- Bitcoin volatility has fallen, reaching long-term lows.

- U.S. inflation is predicted to rise amid rising considerations over Donald Trump’s tariffs.

Though Bitcoin [BTC] has not too long ago rallied to hit a brand new all-time excessive, BTC volatility stays at historic low ranges.

Based on CryptoQuant’s analyst Axel Adler, Bitcoin’s volatility has dropped to 200 Common True Vary (ATR) as buyers await key U.S. inflation information.

The drop to a 200 ATR degree means that Bitcoin’s value actions are at the moment calm, with volatility reaching long-term lows.

At these ranges, the market seems to be in “wait and see” mode, as on-chain exercise slows.

Low volatility sometimes alerts smaller, extra steady value swings, and this typically results in diminished capital influx—from each retail and institutional buyers—as many select to remain on the sidelines.

This diminished momentum, indicated by Bitcoin’s Imply Coin Age, climbed steadily and sat at a yearly excessive of 1.617k, at press time. This indicating that cash are staying untouched as extra buyers shift towards HODLing.

As this holding development strengthens, the Imply Coin greenback Age is approaching 18 million, additional reinforcing the long-term sentiment.

On the identical time, buyers are additionally decreasing leverage, notably within the futures market, signaling a extra cautious and risk-averse method as they sit tight and anticipate clearer momentum.

Why are buyers taking a step again?

Based on CryptoQuant, Bitcoin buyers are at the moment in wait-and-watch mode forward of the U.S. inflation information launch.

The Client Worth Index (CPI) report from the Bureau of Labor Statistics is scheduled for launch right this moment, June 11, 2025.

This announcement has sparked widespread hypothesis concerning the potential market impression.

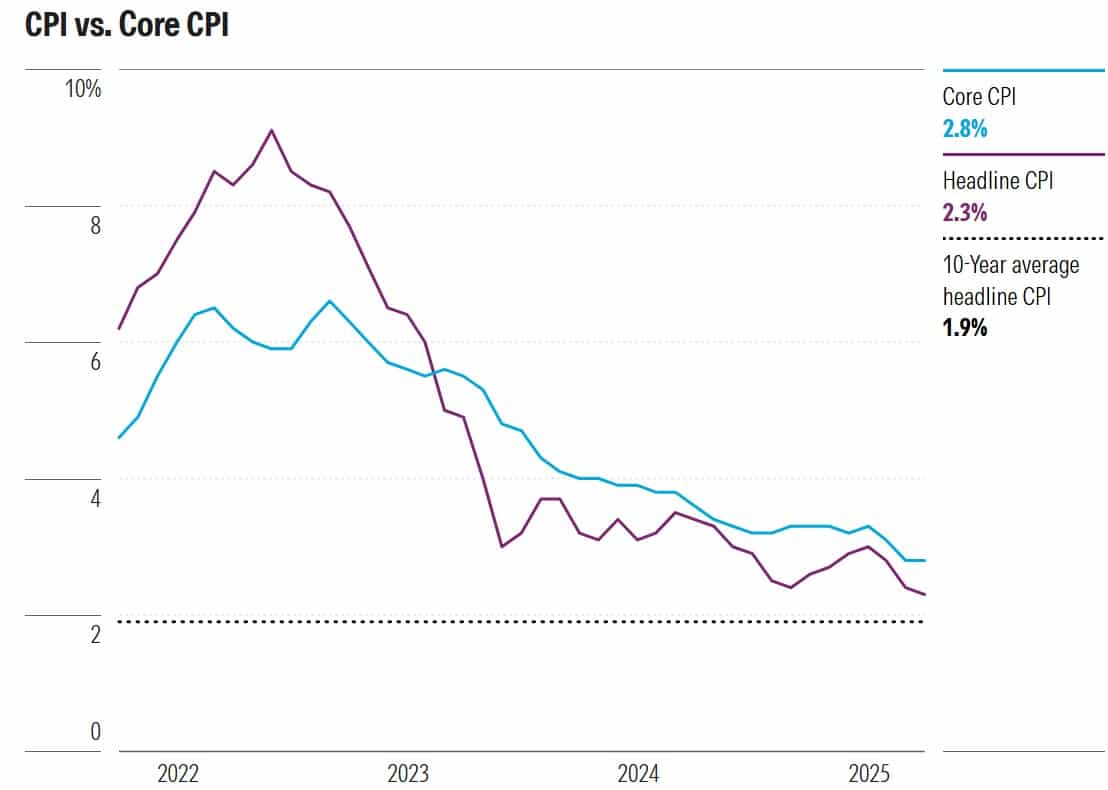

Reuters forecasts that CPI will rise by 0.2% for Might, marking a 2.5% enhance year-over-year. In the meantime, Core CPI—which excludes meals and power—is anticipated to climb 0.3% for the month, with a 2.9% annual enhance.

The upcoming CPI information could present a rise, partly as a result of Liberation Day tariffs imposed in April. Since many retailers had nonetheless been promoting pre-tariff stock, these earlier value hikes seemingly didn’t have an effect on April’s figures.

Now, economists and retailers anticipate increased prices, particularly for meals and power, doubtlessly pushing costs to a four-month excessive.

This CPI launch is vital—it may reshape the broader financial outlook, together with the crypto market.

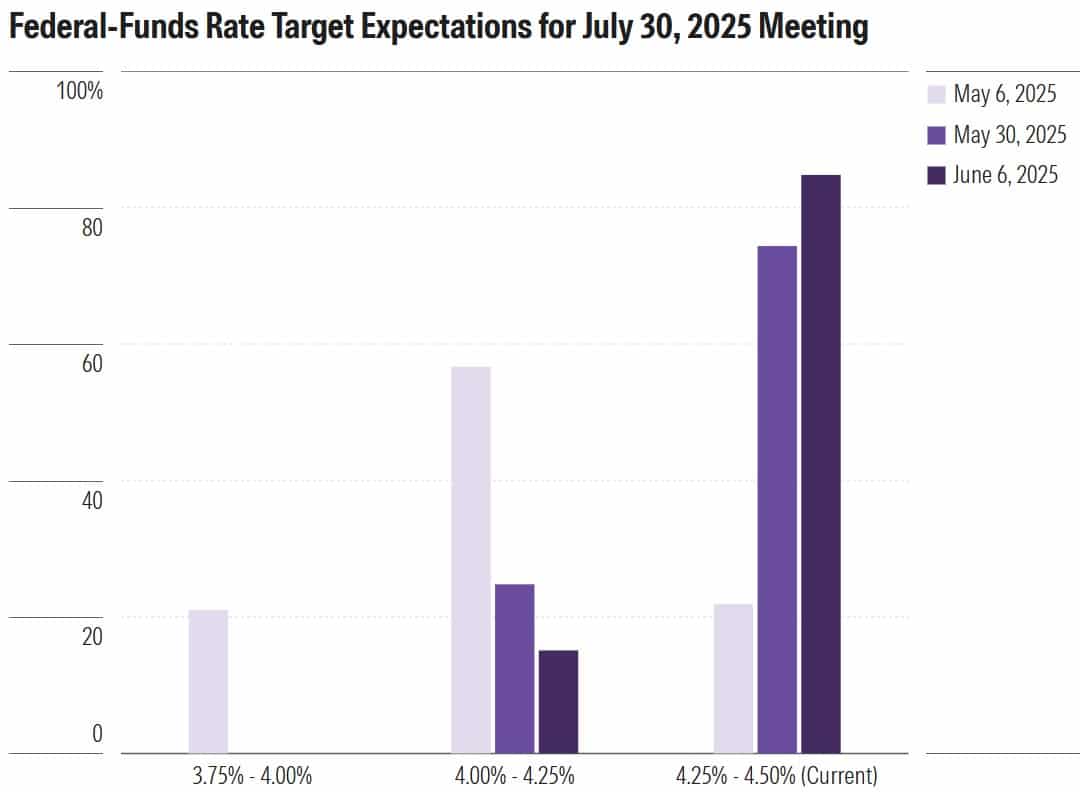

If the studying is available in stronger than anticipated, it’d cool investor sentiment and decrease the probabilities of a near-term Federal Reserve price lower.

If the CPI information is available in increased than anticipated, the Federal Reserve could hold rates of interest elevated for an extended interval—a transfer that’s sometimes bearish for Bitcoin.

Greater charges have a tendency to scale back market liquidity, strengthen the U.S. greenback, and lift yields—all of which might put downward strain on BTC. On this state of affairs, Bitcoin may doubtlessly pull again to round $107,000.

However, if the CPI studying is favorable, Bitcoin’s uptrend may proceed, growing the probability of a retest of its all-time excessive (ATH).