The value of Bitcoin has had fairly the rollercoaster experience during the last seven days, rising from its early-week blues marked by a crash to under the $100,000 mark. The flagship cryptocurrency has roared again to life, working to as excessive as $108,000 up to now few days.

This current resurgence has not notably mirrored on the blockchain, with the most recent on-chain knowledge suggesting that merchants are usually not prepared to bet on Bitcoin’s price. A well-liked market analytics platform has now evaluated this situation, placing ahead the potential impression on worth.

Declining Funding Charges Mirror Elevated Quick-Aspect Positioning: Glassnode

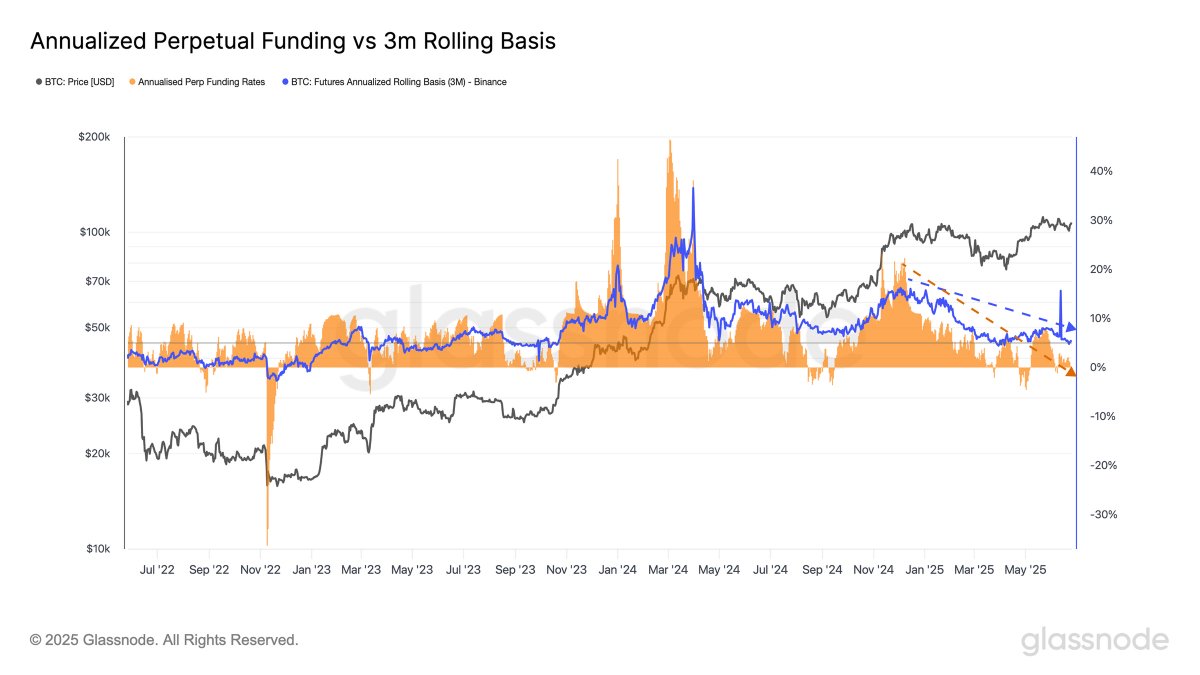

In a June 27 submit on the X platform, on-chain analytics agency Glassnode revealed that the funding fee for Bitcoin, which has been on a decline over the previous few months, appears to be caught in a downward pattern. The related indicators listed below are “Annualized Perpetual (perp) Funding Charges” and “Binance 3-Month (3M) Futures Annualized Rolling Foundation” metrics.

The Annualized Perp Funding Charges is a key metric that tracks the periodic funds between lengthy and brief merchants within the derivatives (perpetual futures) market. This indicator presents well timed insights into the sentiment and leverage within the cryptocurrency derivatives market.

When the funding rate is high or constructive, it implies that the lengthy merchants are paying the merchants with brief positions. Usually, this course of the periodic cost suggests a powerful bullish sentiment available in the market. In the meantime, a damaging worth of the metric implies that brief merchants are paying lengthy merchants — suggesting a bearish market sentiment.

Then again, the 3-Month (3M) Futures Annualized Rolling Foundation estimates the annualized yield from shopping for a cryptocurrency on the spot market and concurrently promoting the crypto’s futures contract expiring in 3 months. Usually, futures contracts commerce at the next worth than the spot asset — a distinction that merchants can exploit for revenue.

Supply: @glassnode on X

As proven within the chart above, the Annualized Perp Funding Charges and 3-Month (3M) Futures Annualized Rolling Foundation have been falling since final November. “Regardless of excessive futures exercise, urge for food for lengthy publicity is fading, reflecting elevated warning and probably extra impartial or short-side positioning,” Glassnode famous.

In essence, the declining funding charges and 3-month rolling foundation point out that brief merchants are constantly crowding the derivatives market. Whereas there was a cautious method to the market from merchants, institutional flows into US-based Bitcoin exchange-traded funds and an enhancing macroeconomic local weather have been fairly a silver lining.

Therefore, even when the funding charges maintain falling, however the macroeconomic atmosphere and institutional capital influx stay regular, the market might witness a brief squeeze — the place brief merchants are compelled to shut their positions. This potential situation is even supported by the truth that the market tends to maneuver within the crowd’s wrong way.

Bitcoin Value At A Look

As of this writing, the value of BTC stands at round $107,180, displaying no important motion up to now 24 hours.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.