- Bitcoin’s demand has been progressively declining since Might’s native prime.

- Low profit-taking ranges recommend that traders are nonetheless leaning towards holding.

Bitcoin’s [BTC] latest worth actions present a market in steadiness, with neither bulls nor bears in management.

Most holders look like in no rush to exit their positions, signaling a continued sentiment of holding.

Regardless of this, Bitcoin is presently struggling to push larger. One key cause is the dearth of sturdy shopping for demand. With out adequate demand to match or exceed provide, upward momentum nonetheless stays restricted.

Metrics signifies waning demand strain

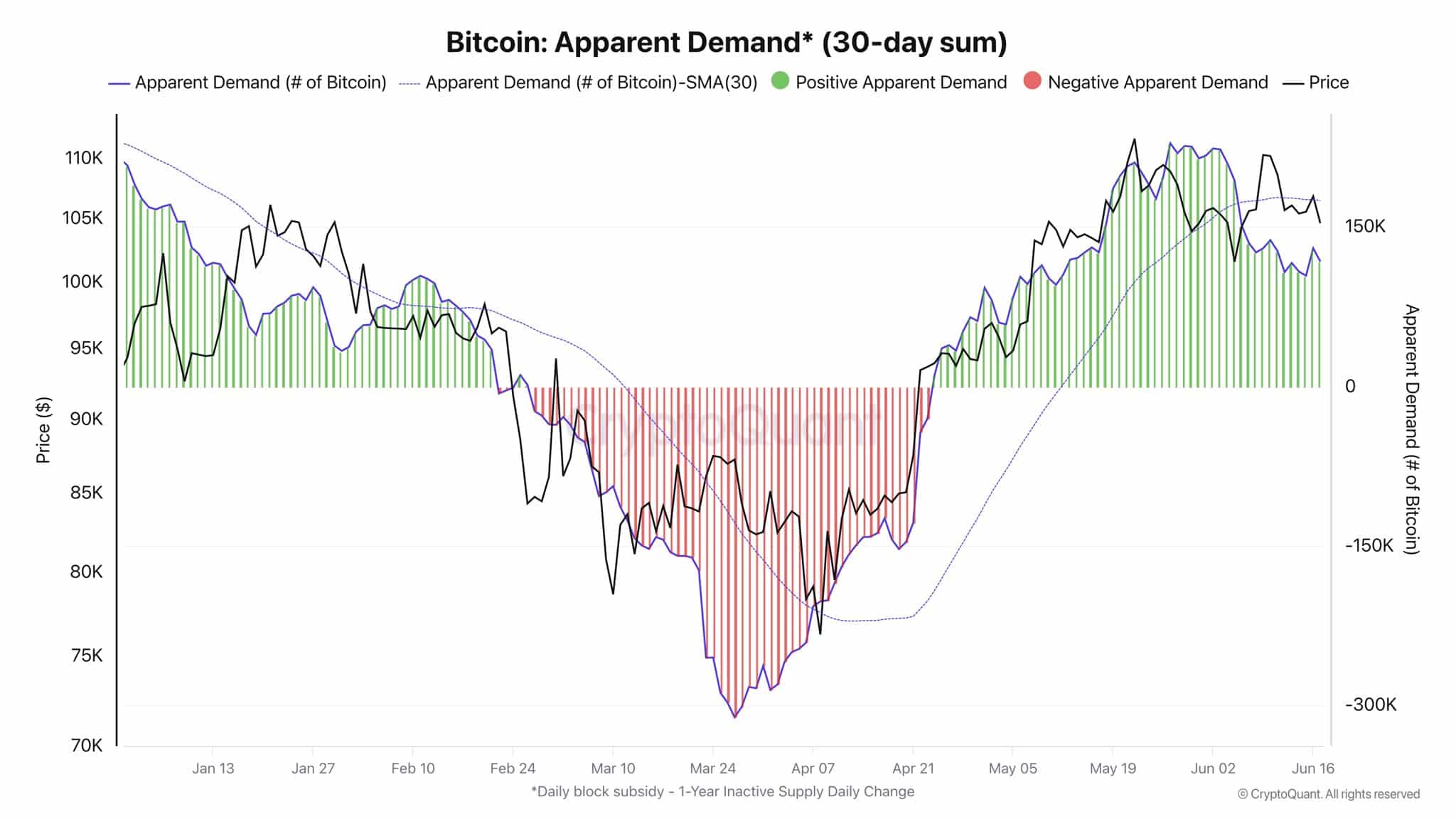

On-chain metrics assist this view. AMBCrypto’s have a look at Bitcoin’s 30-day obvious demand indicated a slowly waning demand for the king coin.

The metric compares Bitcoin’s recent provide with over 1-year dormant provide and ratio can function a proxy for market demand.

Since Bitcoin’s latest native prime in early Might, this ratio has been lowering. Though it has not turned detrimental but, the decline means that recent BTC demand out there has been fading over the latest few weeks.

Help arises from holding habits

Nonetheless, it’s not all bearish. The regular decline in demand has did not push the market right into a sell-off. That’s largely due to the agency holding motion by the long-term holders.

Whilst profit-taking crawl ahead because of rising geopolitical tensions within the Center East, HODLers refuse to budge.

The variety of traders holding small cash, particularly within the 10–100 BTC vary, was approaching 32 million at press time.

This has stored the market in equilibrium. Promoting strain is current, however it’s being mitigated by ample shopping for curiosity to discourage sharp declines.

Market is balanced, however at a breaking level

Nothing holds without end. The present equilibrium courtesy, of the sturdy holders’ sentiment, might fade quickly if the demand for BTC won’t materialize.

Till then, Bitcoin’s worth will seemingly stay at this spot of muted stress.