Bitcoin could also be organising for one more main push towards six-figure costs after reclaiming a key bullish sample and ending a interval of repeated draw back deviations. In accordance with well-known crypto analyst Rekt Capital, the current transfer places BTC again in place to purpose for the $160,000 goal, offered it might maintain an important help stage and break via evolving resistance.

Whereas short-term pullbacks are nonetheless doable, the broader technical picture stays intact. Historic value conduct suggests Bitcoin remains to be in a robust upward pattern, however time and value pressures may quickly power a choice level for the market.

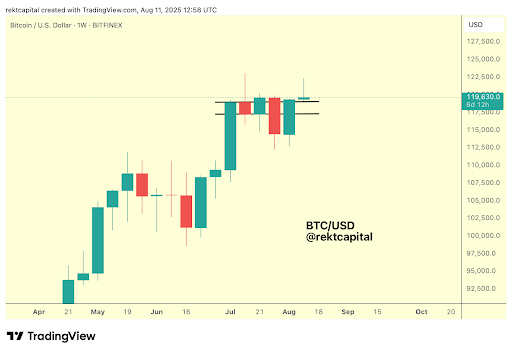

Bitcoin Bull Flag Breakout Revives Lengthy-Time period Bullish Outlook

Rekt Capital’s newest evaluation highlights that Bitcoin not solely reclaimed its Bull Flag sample however has positioned itself above it. That is a necessary shift as a result of a couple of weeks in the past, BTC failed to verify its breakout when it couldn’t maintain the Bull Flag high. That earlier miss left the sample unresolved and saved the market unsure concerning the subsequent large transfer.

Associated Studying

By holding the $119,000 stage as new help, BTC can verify the breakout and solidify the foundation for a rally. The analyst cautions that the worth may nonetheless dip again into the sample quickly, however so long as $119,000 holds, the bullish structure stays in play.

Ending the current draw back deviation provides to the optimism. A number of sharp deviations from bullish constructions have marked this cycle, however reclaiming and holding above the Bull Flag reveals renewed energy from consumers. For long-term bulls, this might be the technical reset wanted to maintain the $160,000 target alive.

Key Resistance Ranges That Stand Between BTC And $160,000

Regardless of a current -9% dip, Bitcoin stays in what Rekt Capital calls “Worth Discovery Uptrend 2.” This part, which follows historical price tendencies, has stayed intact as a result of the dip by no means broke the uptrend’s construction or confirmed a breakdown. Nevertheless, the transfer into Week 6 of this uptrend is notable; traditionally, Weeks 5 and 6 have typically been the “hazard zone” for native tops.

Whereas historical past factors to a possible pause right here, the distinctive nature of this cycle might permit for an extension. Nonetheless, the decisive issue is now value, not simply time. The analyst factors to resistance that first appeared round $124,000 in July however has since advanced right into a dynamic barrier nearer to $126,000.

Associated Studying

Breaking this stage within the subsequent one to 2 weeks may set off a pointy acceleration within the trend, placing the $160,000 roadmap again in focus. However, failure to clear $126,000 would create each time and price confluence for a pullback, which Rekt Capital calls “Worth Discovery Correction 2.”

Such a correction wouldn’t finish the long-term bullish case however would delay the subsequent leg up. Till then, all eyes are on these key ranges: $119,000 for help and $126,000 for breakout. How Bitcoin handles them may resolve whether or not the grand roadmap to $160,000 stays on observe within the weeks ahead.

Featured picture from Unsplash, chart from TradingView.com