- Lengthy-term Bitcoin holders are taking some income, which is an indication of “recalibrated expectations.”

- BTC Open Curiosity spikes and a rising Inventory-to-Move ratio trace at volatility and shortage.

Bitcoin [BTC] climbed 1.33% in 24 hours to commerce at $107,842 on the twenty sixth of June, shaking off short-term panic. Nevertheless, deeper metrics painted a extra cautious image.

BTC concern fades, however confidence doesn’t observe

BTC’s 25 Delta Skew—a measure of dealer sentiment—noticed its 1-week studying fall from over 10% to only 2.96%. This mirrored lowered panic amongst merchants. Nonetheless, not all is calm.

The three-month and 6-month Skews stayed destructive at -2.6% and -4.3%, respectively. That suggests medium-term uncertainty hasn’t gone away.

Notably, Choices volumes nonetheless favor places, pointing to defensive positioning amongst bigger gamers.

Due to this fact, though quick draw back concern has receded, underlying sentiment revealed that traders have but to regain full bullish confidence.

Supply: X/Glassnode

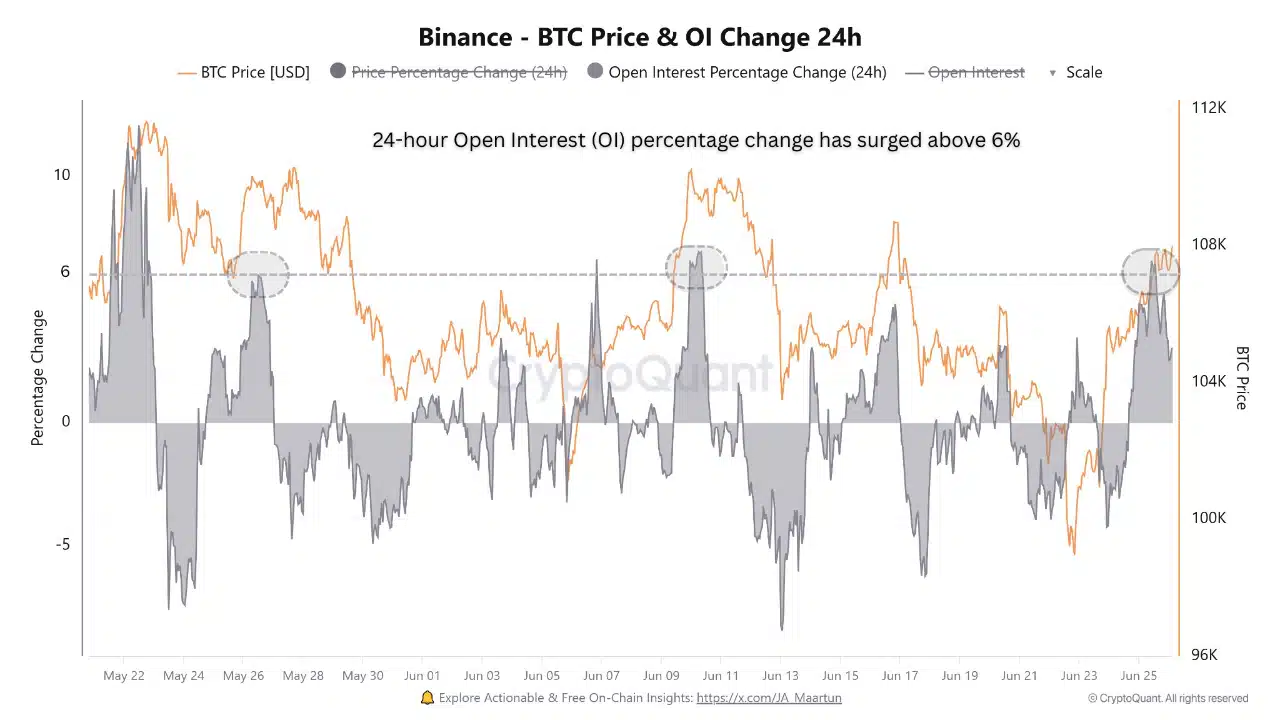

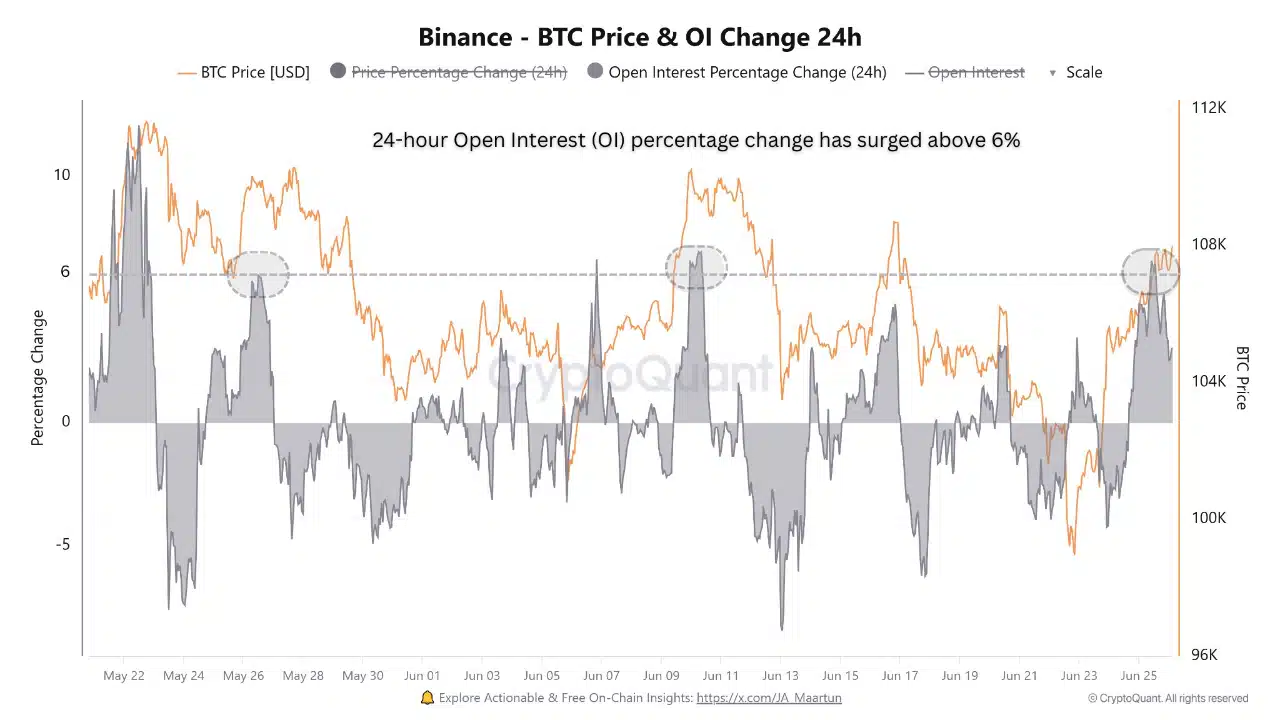

Are merchants fueling the fireplace with THIS?

Binance’s Open Curiosity surged above 6% for the third time in two months, marking a notable uptick in speculative positioning. Every of the final spikes in Might and June preceded sell-offs and non permanent slowdowns.

Naturally, this hints at an uptick in speculative trades and an overheated short-term setting, at the same time as BTC’s worth seems to be steady. In brief, leverage is again on the rise.

Supply: CryptoQuant

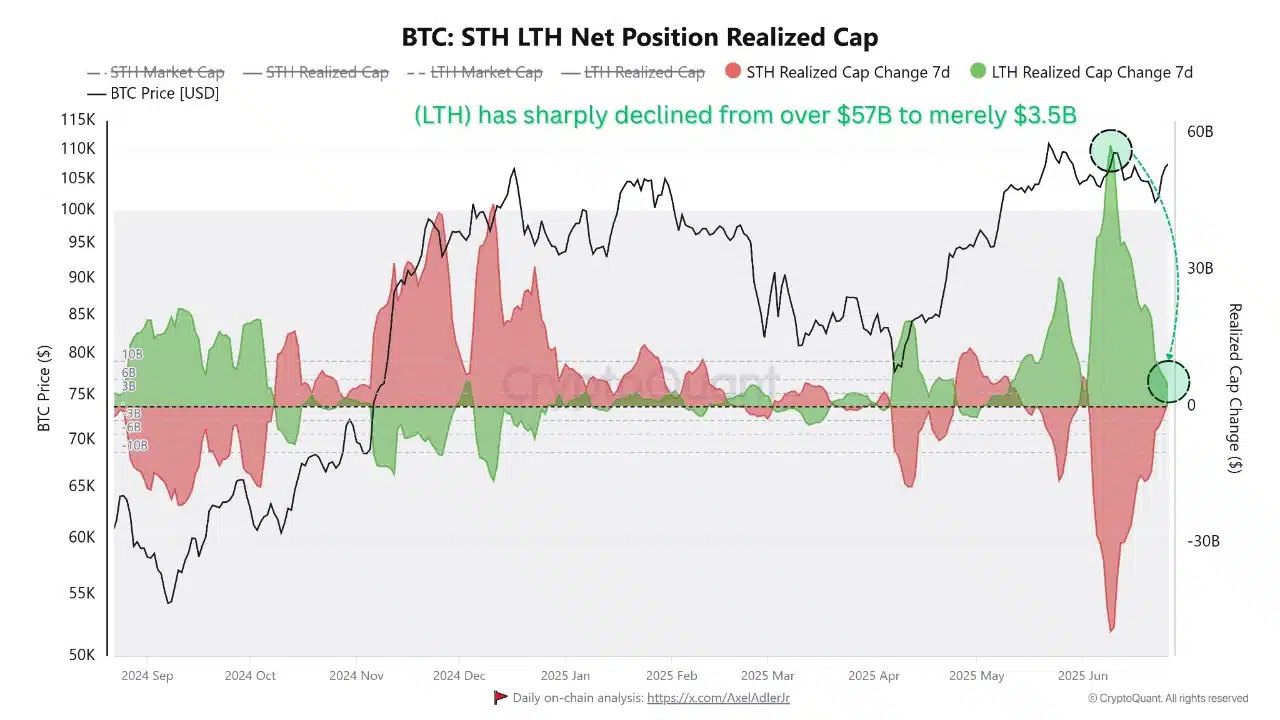

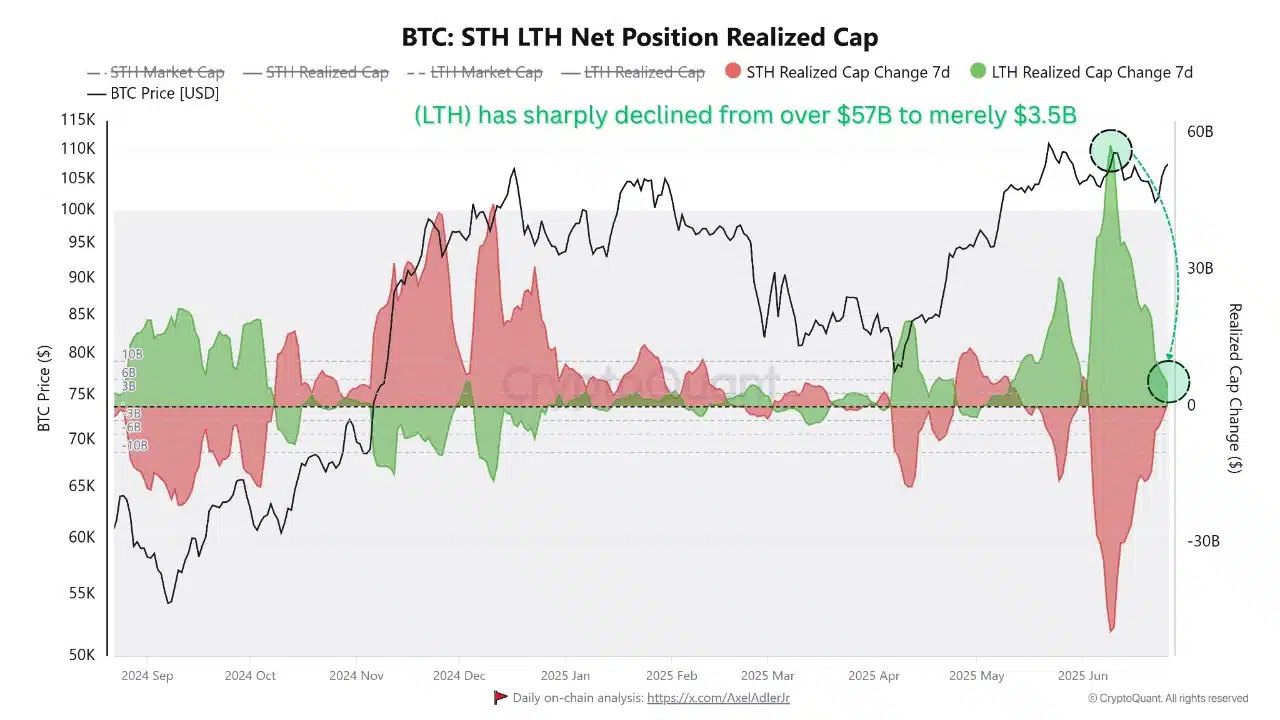

Is long-term confidence slipping?

The Lengthy-Time period Holder Web Place Realized Cap dropped from over $57 billion to only $3.5 billion, revealing main profit-taking.

This plunge confirmed that LTHs, usually the market’s most affected person cohort, have began trimming publicity after important positive aspects.

After all, this doesn’t scream panic. It’s extra possible calculated de-risking, with no main bearish catalysts in sight.

However such a steep drop nonetheless alerts recalibrated expectations, probably linked to macro uncertainty or halving fatigue.

Supply: CryptoQuant

Can BTC keep grounded with out overheating?

Change-wide buying and selling volumes have tapered, in accordance with CryptoQuant’s bubble chart. Regardless of BTC hovering close to ATH, no indicators of frenzy emerged.

Most quantity bubbles stay impartial to blue, reinforcing a wholesome setting the place worth strikes aren’t pushed by concern or greed.

That stability provides Bitcoin room to consolidate, relatively than whip round. As an alternative of overheating, the market may simply be taking a breath earlier than its subsequent leg up.

Supply: CryptoQuant

Lastly, will THIS push BTC into a brand new cycle?

Bitcoin’s Inventory-to-Move ratio surged to 387, to not point out its highest in current months. This metric tracks what number of years it might take to mine BTC at present charges.

Whereas it’s not an all-time excessive, the sharp rise displays rising demand versus diminishing provide, doubtlessly creating upward strain.

Nevertheless, the timing of such results typically lags. Due to this fact, whereas this spike strengthens BTC’s basic worth narrative, it doesn’t but assure short-term upside with out supportive worth motion.

Supply: Santiment

Though concern has declined and the market avoids overheating, warning from LTHs and rising hypothesis introduce complexity.

BTC should navigate this tightrope rigorously—balancing wholesome consolidation with growing leverage—to construct the muse for its subsequent main transfer.