Key Notes

- BitMine elevated ETH holdings to 1.15 million tokens inside one week, boosting treasury worth to $4.96 billion whole.

- Basic International bought 47,331 ETH tokens as a part of formidable $5 billion acquisition fund focusing on market dominance.

- Technical indicators present bullish momentum with potential targets at $5,000, although file open curiosity creates liquidation dangers.

Ethereum

ETH

$4 251

24h volatility:

1.2%

Market cap:

$512.86 B

Vol. 24h:

$42.39 B

worth crossed the $4,360 mark on Monday, August 11, setting a better day by day peak for the fifth consecutive session. The latest surge is primarily pushed by BitMine’s aggressive treasury growth, because the Nasdaq-listed firm disclosed a large ETH accumulation spree that added over 316,000 tokens to its holdings inside only one week.

BitMine Immersion increased its ETH holdings from 833,137 tokens to 1.15 million, boosting its treasury valuation by $2 billion to achieve $4.96 billion whole. This company shopping for stress has coincided with derivatives market exercise reaching unprecedented ranges, as ETH open curiosity climbed to almost $60 billion, signaling intensified institutional and retail curiosity in Ethereum’s worth trajectory.

“We’re main crypto treasury friends by each the rate of elevating crypto NAV per share and by the excessive buying and selling liquidity of our inventory,” Thomas Lee, Fundstrat Chairman and BitMine Board Director stated.

According to Yahoo Finance, BitMine stock (NASDAQ:IMMR) ranks among the many 25 most actively traded US equities, with a $2.2 billion five-day common day by day greenback quantity, surpassing JPMorgan and Micron Know-how.

In the meantime, Basic International (Nasdaq: FGNX) additionally announced its first ETH purchase of 47,331 tokens, simply days after launching a $5 billion acquisition fund focusing on 10% of Ethereum’s whole provide. The corporate goals to grow to be one of many largest ETH treasury holders globally.

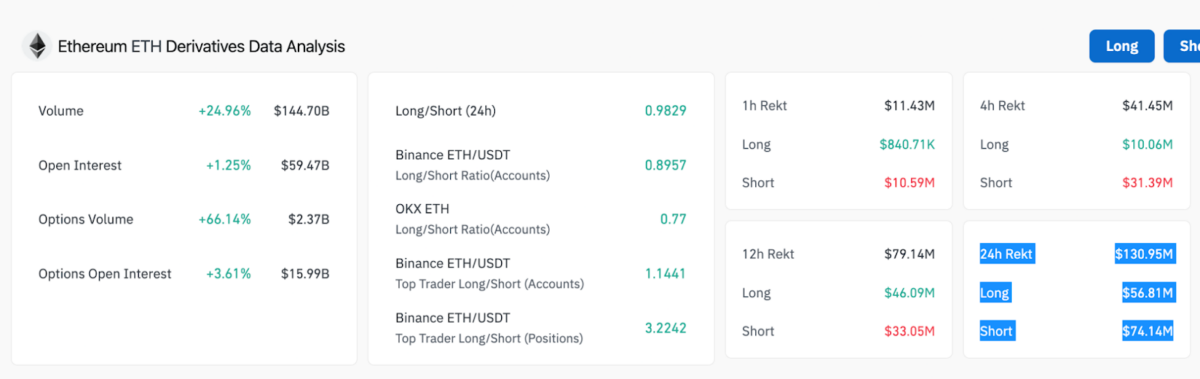

Within the derivatives market, ETH open curiosity rose 1.25% to $59.47 billion, its highest stage but, whereas 24-hour buying and selling quantity climbed 24.96% to $144.7 billion.

Ethereum By-product Market Evaluation | Coinglass

According to Coinglass data, choices quantity surged 66.14% to $2.37 billion, signaling heightened speculative positioning. Liquidations totaled $130.95 million, break up between $56.81 million lengthy positions and $74.14 million shorts.

If company treasury demand for Ethereum persists as hinted by Standard Chartered analysts, and derivatives merchants proceed to position extra aggressive bullish positions, Ethereum worth could possibly be on the verge of reclaiming all-time highs above $4,900.

Nevertheless, with Ethereum bulls clearly over-leveraged at file open curiosity ranges close to $60 billion, a downturn in market sentiment might set off fast liquidations.

ETH Value Forecast: Will ETH Hit All-Time Highs Above $5,000?

The day by day ETH/USDT chart exhibits a robust bullish construction, with worth buying and selling above the higher Bollinger Band at $4,287. The latest breakout from $4,000 assist is backed by increasing Bollinger Band width, indicating rising volatility in favor of patrons.

MACD strains stay effectively above the zero stage, with the blue line (MACD) widening over the sign line, reinforcing bullish momentum. The final 5 day by day candles have all closed in inexperienced, signaling robust shopping for stress.

Ethereum Value Forecast | ETHUSD 24H Chart TradingView

If ETH worth closes above $4,360 with sustained quantity, the subsequent upside targets sit at $4,500 and all-time highs above the $4,891 mark final seen in the course of the 2021 bull cycle. A breach above $4,800 might open the trail to $5,000 psychological resistance.

On the draw back, failure to carry above $4,287 might deliver a retest of the mid-Bollinger Band stage at $3,796. A day by day shut under this could invalidate the near-term bullish setup and expose ETH to deeper pullbacks towards $3,400 assist.

Greatest Pockets Presale Crosses $14 Million as Ethereum Company Adoption Accelerates

With Ethereum company treasuries pulling billions in inflows over the previous month, ETH-compatible crypto wallets like Greatest Pockets (BEST) are positioned for main good points. As ETH’s adoption accelerates, Greatest Pockets goals to grow to be the default gateway for each institutional and retail ETH holders.

Greatest Pockets Presale

Having raised over $14 million in its presale, Greatest Pockets gives early members unique advantages, together with diminished transaction charges, high-APY ETH staking, and precedence entry to imminent decentralized purposes.

The presale’s fast progress displays rising demand for safe, multi-chain wallets optimized for Ethereum’s DeFi ecosystem. Traders looking for early publicity can go to Best Wallet’s official site earlier than the subsequent presale worth tier unlocks.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is presently finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.