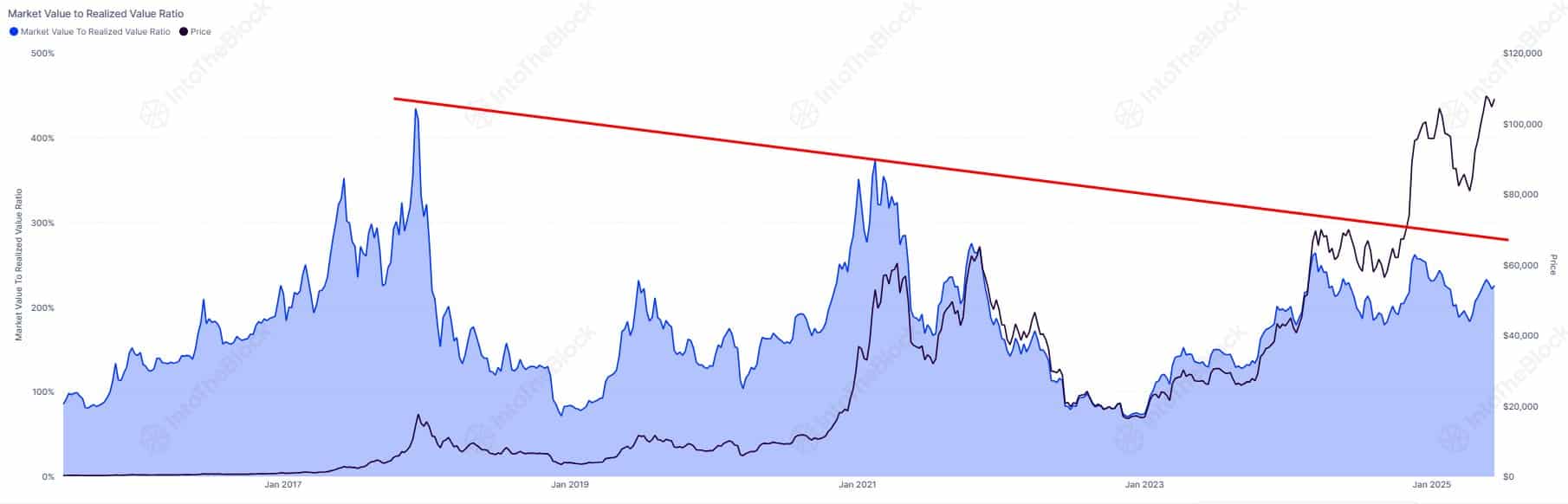

- MVRV at 2.25 urged that Bitcoin stays removed from bull market peak situations.

- Trade outflows rose whereas short-term holders keep inactive, limiting rapid promoting strain.

Bitcoin’s [BTC] continued to hover above $104K, but a number of on-chain indicators recommend the market hasn’t hit euphoric extremes.

In truth, a mix of undervaluation metrics, destructive sentiment, and quiet short-term exercise hints that the bull run should be intact.

MVRV says: This isn’t the highest—But

At press time, the MVRV ratio, at 2.25, remained properly beneath prior bull market peaks regardless of the asset buying and selling above $104K.

Traditionally, increased MVRV values have aligned with tops, however the ongoing long-term decline on this metric implies that Bitcoin may nonetheless have room to run.

Due to this fact, present worth motion displays sustainable momentum quite than excessive speculative habits usually seen in euphoric situations.

Why is sentiment destructive regardless of Bitcoin’s rally above $100K?

Curiously, Bitcoin’s Weighted Sentiment dropped to -0.723, revealing widespread skepticism amongst merchants and traders.

Usually, destructive sentiment throughout an uptrend suggests disbelief within the rally’s sustainability.

Nevertheless, contrarian evaluation usually views this as a bullish sign, implying that the market nonetheless holds potential for upside. As crowd doubt persists, fewer individuals are prone to take earnings prematurely.

Consequently, sentiment-driven resistance stays weak, supporting the potential for continued worth growth within the close to time period.

Might BTC NVT and Puell A number of be hinting at undervaluation?

Each the NVT Golden Cross and Puell A number of declined by over 23% and 25%, respectively.

Collectively, these recommend that Bitcoin’s worth continues to be catching up with on-chain fundamentals. Miners aren’t exhibiting stress, and community exercise isn’t in overdrive.

In different phrases—no froth. This factors to value-driven development quite than a speculative surge.

Are BTC traders shifting in the direction of long-term holding?

On-chain trade metrics present a ten.72% enhance in outflows and a ten.27% decline in inflows.

This habits indicators that extra Bitcoin is being withdrawn from exchanges than deposited. Such a sample normally displays investor intent to carry quite than promote, thereby reducing short-term promoting strain.

Moreover, sturdy outflows usually precede provide squeezes, amplifying upward momentum when demand will increase. Therefore, this reinforces the narrative of confidence amongst holders through the rally.

Why are short-term holders unusually quiet throughout this surge?

Realized Cap HODL Waves knowledge exhibits short-term (0d–1d) exercise at simply 0.278, a considerably low degree throughout a bullish run.

Usually, this metric spikes when new traders take earnings throughout speedy worth will increase. Nevertheless, the subdued habits right here signifies that short-term holders should not actively cashing out.

Because of this, the dearth of contemporary promoting reduces overhead strain and strengthens the case for sustained upward momentum, with seasoned holders remaining in management.

Will lengthy liquidations set off the subsequent main correction?

Based on Binance’s Liquidation Map, a big cluster of lengthy liquidations sits slightly below the $104K degree.

If costs fall beneath this threshold, it may set off cascading compelled sell-offs, intensifying downward volatility.

Nevertheless, important quick positions lie simply above, suggesting potential for a brief squeeze if the value breaks increased as a substitute.

Due to this fact, the market stays at a crucial crossroads the place leverage dynamics may dictate the subsequent decisive transfer.

Bitcoin’s rally above $100K has not triggered conventional indicators of market overheating, as on-chain indicators stay impartial and even bullish.

Detrimental sentiment, declining valuation metrics, and holding habits recommend the uptrend should have gas.

Nevertheless, elevated long-term liquidation ranges spotlight short-term threat if assist breaks.

General, the information paints an image of cautious optimism, the place basic power stays intact, but leverage and sentiment may form near-term volatility.