ethereum faces technical stress at $4,250 help degree following current 11% pullback from August peak ranges.

- Institutional backing from ARK, Founders Fund, and Galaxy Digital strengthens BitMine’s place in crypto markets.

BitMine Immersion Applied sciences (BMNR) has consolidated its place because the world’s largest Ethereum

ETH

$4 197

24h volatility:

3.2%

Market cap:

$506.95 B

Vol. 24h:

$37.94 B

treasury after saying crypto holdings of $6.612 billion in an official press launch on August 18. The disclosure marks a major milestone in institutional crypto adoption, positioning BitMine as a significant drive within the digital asset panorama.

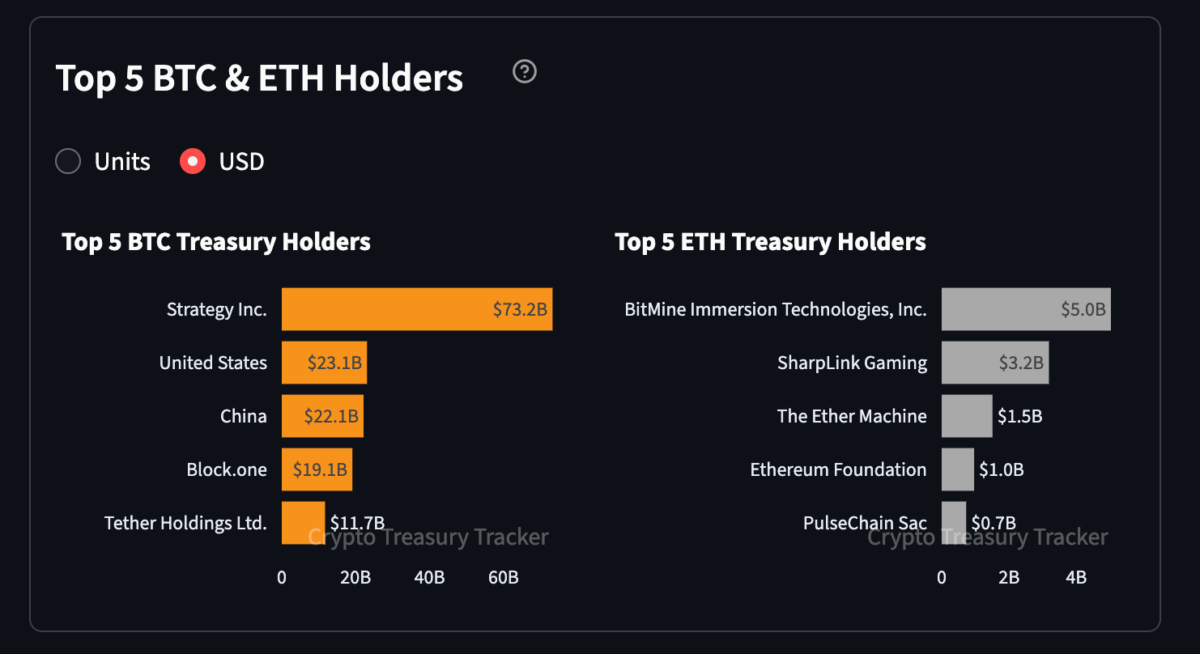

In its announcement, BitMine disclosed holdings of 1.52 million ETH and 192 BTC, representing a $1.7 billion enhance from the earlier week. This huge accumulation locations BitMine because the world’s largest Ethereum treasury and the second-largest world crypto treasury, trailing solely Strategy’s $73 billion Bitcoin

BTC

$113 928

24h volatility:

1.5%

Market cap:

$2.27 T

Vol. 24h:

$39.40 B

holdings at press time, according to Sentora Research dashboards.

Prime 5 Bitcoin and Ethereum Treasury Holders | Supply: Sentora Analysis, August 2025

Traders acquired the information positively, with BitMine’s (BMNR) inventory surging in buying and selling exercise, averaging $6.4 billion in each day turnover during the last week, making it the tenth most liquid US-listed inventory by greenback quantity.

“As we proceed to say, we’re main crypto treasury friends by each the speed of elevating crypto NAV per share and by the excessive buying and selling liquidity of our inventory,” mentioned Thomas Lee of Fundstrat, Chairman of BitMine.

Institutional companies together with ARK’s Cathie Wooden, Founders Fund, Pantera, Galaxy Digital, and Kraken are amongst high backers of the BitMine inventory, as the corporate targets possession of 5% of Ethereum’s circulating provide.

Ethereum Value Evaluation: ETH Checks $4,250 Assist

Amid BitMine’s announcement, Ethereum dipped under $4,250 on Monday, August 18, extending its pullback with a 2.18% intraday loss. The decline follows a pointy 42% rally between August 3 and August 14, the place ETH climbed from $3,356 to $4,831.

Since reaching that native peak, purchaser fatigue and market-wide revenue taking has pushed an 11% retracement over 4 days, with ETH buying and selling as little as $4,232 on Monday. Weak weekend momentum carried into US morning buying and selling, putting Ethereum on track for its fourth crimson session within the final 5 days.

Technical indicators at present present blended indicators for the short-term outlook. The ETHUSD 24-hour chart reveals buying and selling momentum stays marginally constructive, with the MACD line holding above the sign line, whereas narrowing bars point out weak demand. Furthermore, widening Bollinger Bands replicate elevated volatility, with ETH buying and selling close to the higher band however dealing with resistance at $4,886.

Ethereum Value Forecast

The important thing degree to look at is $4,250, which serves as a vital help threshold. A break under might ship ETH towards the 20-day easy transferring common at $4,058, whereas a profitable maintain above this degree and subsequent break of $4,886 resistance might propel ETH into value discovery above $5,000.

Regardless of current profit-taking, persistent institutional inflows led by BitMine might set off expectations of an imminent rebound because the week unfolds.

Ethereum Rally Boosts Curiosity in Finest Pockets’s $14M Presale

Ethereum’s renewed market exercise this week has additionally pushed consideration towards safe multi-chain wallets akin to Finest Pockets (BEST).

Finest Pockets Presale

The undertaking has already raised over $14 million in its presale, providing traders low transaction prices, enticing staking rewards, and early entry to decentralized functions.

Finest Pockets’s presale momentum indicators robust demand from Ethereum customers looking for each security and yield. Traders can nonetheless be part of at discounted tiers by the official Best Wallet site earlier than the following value enhance.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.