Bitcoin has held regular across the $108,000 worth degree in latest days. After bouncing again from a quick pullback close to $105,500 on Wednesday, Bitcoin recently tested $109,000 again up to now 24 hours.

A preferred crypto analyst has shared a long-term “Bitcoin Bull Run Cheat Sheet” that claims that the cryptocurrency has now entered into the ultimate part that can result in huge worth beneficial properties.

Associated Studying

Bitcoin Cheat Sheet Declares Begin Of Closing Bull Part

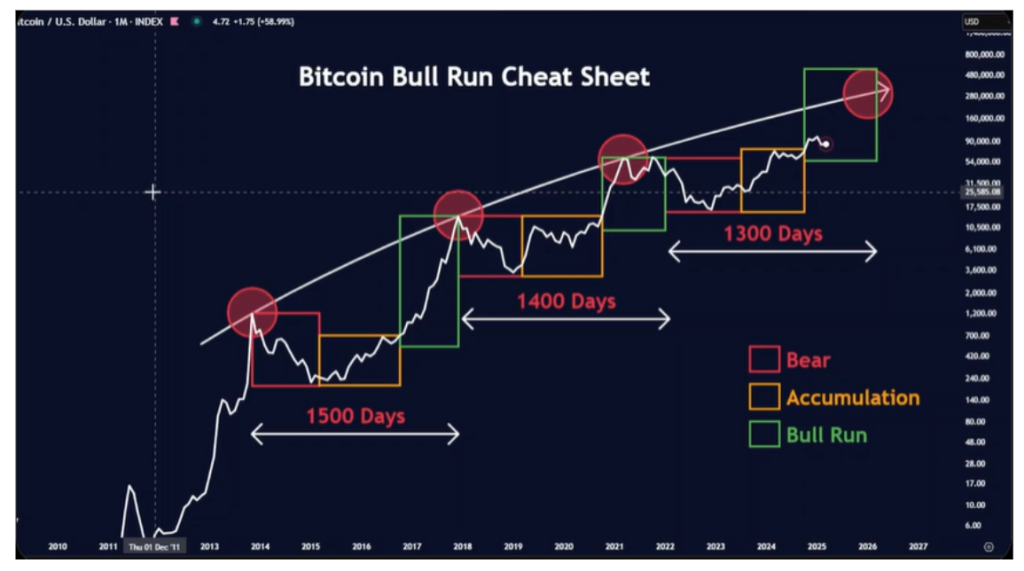

In a latest publish on X, Merlijn The Dealer released what he dubbed the “Bitcoin Bull Run Cheat Sheet.” This cheat sheet is a breakdown of Bitcoin’s previous market actions that reveals the distinct phases of bear markets, accumulation zones, and subsequent parabolic bull runs.

The cheat sheet divides every of Bitcoin’s two earlier cycles from 2014 into three coloured containers: pink for bear markets, orange for accumulation, and inexperienced for bull runs. Merlijn’s chart traces this repeating construction over the previous decade, exhibiting how every bull market adopted an identical rhythm that started after a prolonged consolidation interval and ended with a robust worth explosion.

The first full cycle began with Bitcoin’s peak round $1,000 in December 2013. Following that high, the value entered a protracted, painful bear market that spanned into 2015. This red-box part finally transitioned into accumulation, the place Bitcoin traded sideways between $80 and $500 for a protracted interval. The inexperienced bull run field on the chart started round early 2017, and finally ended with a peak just under $20,000 in late 2017. In accordance with the cheat sheet, this whole cycle from peak to new peak lasted 1500 days.

Bitcoin’s second cycle kicked off after its December 2017 high. An extended drawdown adopted, and the bear market part dragged Bitcoin all the way down to $3,000 by the top of 2018. The chart marks this level with one other pink field, adopted by the orange accumulation zone that stretched effectively into 2020.

The cheat sheet’s inexperienced field reappeared in late 2020 proper as Bitcoin broke above its earlier highs. The worth shot up all through 2021 and finally reached a brand new all-time excessive round $69,000 in November of that yr. This second full cycle was shorter than the primary and spanned round 1400 days from the earlier high.

When Will The Subsequent Bull Run Start?

The present cycle started with Bitcoin’s all-time excessive in November 2021. Since then, the market has gone by means of its acquainted sequence. A pointy decline into 2022 which bottomed round $15,000 represents the bear market part. The decline was adopted by almost a yr of sideways motion and sluggish restoration up until early 2025. That is represented because the orange accumulation field on the cheat sheet above.

In accordance with the analyst, Bitcoin is now within the subsequent bull part, and possibly the largest one yet. The chart initiatives a continuation alongside the long-term progress curve, presumably towards the $250,000 to $300,000 vary over the approaching yr. Notably, the timeline for the whole cycle this time ought to take about 1,300 days from late 2021 to finish.

Associated Studying

On the time of writing, Bitcoin is buying and selling at $108,260.

Featured picture from Pixabay, chart from TradingView