Key Notes

- BlackRock Ethereum ETF has now approached nearer to the milestone of $10 billion in inflows since inception.

- ETH’s rally above $4,000 for the primary time since December 2024 triggered $105 million in Ether quick liquidations.

- Analysts counsel Ethereum’s surge may pave the way in which for a broader altcoin rally.

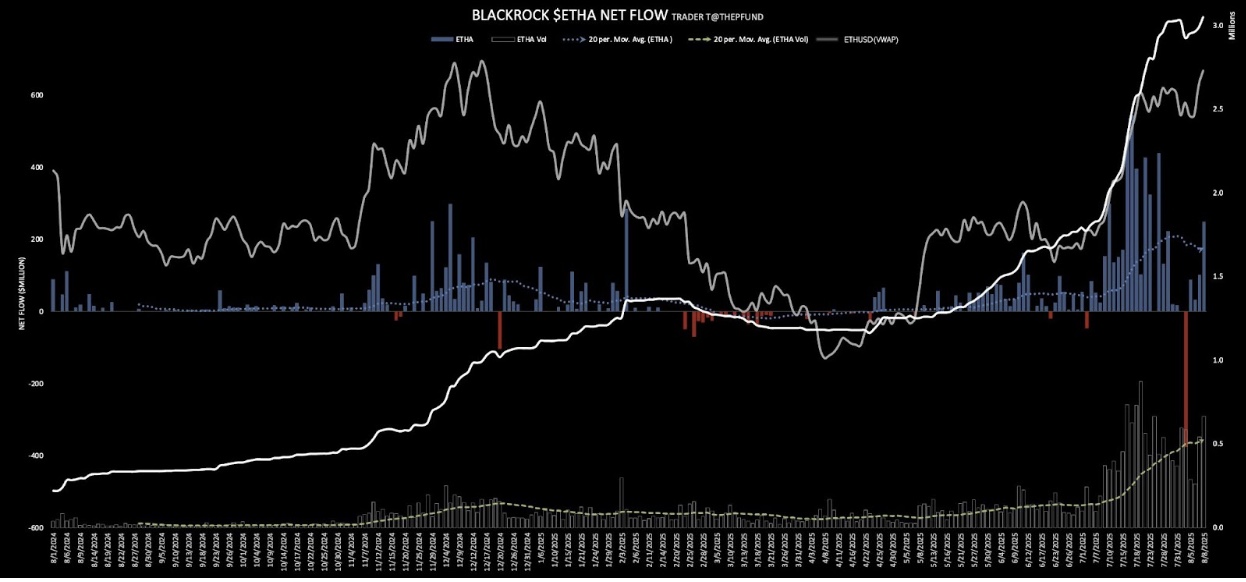

Inflows into spot Ethereum ETFs shot as much as greater than $460 million on Friday, August 8, as ETH value reclaimed the $4,000 degree as soon as once more for the primary time since December 2024. BlackRock iShares Ethereum Belief (ETHA) led probably the most inflows at $254.7 million.

BlackRock’s ETHA Dominates Ethereum ETF Inflows

As mentioned, the BlackRock Ether ETF (ETHA) dominated the online inflows throughout all US Ethereum ETF issuers. Throughout Friday’s buying and selling session, ETHA bought a complete of 62,936 ETH, price a staggering $254 million, with each inflows and buying and selling quantity surpassing the 20-day shifting common. The ETF noticed $1.7 billion in whole buying and selling quantity throughout the session.

As per the data from Farside Traders, the online inflows into BlackRock’s ETHA since inception have reached nearer to $10 billion. Following these sturdy inflows, the ETHA share value surged 5% on Friday, closing at $30.79. The share has gained a large 47% over the previous month, because the inflows jumped from $5 billion straight as much as $10 billion. Other than BlackRock, Constancy’s FETH additionally contributed $132 million in inflows.

ETH Value Rally Triggers Brief Liquidations

The latest ETH price rally previous $4,000 yesterday led to main quick liquidations. “It places a smile on my face to see ETH shorts get smoked in the present day. Cease betting in opposition to BTC and ETH – you can be run over,” famous Eric Trump.

Blackrock Ethereum ETF inflows | Supply: Dealer T

On Friday, roughly $105 million price of Ether (ETH) quick positions had been liquidated, accounting for about 53% of the full $199.61 million in brief liquidations throughout the crypto market. The liquidations got here as ETH crossed the $4,000 mark for the primary time since December 2024. Talking on the present improvement, standard analyst Michael van de Poppe writes:

“Wild transfer of $ETH. It has swept the excessive and it’s a little too dangerous to be shopping for $ETH at these highs. It’s organising for an enormous breakout in the direction of ATHs, however I believe it’s wiser to allocate funds throughout the $ETH ecosystem because it ought to yield the next return”.

http://twitter.com/CryptoMichNL/standing/1954091190086705623

Crypto market analysts consider that Ethereum rally may set the stage for a broader altcoins season shifting forward. Other than ETH different, altcoins have additionally proven power with XRP, ADA, SOL, DOGE, gaining 5-10% yesterday.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.

Bhushan is a FinTech fanatic and holds a great aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in the direction of the brand new rising Blockchain Know-how and Cryptocurrency markets. He’s repeatedly in a studying course of and retains himself motivated by sharing his acquired data. In free time he reads thriller fictions novels and typically discover his culinary expertise.