After falling beneath a vital assist degree, Bitcoin (BTC) is making an attempt to recuperate a few of its misplaced floor. An analyst steered that this week’s efficiency shall be decisive for the cryptocurrency’s subsequent pattern.

Associated Studying

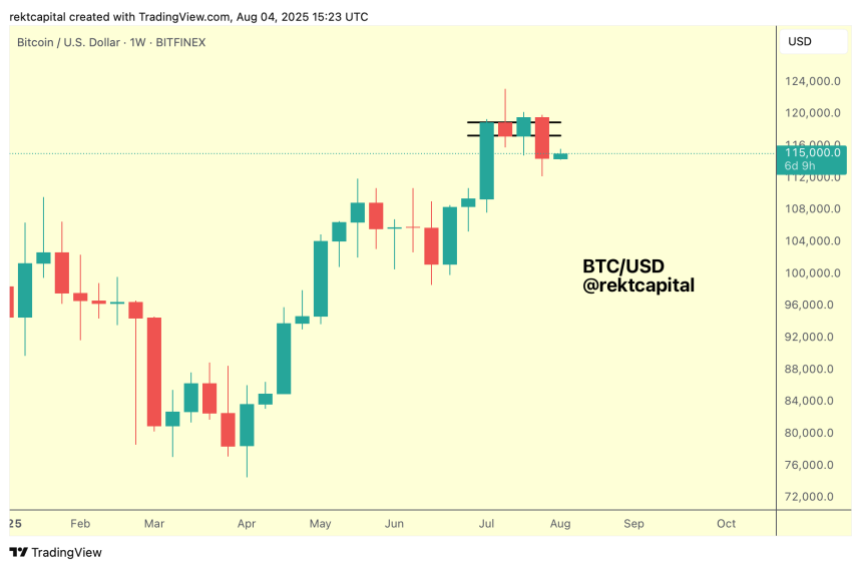

Bitcoin Loses Bull Flag Formation

Over the weekend, Bitcoin misplaced its post-breakout vary for the primary time in three weeks, falling to an area low of $112,296 on August 3. The flagship crypto had been buying and selling between the $114,000-$120,000 vary for the reason that early July breakout, hitting its all-time excessive (ATH) of $122,838 amid the rally.

As July neared its finish, BTC skilled some volatility, retesting the vary lows twice over its final week. Nevertheless, the cryptocurrency was unable to repeat its worth restoration from the earlier weekend, shedding the essential space on August 1.

Rekt Capital noted that Bitcoin’s rally could possibly be in danger, explaining that BTC has fashioned a bull flag within the weekly chart and held the sample’s lows as assist till the most recent Weekly Shut.

Following its latest worth motion, the analyst considers that this week’s efficiency shall be pivotal to see whether or not the sample’s backside, across the $117,200 space, will develop into a brand new resistance and ensure the breakdown, or if the flagship crypto’s worth will recuperate the construction.

In line with the evaluation, if the worth can reclaim the construction, the correction can be thought of a pretend draw back deviation earlier than resynchronizing with the sample.

In the meantime, turning the sample’s backside into resistance can be a bearish retest, confirming the breakdown, and doubtlessly resulting in a brand new retest of the $112,000 space as assist.

BTC’s Weekly Shut To Decide Subsequent Pattern

Rekt Capital additionally detailed that this week’s efficiency will decide the way forward for BTC’s second Worth Discovery uptrend, which has technically began its fifth week.

Relying on what occurs to the Bull Flag (reclaim or a affirmation of the breakdown), we’ll know whether or not the Worth Discovery Uptrend 2 will proceed or whether or not BTC has skilled a really quick PDU2 as a substitute.

Final week, the analyst retesting that the continuation of the Worth Discovery pattern might fail as BTC transitioned into weeks 5-7 of this section. Traditionally, the second uptrend has began to decelerate round Weeks 5-6, hitting its peak throughout this “Hazard Zone.”

If Bitcoin reclaims the Bull Flag and challenges new highs, then its second Worth Discovery uptrend will progress in response to its historic tendencies.

Nevertheless, if it fails to Weekly Shut above the sample’s backside and confirms further draw back, the second Worth Discovery uptrend would have led to Week 2, a lot faster than has traditionally been the case.

Furthermore, it might reveal that BTC has been in its second Worth Discovery Correction, which “can be going utterly in opposition to the grain of historical past.”

Associated Studying

The analyst steered that macro-wise, Bitcoin nonetheless has loads of time for a 3rd Worth Discovery uptrend. If the second section has already ended, a ultimate uptrend might overcompensate for the present uptrend’s underperformance.

Beforehand, Rekt Capital asserted that what comes after the second uptrend would rely upon how lengthy the corrective section takes, as a shot correction might enable for a 3rd uptrend earlier than the bear market.

Featured Picture from Unsplash.com, Chart from TradingView.com