Bitcoin briefly climbed again above $100,000 this month, pushing near the $108,000 degree earlier than a brand new pullback. The transfer seems robust on the floor. However based mostly on reviews from Glassnode, a lot of that surge got here from merchants utilizing borrowed funds, not recent consumers piling in.

Speculative Bets Gas Current Rally

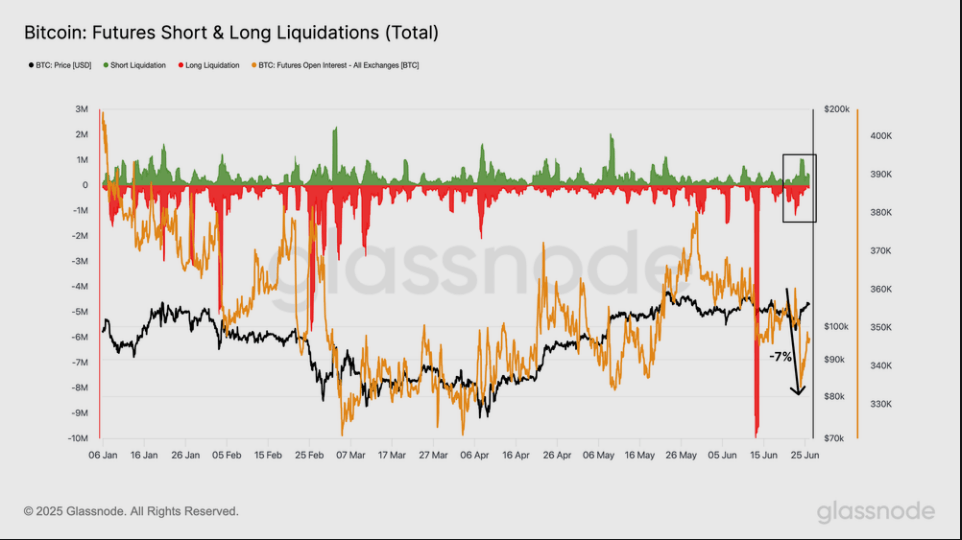

Based on on-chain knowledge, late-June’s quantity on Bitcoin futures stayed excessive as costs marched upward. Merchants betting on short-term beneficial properties drove the market, whilst the joy behind the rally pale. Funding charges and the three-month futures foundation each moved decrease, signaling much less bullish conviction. In different phrases, fewer individuals had been making huge, lengthy bets on Bitcoin today.

Spot Market Stays Quiet

Spot trading didn’t comply with the futures increase. At its $111,910 peak in Could, each day spot quantity hovered round $7.65 billion. That’s effectively beneath the earlier cycle highs, which topped $20 billion on some days. Primarily based on reviews, new money from retail or long-term holders stayed on the sidelines as an alternative of flooding in.

Institutional Patrons Nonetheless Including

Massive companies did hold shopping for. This week noticed Michael Saylor’s Strategy, Metaplanet and ProCap BTC collectively choose up about $1 billion price of Bitcoin. On the identical time, US-listed Bitcoin ETFs purchased over $1.5 billion in recent provide. These regular purchases trace at real curiosity from establishments, even when short-term merchants set the tempo lately.

Provide Tightness May Drive Costs

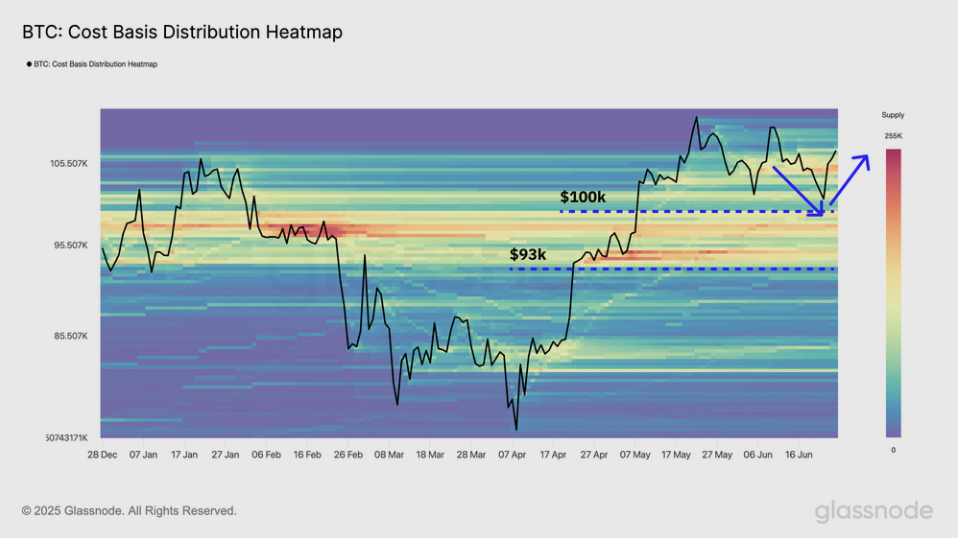

Glassnode now reveals simply 7 million BTC left freely out there on exchanges. Roughly 14 million BTC are held by individuals who haven’t moved their cash in ages. That provide squeeze might assist costs if demand holds up. But it surely additionally means any sudden sell-off would possibly hit exhausting when change wallets run low.

What Comes Subsequent For Bitcoin

All in all, the latest soar above $100,000 feels extra like a dash by margin gamers than a marathon fueled by new believers. Corrections typically comply with rallies pushed by heavy margin exercise. But, the continued shopping for by huge firms and ETFs gives a buffer. In the event that they hold at it, Bitcoin might have a breather now however might rally once more later.

As of June 28, Bitcoin traded at $106,500, down 0.85% on the day. Market watchers shall be in search of a return of recent spot demand or a stabilizing of futures bets earlier than declaring the uptrend again on stable floor.

Featured picture from Unsplash, chart from TradingView