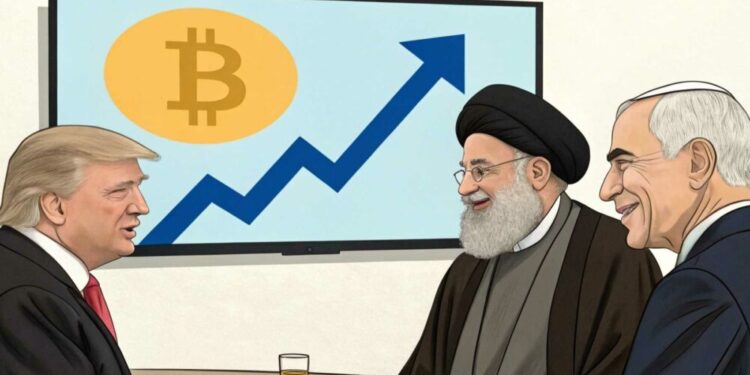

- BTC recovered 8% to $106,000, following a probable ceasefire between Israel and Iran.

- Trump anticipated the 2 nations to enter a ceasefire as quickly as potential.

Bitcoin [BTC] briefly retested $106K on the twenty third of June after the Israel-Iran ceasefire deal. The upswing prolonged its restoration to eight% from a weekend low of $98k.

Regardless of that, market costs fluctuated yesterday in response to new developments within the Center East.

A macro backside for BTC?

Earlier on Monday, BTC dipped sharply to $99K following Iran’s retaliatory assault in opposition to a U.S. army base in Qatar.

In the meantime, Qatar warned of ‘the appropriate to reply,’ triggering concern of potential contagion throughout the area, briefly dragging BTC beneath $100K once more.

Following the announcement of a ceasefire involving the U.S., Israel, and Iran, market tensions eased, propelling Bitcoin above $100,000.

President Donald Trump stated—by way of a Reality Social put up relayed by U.S. Treasury Secretary Scott Bessent—that the ceasefire would assist forestall the 12-day battle from escalating right into a broader regional conflict.

Israel acknowledged the ceasefire however warned that it might reply with power if it have been violated. A part of the assertion read,

“In gentle of getting achieved the goals of the operation, and in full coordination with President Trump, Israel agrees to the President’s proposal for a bilateral ceasefire. Israel will reply forcefully to any violation of the ceasefire.”

An analogous however tacit statement was made by Seyed Abbas Araghchi, Iran’s Overseas Minister.

That mentioned, the market was trying ahead to such an final result, in line with crypto buying and selling desk QCP Capital. In a market replace, the agency stated,

“Markets appear to be discounting the prospect of main escalation. The U.S. is pressuring China to comprise Tehran, which can be calming sentiment.”

The agency added,

“Whereas the put skew stays excessive, the bounce in spot and drop in front-end volatility present traders are usually not pricing in broader contagion.”

At press time, Velo data confirmed that the BTC 25 Delta Skew recovered 4% for the 1-week tenor, indicating a premium for short-dated calls (bullish bets). This strengthened market optimism.

On key worth ranges to observe, the 30-day liquidation heatmap marked out $111k and $108k as key resistance ranges with excessive liquidity swimming pools.

On the draw back, $101k and $103k might act as short-term help in case of untamed worth swings.