- BSC now leads in uncooked block output, clocking 115,200 blocks/day, 8x greater than Ethereum’s projected quantity

- Does this efficiency hole replicate deeper on-chain traction too?

As blockchain use circumstances quickly develop into mainstream finance, Layer-1 chains are tightening their protocols to stake their declare as the subsequent Web3 powerhouse.

In reality, BNB Chain [BSC] isn’t ready round. Whereas Ethereum [ETH] devs debate block time reductions, the Maxwell improve has already slashed BSC’s block time from 1.5s to 0.75s.

This transfer goals to spice up velocity, consumer expertise, and throughput throughout the community. However does this daring step give BNB Chain an actual edge over Ethereum?

BNB chain doubles down on velocity with Maxwell improve

As AMBCrypto flagged, Ethereum is deliberating a block time discount from 12 seconds to six seconds as a part of the upcoming Glamsterdam improve, anticipated in 2026.

In the meantime, BNB Chain has already taken motion. Its Maxwell upgrade has slashed block time from 1.5 seconds to 0.75 seconds.

Statistically, decrease block time interprets to greater block frequency. With Maxwell in place, BSC now produces roughly 4,800 blocks per hour, or 115,200 per day.

Even when Ethereum implements the 6-second slot time, it could generate solely 14,400 blocks per day. Meaning BSC is on tempo to supply almost 8x extra blocks each day, giving it a big edge in transaction throughput and settlement velocity.

Nonetheless, velocity alone doesn’t assure community dominance. So, does this architectural divergence translate into measurable good points in BSC’s on-chain exercise, DeFi liquidity flows, and value momentum?

Can efficiency good points drive BSC’s ecosystem impression?

On the time of writing, on-chain numbers appeared to counsel that BSC’s velocity enhance may truly be paying off. It’s seeing 2.04 million energetic addresses, almost 5 occasions greater than Ethereum’s 411,000 – A transparent signal of broader consumer exercise.

The DEX quantity backed it up too – $7.38 billion on BSC in simply 24 hours, in comparison with $1.44 billion on Ethereum. That type of liquidity circulation means BSC’s sooner block occasions are serving to gas actual utilization throughout DeFi.

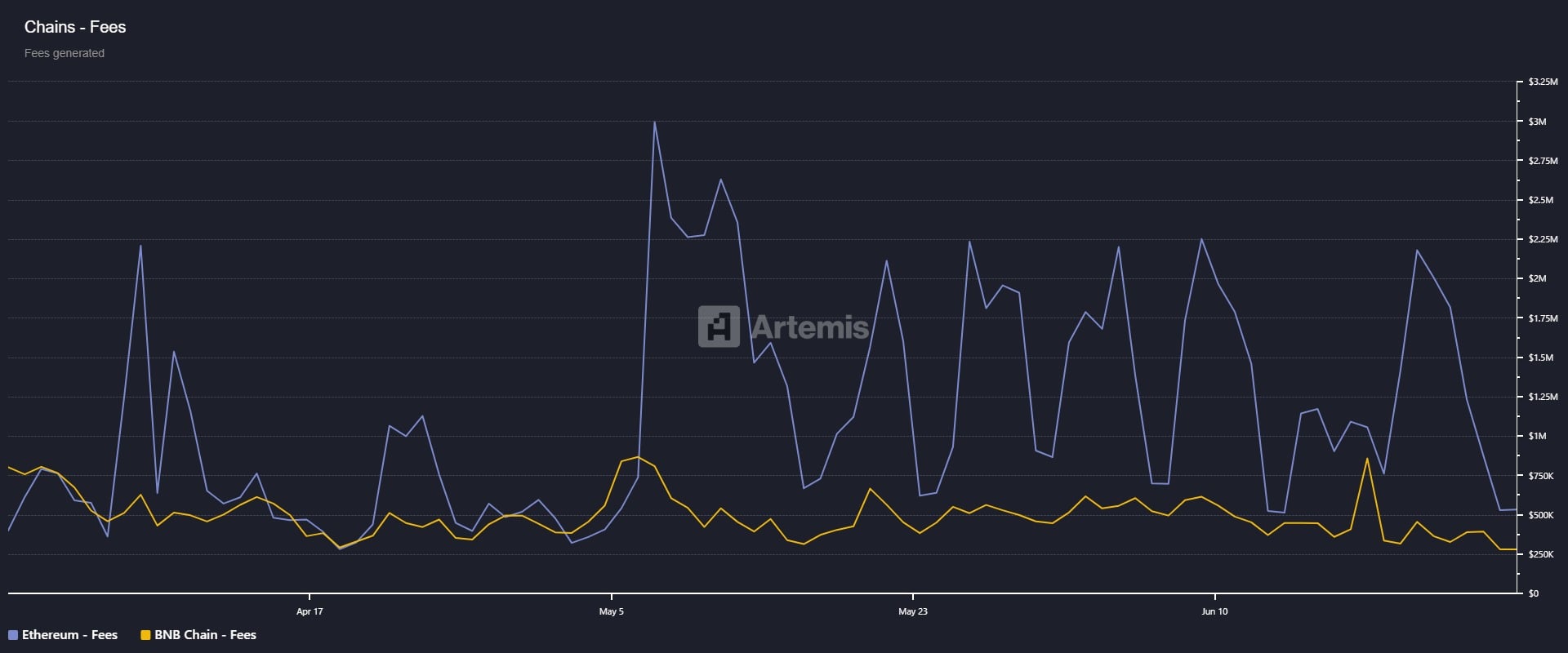

And but, BSC nonetheless lags behind Ethereum in complete worth locked (TVL) and protocol income. This means that whereas BSC excels in consumer exercise, Ethereum continues to draw deeper capital and higher-value DeFi interactions.

The divergence alludes to a structural distinction too – BSC is optimized for scale and velocity, whereas Ethereum stays the first venue for capital-intensive, yield-bearing protocols.

In essence, one chain is transferring sooner, whereas the opposite remains to be holding extra worth. Meaning whereas the Maxwell improve might drive greater engagement, it nonetheless operates effectively beneath Ethereum’s dominance in TVL and price seize.

If Ethereum’s Glamsterdam upgrade efficiently improves block occasions with out compromising decentralization, it might neutralize BSC’s velocity benefit. In flip, tightening the race for DeFi relevance.