Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

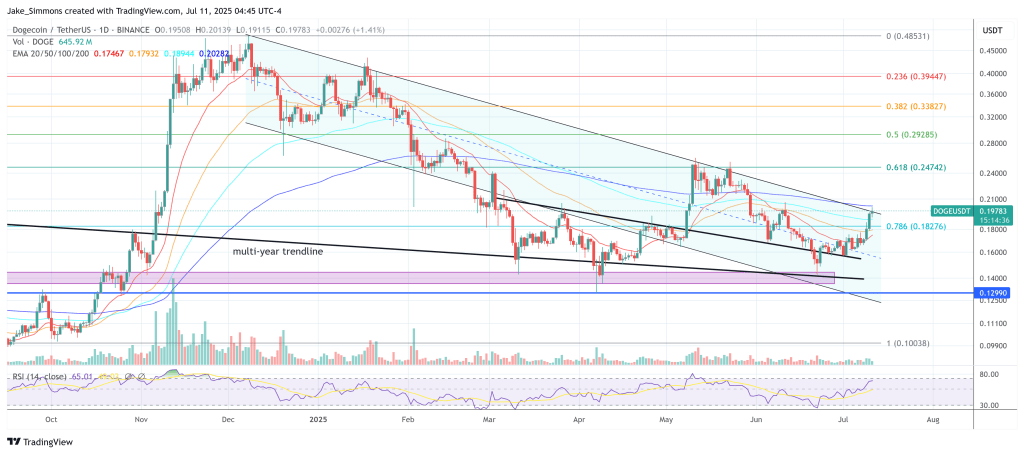

Dogecoin hovered close to $0.20 on Friday, nursing a weekly achieve of about 17 % and a 24-hour buying and selling quantity above $2 billion as merchants digested a late-June livestream by technical analyst Kevin, who argued that the meme-coin’s construction “needs to be one of many best-looking altcoin charts on the market.”

Dogecoin Double Backside Might Set off $1

In the course of the one-hour session Kevin highlighted a textbook double-bottom that printed on Dogecoin’s weekly chart precisely on the confluence of the 200-week easy and exponential transferring averages, the 0.382 Fibonacci retracement of the 2023–2025 advance, and a long-term up-trend line relationship again to the 2022 bear-market trough. Coming into at that zone, he mentioned, “the risk-reward right here is phenomenal,” noting {that a} tight cease slightly below the cluster implied restricted draw back whereas upside targets stretched towards the earlier cycle’s highs.

Kevin informed viewers the weekly momentum profile helps a bigger breakout. Cash-flow on Market Cipher is curling larger for the primary time in additional than a yr; the MACD is making ready to cross bullish from a better low; and the stochastic RSI has turned up from mid-range. On the month-to-month chart, relative power continues to print larger highs and better lows, and the stock-RSI “is hanging on, able to push again up,” he mentioned, including that the complete construction “appears freakin’ nice” for a sustained transfer as soon as Bitcoin clears its personal resistance band close to $116,000.

Associated Studying

His worth map for the approaching months begins with a purple resistance field between $0.94 and $1.31—the 2021 peak plus the 1.618 extension of the 2022–24 base. “I’d be fairly shocked if Dogecoin can’t at the very least tag 94 cents,” Kevin mentioned, stressing {that a} decisive break of a greenback would doubtless entice a brand new wave of retail merchants and algorithmic trend-followers. He stopped wanting providing an end-of-cycle goal, however insisted “$1 remains likely,” conditional on Bitcoin extending towards the $150,000 area and—crucially—on macro tail-winds reminiscent of an finish to quantitative tightening by the Federal Reserve.

Even so, Kevin warned towards complacency. Dogecoin’s intraday spike coincided with Bitcoin’s check of a serious Fib cluster at $116,000, whereas USDT dominance hit golden-pocket help—ranges that might spark a near-term cooldown. “Don’t be fooled by inexperienced candles,” he mentioned, reminding viewers that meme-coins “can get crushed even in bull markets” and advising strict danger administration: take partial earnings after huge thrusts, transfer stops to break-even, and “rinse and repeat.”

Associated Studying

Past pure chart work, Kevin framed Dogecoin as a perpetual beneficiary of retail psychology. “You may stroll into any gasoline station and somebody owns Doge,” he quipped. “It’s the retail darling—it all the time can be—particularly when new cash exhibits up with deeper pockets than final time.”

For now, worth motion is validating that thesis. If the double-bottom holds and macro situations align, the analyst argues, Dogecoin may as soon as once more headline the following alt-season—this time with a greenback tag that merchants within the last cycle may solely meme about.

At press time, DOGE traded at $0.1978.

Featured picture created with DALL.E, chart from TradingView.com