Dogecoin could also be gearing up for its subsequent breakout. After holding agency close to $0.17 on the weekly chart, DOGE not too long ago bounced off key Fibonacci and trendline help, hinting at renewed bullish potential.

With its 200‑week shifting common providing regular help and worth comfortably above the ascending channel, technicals counsel the setup is aligning. If the current dip towards the 200 MA on the M15 chart proves to be a low-risk entry, this might set the stage for a retest of the $0.16490 resistance, and presumably extra.

Rejection At Resistance, However Technicals Nonetheless Favor Bulls

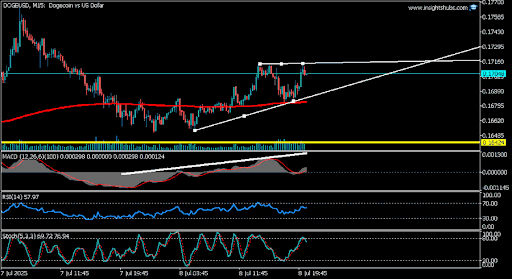

In a current evaluation shared on X, Thomas Anderson offered an in depth breakdown of DOGE/USD worth motion throughout the M15 and M30 timeframes. In keeping with the knowledgeable, Dogecoin is presently buying and selling at $0.17043, and the worth is dealing with rejection on the yellow horizontal resistance line round $0.16490. The value motion reveals consolidation slightly below this key degree, signaling indecision amongst merchants.

Anderson identified that the 200 MA (pink line) is appearing as dynamic help from under, serving to to anchor the worth through the present consolidation part. This shifting common help supplies bulls the inspiration to regain management if momentum shifts of their favor.

On the M30 chart, Anderson famous that the broader bullish construction stays intact, with DOGE worth holding above the ascending trendline. This technical sample suggests continued optimism for upward motion, offered the worth doesn’t break under key help areas. Thomas Anderson concluded that any pullback towards the 200 MA on the M15 timeframe might provide a shopping for alternative, notably for merchants eyeing a retest of the $0.16490 resistance.

Dogecoin Weekly Chart Echoes Elliott Concept’s Bullish Blueprint

Taking a better take a look at Dogecoin’s weekly chart, crypto analyst Andrew observed a notable long-term wave construction unfolding. He defined that over the previous three years, DOGE has accomplished a five-wave impulse to the upside, which was adopted by a typical ABC correction, in keeping with Elliott Wave concept.

Andrew additional famous that worth discovered a powerful response on the 0.786 Fibonacci degree, marked by a lightweight blue line, which traces the retracement from the whole upward transfer. This response means that DOGE could have reached a important support area, the place consumers might start stepping in.

With this in thoughts, Andrew believes the present construction seems to be forming a bigger 1-2 setup, which might result in a strong Wave 3 advance. If this sample performs out, it might sign the beginning of a brand new bullish part with the potential to interrupt past earlier highs.