Key Notes

- XRP fell beneath $2 for first time since April 9, triggered by SEC case delays and geopolitical tensions.

- Bearish merchants opened $318M in shorts versus $89M longs, creating provide wall at $2.10 resistance degree.

- Technical evaluation reveals Head and Shoulders breakdown focusing on 30% decline towards $1.45-$1.50 vary.

Ripple

XRP

$2.09

24h volatility:

6.2%

Market cap:

$123.14 B

Vol. 24h:

$3.67 B

value broke beneath the important $2 degree on Monday, June 23, marking its lowest level in 75 days. Now hovering close to $1.92, XRP seems technically weak.

XRP Touches 75-Day Low as Ripple vs. SEC Case and Geopolitical Disaster Kind Twin Catalyst

XRP’s latest value slide has been fueled by a uncommon convergence of authorized and macroeconomic catalysts. The token misplaced its grip on the $2 degree for the primary time since April 9, following a pointy rise in world threat aversion and contemporary authorized ambiguity within the ongoing SEC vs. Ripple litigation.

On June 20, rumors of a delay within the long-awaited abstract judgment added uncertainty to Ripple’s authorized trajectory. On the identical time, deteriorating diplomatic ties between main economies despatched tremors throughout world markets, prompting institutional outflows from high altcoins. XRP, Solana

SOL

$141.1

24h volatility:

8.7%

Market cap:

$74.89 B

Vol. 24h:

$5.82 B

, Ethereum

ETH

$2 343

24h volatility:

6.8%

Market cap:

$282.76 B

Vol. 24h:

$18.15 B

and Cardano

ADA

$0.57

24h volatility:

7.0%

Market cap:

$20.40 B

Vol. 24h:

$806.25 M

all posted losses on Monday, June 23.

The value decline seems to have triggered a cascade of technical breakdowns. XRP broke beneath its 50-day exponential shifting common on June 21, adopted by a breach of the $2 psychological assist two days later. The each day RSI has dropped beneath 40, indicating growing bearish momentum with little signal of reversal.

Except the Ripple authorized workforce gives a concrete replace or macro sentiment stabilizes, XRP could proceed to bleed towards the $1.50 technical ground recognized from the neckline of the rising Head and Shoulders sample. A each day shut above $2.10 stays the minimal requirement to invalidate the bearish thesis.

Bears Set up Dominance with $37.9M Leverage at $2.10 Resistance

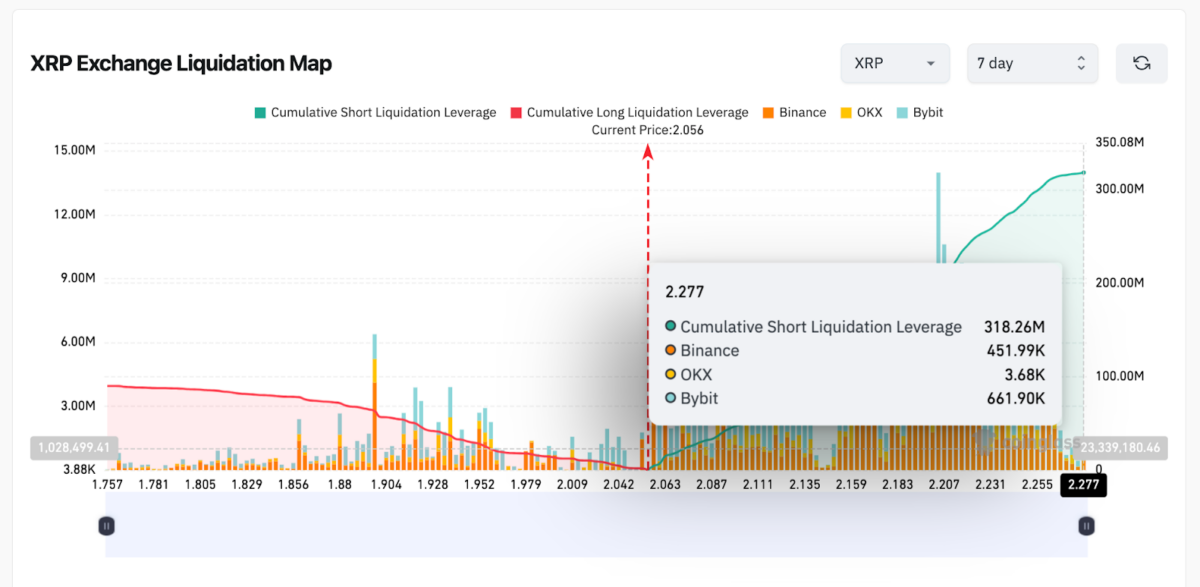

Data from Coinglass reveals that bearish merchants are firmly in charge of XRP’s short-term value motion. Previously seven days, $318 million in brief positions have been opened on XRP, outpacing the $89 million in lengthy contracts recorded over the identical interval.

Ripple (XRP) Liquidation Map | Coinglass

Of the leveraged shorts, roughly $15 million are concentrated across the $2.10 resistance zone, suggesting that bears are defending this degree as a key psychological and technical threshold. This cluster of leverage is performing as a provide wall, capping any bullish reversal makes an attempt.

If XRP fails to decisively shut above the $2.10 degree to set off quick liquidations, the present imbalance could proceed to push the token downward.

Ripple (XRP) Value Forecast: Is XRP at Danger of One other 30% Breakdown?

XRP’s each day chart presents a clearly outlined Head and Shoulders sample, usually thought of a dependable indicator of bearish reversals. With the neckline now damaged on the $2.00 degree, technical projections recommend XRP could also be on the verge of a 30% correction towards the $1.45, $1.50 vary.

As depicted above, the left shoulder shaped in early Might, the pinnacle peaked close to $2.80 in mid-Might, and the best shoulder did not breach the earlier excessive, topping out close to $2.45. The breakdown beneath the neckline has been accompanied by rising quantity, a affirmation sign that lends additional weight to the bearish thesis.

The Relative Power Index (RSI) has declined to 38.95, hovering simply above oversold territory, with no rapid indicators of bullish divergence. This momentum development helps the notion that XRP could not but have discovered a neighborhood backside.

XRP Value Forecast | Supply: TradingView

Except bulls can pressure a each day shut again above $2.10, the trail of least resistance stays to the draw back. Quick-term restoration could face stiff resistance at $2.20 and $2.45, whereas continuation of the sample’s trajectory locations XRP’s mid-term assist on the $1.50 mark.

Within the absence of a elementary reversal catalyst, reminiscent of a positive courtroom ruling or de-escalation in geopolitical tensions, bearish strain is prone to persist.

XRP Steadies as Solaxy ($SOLX) Launches Solana’s First Layer-2

Whereas XRP consolidates close to $0.49, early-stage buyers are turning to Solaxy ($SOLX)—the primary Layer-2 answer on Solana.

With its testnet dwell and trade listings on the horizon, Solaxy affords unmatched scalability, 0% staking charges, and multi-chain assist. The $SOLX presale is now dwell, positioning itself as a high-upside play in Solana’s rising ecosystem.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.