- Ethereum’s dominance is rising as different altcoins proceed to battle.

- ETH remains to be experiencing robust downward strain and dangers a dip beneath $2k.

Since reaching an area excessive of $3.7k in early January, Ethereum [ETH] has declined considerably. After trying a breakout from this downtrend a month in the past, ETH confronted resistance at $2.8k, resulting in a pullback.

Regardless of these struggles on its value charts, CryptoOnchain has noticed that ETH dominance has continued to surge.

Ethereum dominance development continues

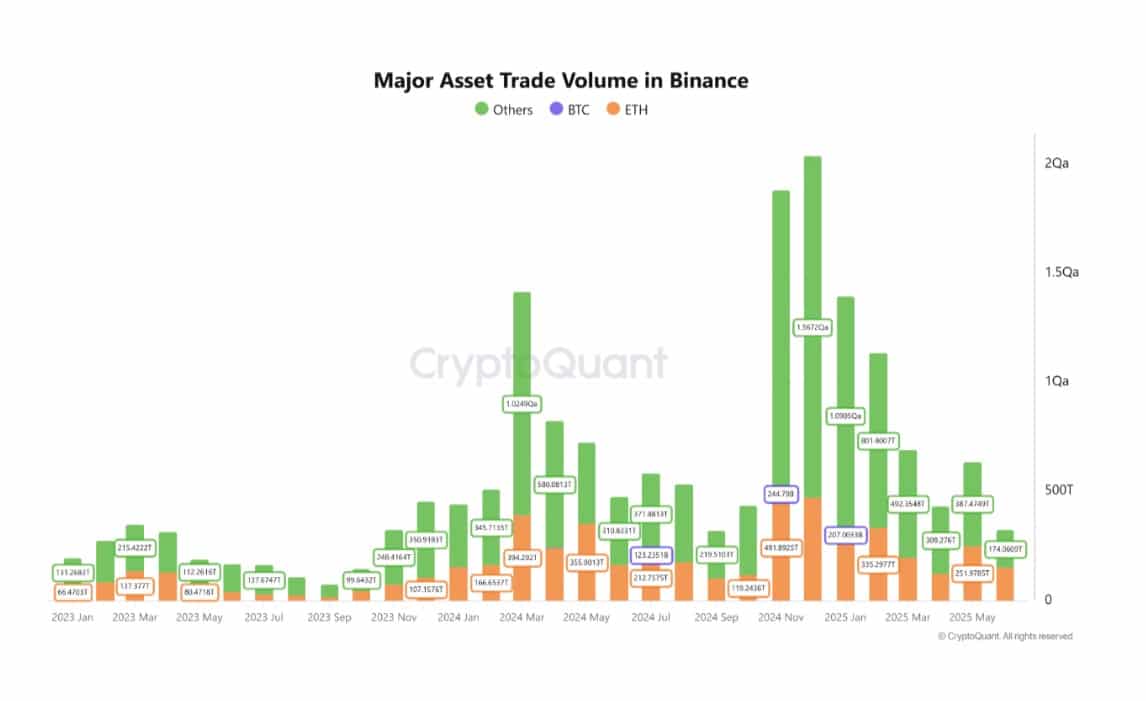

In keeping with CryptoQuant, Ethereum has captured a big share of the market primarily based on information from January to Could 2025.

This surge in ETH dominance is primarily pushed by a big drop within the quantity of different altcoins.

Opposite to market expectations, Ethereum’s buying and selling didn’t drive the current surge. From 2024 to 2025, ETH’s buying and selling quantity remained comparatively regular, ranging between 300 trillion and 490 trillion.

In distinction, altcoin buying and selling quantity peaked at 1.5672 quadrillion in November 2024, however dropped sharply to 387.47 trillion by Could 2025. The share of altcoin trades fell from over 1 quadrillion to beneath 400 trillion, reflecting a big decline.

This pattern suggests buyers are pulling liquidity from riskier tasks. A few of that capital seems to have been redirected into Ethereum, seen as a comparatively safer various.

Subsequently, Ethereum’s dominance will not be primarily the results of its development however fairly the retreat of its rivals. Regardless of ETH failing to develop considerably, it stays extremely favorable in comparison with different smaller cash.

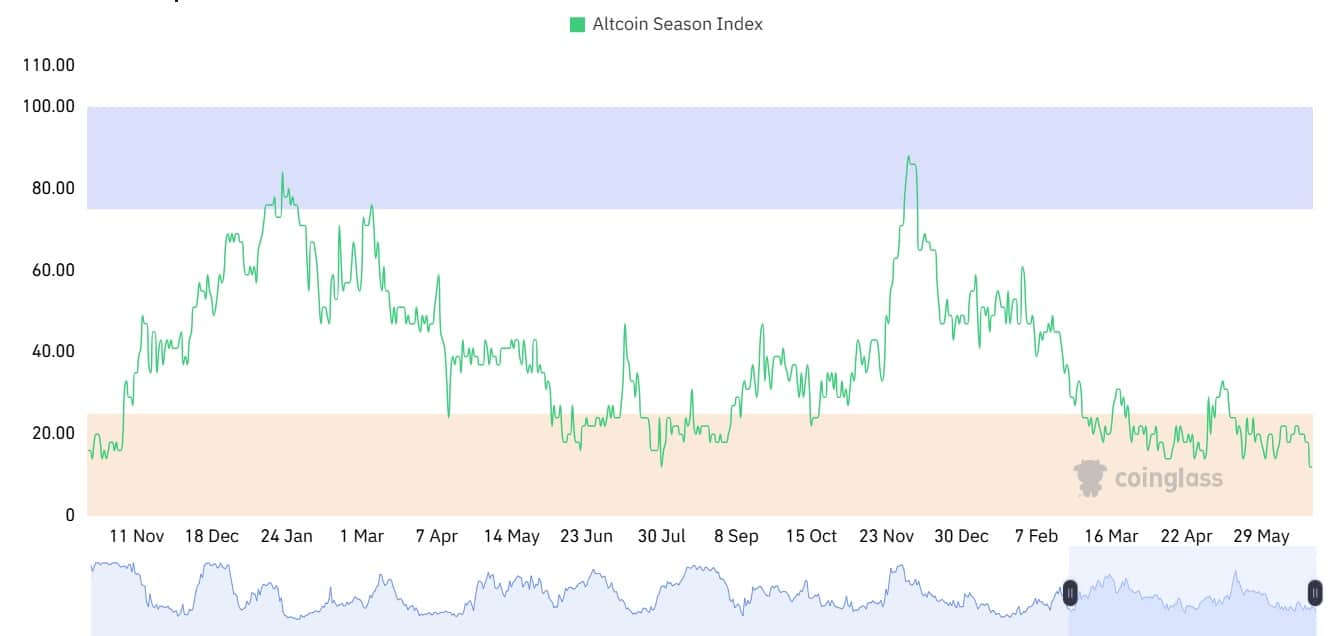

After we have a look at Altcoin’s Season Index, it exhibits that the general altcoin market has declined. This metric has declined from 88 to 12 between December 2024 and June 2025, signaling a weakening altcoin market.

Any influence on ETH’s value motion?

Though Ethereum dominance has surged considerably, its development has been problematic. Since then, demand, on-chain exercise have all struggled to maintain up with the market.

At press time, Ethereum’s NVT ratio s surged to 1041, indicating important community overvaluation.

This implies on-chain exercise is low relative to cost, suggesting that present ETH costs is probably not supported by natural demand.

Traditionally, such disconnects—the place worth outpaces precise community utilization—usually sign market tops and are adopted by corrections.

If this pattern continues, ETH may retrace to raised align with actual demand, pointing to a speculative market atmosphere.

Regardless of Ethereum’s rising market dominance, long-term holders are nonetheless within the purple.

Additionally, the MVRV Lengthy/Quick Distinction remained unfavourable, and has been so for the previous 4 months, signaling persistent unprofitability for long-term ETH buyers.

A unfavourable worth right here means that short-term holders have greater unrealized revenue than LTHS. As an example, those that acquired ETH between December 2024 and February 2025 are principally sitting at a loss.

This suggests that regardless of rising affect, ETH will not be recording important strikes to the upside whereas different altcoins proceed to dip. On the prevailing market circumstances, ETH appears overvalued and has to retrace to satisfy precise demand.

If a retrace emerges, we may see ETH drop beneath $2k. Nevertheless, if speculators proceed to carry the market, Ethereum will proceed with restoration and try to reclaim $2.5k.