- Bitcoin’s worth reacted sharply to U.S tariff headlines, dipping throughout threats and surging when tensions cooled

- Rising BTC-Gold worth correlation highlighted a hike in investor confidence

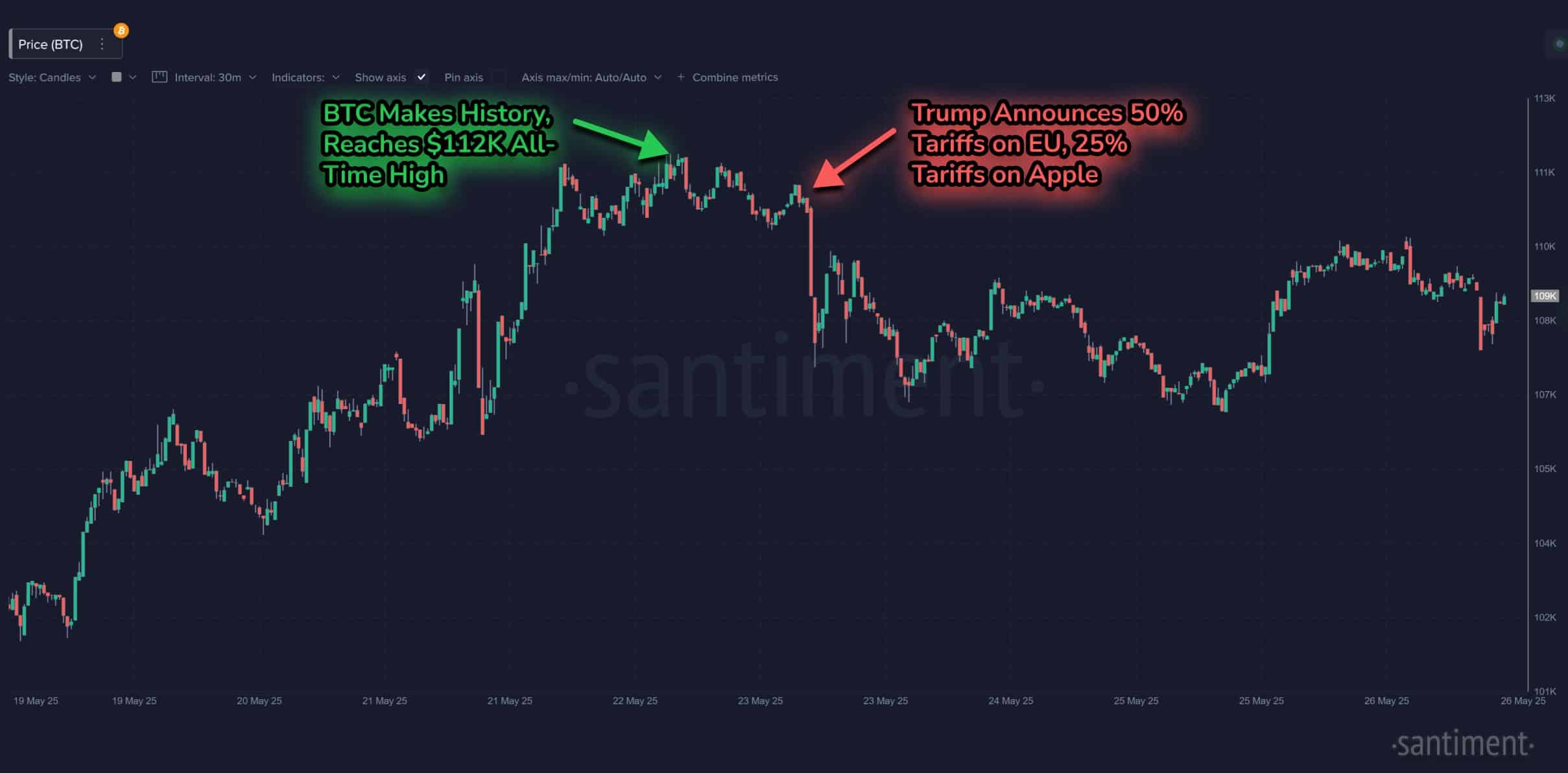

Geopolitical developments had essentially the most important affect on Bitcoin’s price development over the previous week. The market reacted shortly to hypothesis by the previous U.S. President Donald Trump relating to the reinstatement of aggressive tariffs – 50% in opposition to Chinese language items and 25% in opposition to the European Union.

The assertion frightened the crypto market, momentarily halting Bitcoin’s rally in direction of its report excessive.

The shock coverage uncertainty created promoting strain as threat sentiment relaxed. Traders pulled again, hesitant concerning the broad financial penalties of aggressive commerce coverage.

The consequence was a brief worth decline for Bitcoin – A reminder to the market of its vulnerability to macro headlines.

Tariff pause brings aid rally and a renewed hope

By midweek, nevertheless, a coverage pause de-escalated the strain. No transfer of any sort on the tariffs allowed markets to breathe, triggering a dramatic rebound in Bitcoin. The temper shifted from anxious to euphoric.

Social temper accelerated and buyers rushed again into longs, fueling a late-week surge.

This turnaround highlighted simply how delicate crypto is to hints on worldwide commerce. The extra decentralized it’s, the extra Bitcoin stays more and more entangled in world economics and investor psychology.

With the tariff risk now stalled, Bitcoin has area to consolidate and even transfer up. Particularly if macro stability persists.

Is Bitcoin emulating gold as a brand new safe-haven?

Curiously, the worth motion of Bitcoin is starting to maneuver in tandem with that of gold. When tariff tensions reached their peak, each the belongings dipped. When tensions eased, each surged. The hike in BTC-Gold correlation could also be an indication that buyers are retaining Bitcoin as a safe-haven asset, identical to gold.

In instances of macro uncertainty, conventional buyers search refuge in gold. Bitcoin, as soon as labeled too unstable to take action, now appears to be making its case in tandem.

Such a turnaround has the potential to change the way in which Bitcoin responds to world shocks going ahead.

Will the calm persist or is one other storm on the horizon?

Though the tariff pause is offering some non permanent aid, markets are nonetheless on excessive alert proper now. Merchants will observe extra feedback from the management in the US over the subsequent few weeks.

Any additional escalation could as soon as once more ship Bitcoin’s price down a spiral.