- Technique’s $14 billion Q2 acquire highlights its robust Bitcoin-driven efficiency over its software program enterprise.

- Public companies are accumulating BTC ETFs, signaling rising institutional confidence in crypto.

Technique (previously MicroStrategy) has as soon as once more captured market consideration, this time with its inventory leaping 7.76% to $402.28, based on Google Finance.

MSTR inventory jumps sky-high

The corporate, buying and selling underneath the NASDAQ ticker MSTR, isn’t gaining momentum from its software program enterprise, however fairly from its huge Bitcoin [BTC] holdings, which exceeded 528,000 BTC as of March.

With these belongings valued at roughly $43.5 billion, Technique is on observe to submit a staggering $14 billion acquire for Q2 2025.

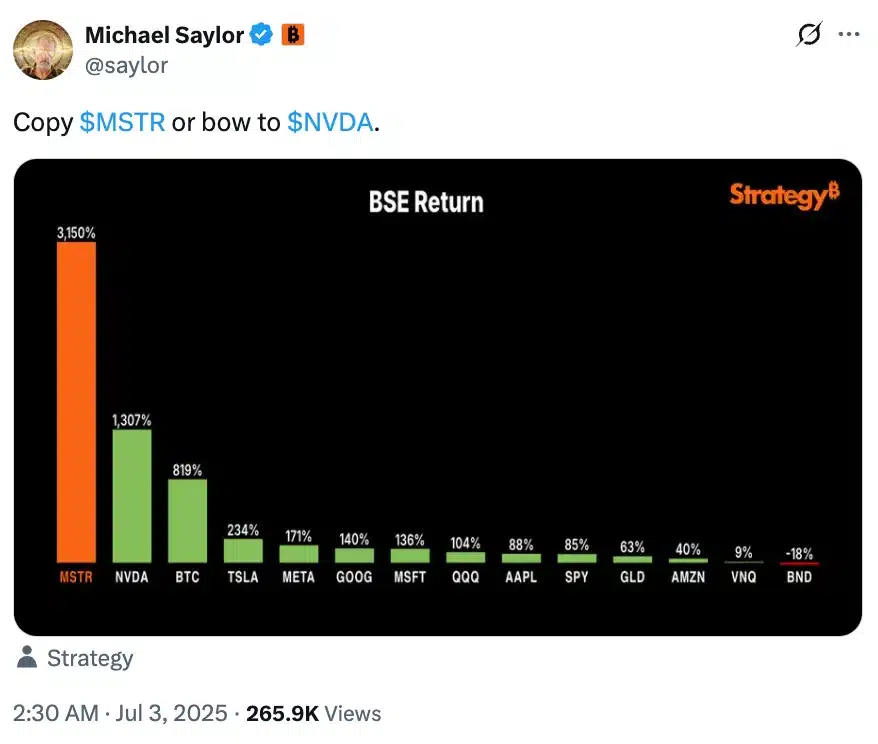

Since pivoting to a Bitcoin-focused technique in 2020, the corporate’s inventory has soared over 3,300%, far outpacing Bitcoin’s personal 1,000% acquire throughout the identical interval.

In Q2 2025 alone, MSTR jumped 40%, simply outperforming the S&P 500’s 11% rise.

This pattern isn’t distinctive to Technique. Japan’s Metaplanet—one other crypto-forward agency—reported a 42% quarter-over-quarter income surge in its Bitcoin operations, additionally beating S&P 500 development estimates.

Notably, for the third consecutive quarter, public firms with massive Bitcoin treasuries have outpaced ETFs in internet BTC accumulation, signaling rising institutional conviction in crypto.

MSTR outpaces numerous tech giants

Seeing this, Bloomberg lately reported that Michael Saylor’s (Chairman of Technique) crypto technique may translate into an unrealized second-quarter acquire of roughly $14 billion, inserting Technique within the league of company giants like Amazon and JPMorgan.

Curiously, these huge positive aspects will not be backed by conventional operations, as analysts count on the corporate to report solely $112.8 million in software program income.

As a substitute, the spectacular efficiency stems from Bitcoin’s rebound and a latest shift in accounting requirements affecting how crypto belongings are valued on steadiness sheets.

Remarking on the identical, Michael Saylor took to X and famous,

Combined group response

As anticipated, the crypto group too appreciated this success of Technique, as famous by an X (formerly Twitter) user who stated,

“Technique teasing everybody with a bull flag. Anyday now. $MSTR. Endurance.”

Echoing related sentiments, one other X consumer, Cole, added,

This coincided with the agency lately outpacing U.S. spot ETFs in Bitcoin accumulation, signaling a shift in institutional confidence.

Whereas this surge bolstered the rising attraction of direct Bitcoin publicity via company treasuries, it additionally sparked criticism.

Notably, longtime Bitcoin skeptic Peter Schiff aimed toward these firms, suggesting that their aggressive crypto positions have been extra speculative than strategic.

This added gas to the continuing debate over Bitcoin’s function in company finance.

He said,

“All the businesses including Bitcoin to their steadiness sheets are both Bitcoin treasury firms or crypto-related companies. No non-crypto firms are including Bitcoin to their steadiness sheets.”

He additional added,

“That is concentrated crypto hypothesis, not broad-based adoption.”

Bitcoin’s worth motion

In the meantime, Bitcoin’s latest rebound, following a dip to $105K, reignited bullish sentiment out there.

With a 2.19% acquire within the final 24 hours, at press time, BTC seems to be regaining its footing.

If this upward momentum sustains, Bitcoin may very well be on observe to problem the $111K resistance as soon as once more, probably marking a key breakout level.

As institutional accumulation strengthens and market sentiment leans optimistic, all eyes at the moment are on whether or not BTC can preserve this trajectory and solidify a brand new leg up within the present cycle.