Ethereum is present process its first notable pullback after an explosive rally that took the value from $2,500 to $3,800 in lower than three weeks. Regardless of this cooldown, bulls stay in management, with ETH holding agency above the $3,600 stage—a key help zone now performing as the bottom for potential consolidation. The market seems to be digesting current positive aspects, with indicators that Ethereum’s energy could possibly be removed from over.

Associated Studying

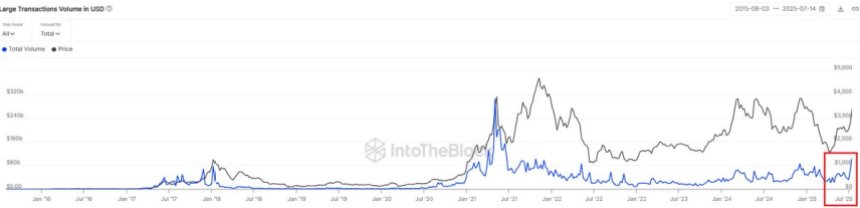

On-chain knowledge from Sentora provides to the bullish outlook. Final week, Ethereum noticed the best weekly quantity of huge transactions since 2021. This surge in big-money exercise alerts rising curiosity from institutional gamers and enormous buyers, even amid short-term volatility.

With authorized readability within the US bettering and Ethereum fundamentals strengthening, the present pause could also be setting the stage for an additional leg increased. Whether or not this consolidation lasts days or even weeks, the elevated on-chain exercise suggests Ethereum’s ecosystem is heating up once more, with main gamers positioning for the subsequent transfer.

Establishments Rotate From BTC Into Ethereum

Sentora data confirms a serious shift underway: big-money Ethereum is again. Final week, on-chain transfers over $100,000 totaled greater than $100 billion—the best weekly quantity since 2021. This spike in high-value transfers displays renewed institutional curiosity, reinforcing Ethereum’s position because the main altcoin amid evolving market dynamics.

The timing of this surge is important. Ethereum’s value has rallied aggressively from $2,500 to $3,800 in a matter of weeks, and institutional capital seems to be rotating from Bitcoin into ETH. Whereas Bitcoin stays in a good consolidation vary slightly below its all-time excessive, Ethereum’s upside momentum and on-chain energy recommend it might now be main the cost. This rotation has sparked discussions in regards to the starting of “Ethereum season,” a sample seen in earlier market cycles when ETH outperforms BTC and capital begins to move into the broader altcoin market.

Some analysts imagine this might mark the early phases of a long-awaited altseason. Traditionally, Ethereum leads such phases, performing because the gateway for buyers to discover high-beta belongings throughout the crypto ecosystem. If ETH maintains present energy and breaks above the $4,000 stage, it may set off a broader market growth.

Associated Studying

ETH Worth Holds Above Key Assist After Parabolic Rally

Ethereum is present process its first significant pullback since starting a strong surge from the $2,500 area in early July. After reaching a neighborhood excessive of $3,801, ETH is now buying and selling round $3,662, down roughly 2.7% on the day. Regardless of the minor correction, the general construction stays bullish. The present value sits above the $3,600 zone, a stage that now acts as key short-term help.

Quantity has barely decreased throughout this pullback, suggesting that promoting stress stays comparatively managed. ETH remains to be buying and selling nicely above its 50-day, 100-day, and 200-day shifting averages, reinforcing the energy of the uptrend. The subsequent main resistance lies round $3,800–$3,850, which aligns with earlier peaks seen in early 2024.

Associated Studying

A profitable consolidation above $3,600 may present the inspiration for a brand new leg increased towards the $4,000 mark. Nevertheless, failure to carry this help stage may set off a retest of the $3,450–$3,500 space, adopted by stronger help round $3,000 and the $2,850 breakout zone.

Featured picture from Dall-E, chart from TradingView