A Bitcoin whale from the early 2010s, holding cash mined or acquired in Bitcoin’s infancy, just lately woke up and bought 80,000 BTC. The sale was handled by Galaxy Digital, which executed the switch of over 80,000 BTC (price $9 billion) on behalf of this shopper, who’s described as a “Satoshi-era” investor.

Regardless of this huge sale and the volatility that came after, Bitcoin has managed to regular and the following worth motion exhibits that bulls had been greater than ready to soak up the promote shock.

Associated Studying

Bitcoin Dips To $115,000, Bulls Shortly Purchased The Dip

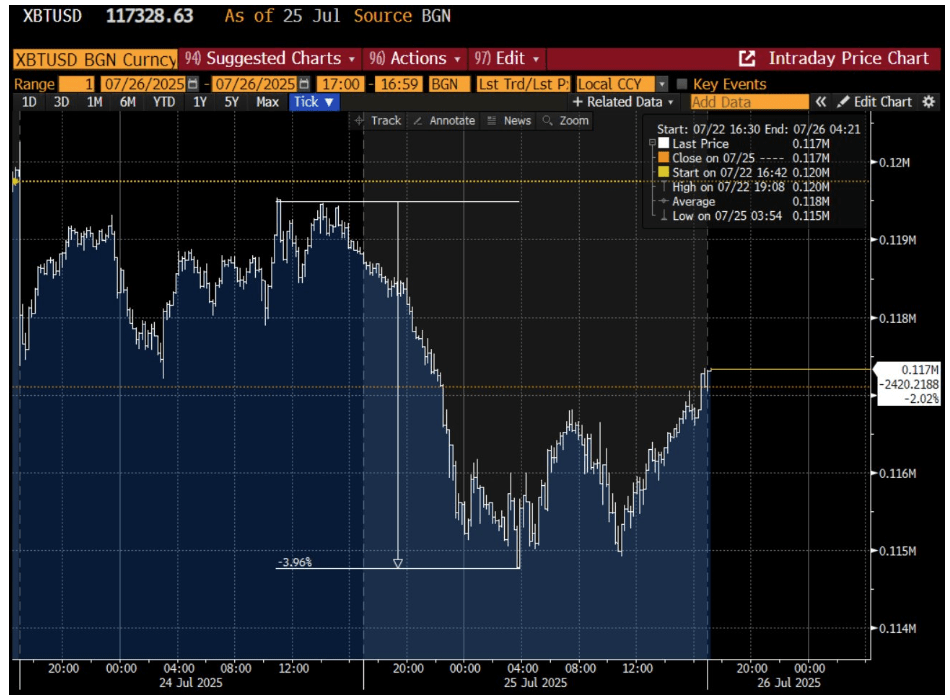

Information of the $9 billion Bitcoin sale initially caused price volatility. Bitcoin’s worth had just lately been buying and selling round $119,000, so the sudden inflow of promote orders prompted a short-lived pullback. On July 25, as stories of Galaxy’s whale sale unfold, BTC/USD swiftly fell to round $114,000 to $115,000.

The sheer measurement of 80,000 BTC (over 0.4% of complete provide) hitting the market had the potential to set off panic. Certainly, there have been indicators of profit-taking and better change inflows within the days surrounding the sale. This, in flip, led to a 3.5% drop, which is one in all Bitcoin’s steepest intraday dips in weeks, temporarily breaking below the $115,000 assist degree.

Nonetheless, it quickly grew to become clear that Bitcoin’s bulls had been greater than ready to soak up the shock. The value decline bottomed out in mere hours. By the top of that very same day, Bitcoin had rebounded above $117,000, and it was buying and selling again within the mid-$117,000.

This speedy restoration demonstrated exceptional liquidity and depth within the Bitcoin market. “80,000 BTC, over $9 billion, was bought into open market order books, and Bitcoin barely moved,” observed crypto analyst Joe Consorti, exhibiting how rapidly consumers stepped in to counter the promoting strain.

Again in earlier years, a promote order of this magnitude might have triggered a double-digit proportion worth crash. Against this, the ecosystem in 2025 dealt with it with shocking ease. “All the sale has been absolutely absorbed by the market,” noted Bitcoin analyst Jason Williams.

What’s Subsequent For Bitcoin Worth?

With the whale’s 80,000 BTC sale now largely within the rearview mirror, the subsequent step is looking forward to the place Bitcoin would possibly go from right here. The truth that the market digested a $9 billion sell-off with solely minor turbulence has many observers feeling much more bullish about Bitcoin’s trajectory. “We’re going a lot larger,” Jason Williams famous.

It’s a sentiment shared by a number of crypto analysts on X, who see the fast restoration as proof of sturdy upward momentum. The consensus amongst bulls is that new all-time highs may very well be on the horizon within the coming months. Bitcoin already notched a file round $123,000 on July 14, however analysts are nonetheless calling for brand spanking new highs above $130,000, $150,000, or even higher.

Associated Studying

On the time of writing, Bitcoin is buying and selling at $118,063, up by 0.5% prior to now 24 hours.

Featured picture from Unsplash, chart from TradingView