- Bitcoin’s RCV exits purchase zone as reserves and whale exercise sign elevated market threat.

- MVRV Ratio and miner flows trace at profit-taking, whereas valuation metrics present blended community power.

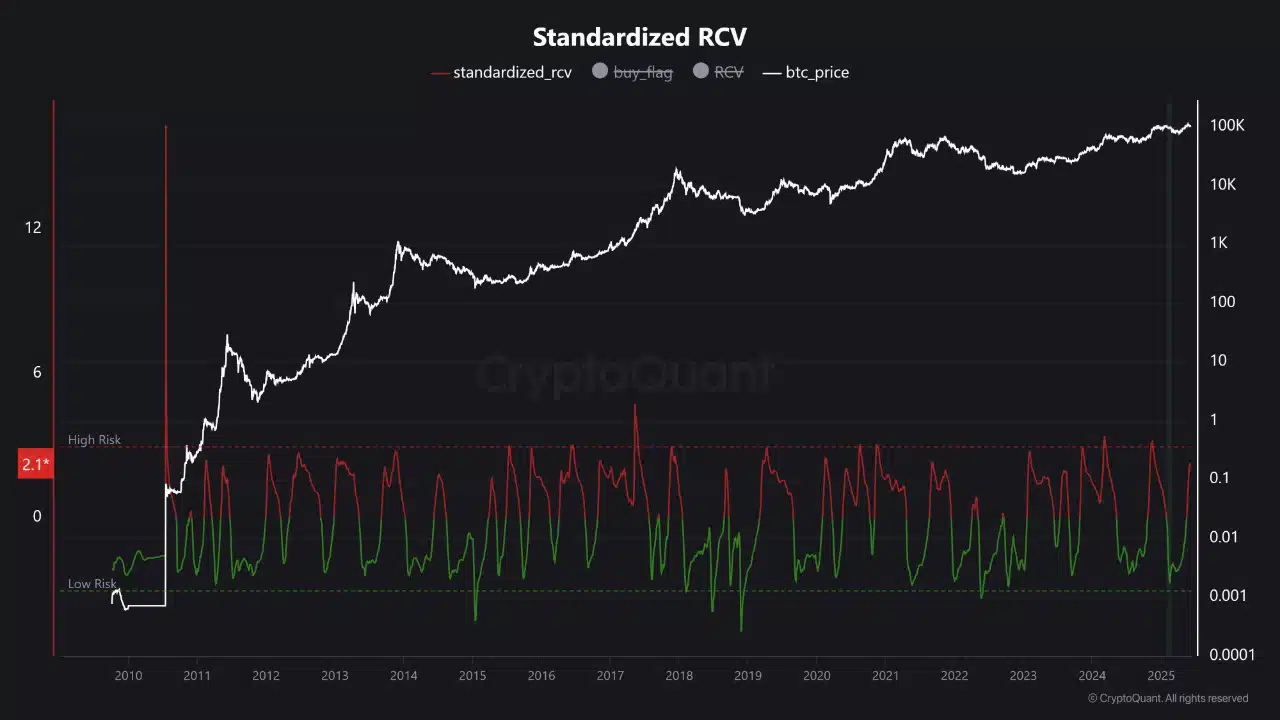

Since exiting its low-risk accumulation zone, Bitcoin’s [BTC] 60-day Realized Cap Variance (RCV) has triggered a market reassessment.

Beforehand, purchase alerts have been lively when RCV ranges have been adverse, paired with upward worth momentum.

Now, though the yellow purchase flags have vanished, a promote set off has not but emerged, as 30-day momentum stays sturdy. This transitional state displays a shift from optimum accumulation to a extra cautious market part.

As BTC traded above $109,000, at press time, the market confirmed bullish power, however rising RCV ranges counsel diminished reward potential for recent lengthy entries shifting ahead.

Are BTC rising reserves setting the stage for a sell-off?

Change Reserve USD has climbed 3.45% to over $273 billion, signaling a possible rise in promoting stress.

A better reserve signifies extra cash can be found on exchanges, usually previous elevated volatility or downward corrections. This uptrend usually aligns with market contributors getting ready to dump holdings at larger costs.

Due to this fact, though momentum stays intact, the uptick in reserves might mirror a strategic shift amongst holders, particularly as favorable accumulation situations fade.

If this development persists, the chance of near-term worth headwinds might develop stronger throughout main buying and selling platforms.

Warning emerges as miners and whales reposition

Conduct from miners and whales additional helps the rising warning. The Miners’ Place Index (MPI) spiked over 96%, indicating elevated miner outflows, although values stay barely adverse.

On the identical time, the Change Whale Ratio displays constant top-holder inflows to exchanges.

Traditionally, these dynamics sign diminished market conviction from key contributors. Whereas not but excessive, these coordinated actions might trace at a distribution part taking form.

Due to this fact, present market contributors ought to carefully monitor pockets flows, particularly from high-impact gamers, as they usually precede broader development reversals in Bitcoin’s worth construction.

Unrealized features stack up: Will holders take revenue?

BTC’s MVRV Ratio has surged 3.88% to 2.32, exhibiting {that a} majority of holders are actually sitting on vital unrealized features.

When this ratio rises above 2, it usually alerts that buyers are more and more tempted to safe earnings.

Due to this fact, the upper this metric climbs, the extra susceptible the market turns into to a pullback. Whereas it doesn’t verify an imminent correction, it does counsel that the upside might face headwinds from inner promoting stress.

Merchants ought to stay alert, as even gentle shifts in sentiment might activate widespread promoting in an overheated market surroundings.

Valuation disconnect? Community utilization gives blended clues

On-chain valuation indicators present diverging alerts. The NVT Ratio dropped over 31%, whereas the NVM Ratio declined practically 24%, suggesting improved transaction exercise relative to BTC’s market cap. Usually, this factors to elevated community effectivity.

Nevertheless, the decline may sign a disconnect, the place market valuation exceeds precise utilization. This creates a refined imbalance that would problem present worth ranges if not corrected by stronger transactional throughput.

Because of this, whereas the floor exercise seems to be optimistic, underlying utility developments stay too unsure to verify full bullish conviction throughout the board.

Is BTC heading for a distribution part?

BTC stays in a momentum-driven uptrend, however threat alerts are beginning to floor.

The disappearance of purchase alerts, rising change reserves, cautious miner conduct, and elevated MVRV all counsel a possible turning level.

Whereas not in full distribution mode but, the market is now not in its accumulation part.

Merchants ought to now give attention to defending features, looking forward to a confirmed promote set off, and avoiding overexposure as Bitcoin’s risk-reward profile continues to evolve.