- Bitcoin noticed excessive buying and selling quantity within the derivatives markets, however not within the spot markets.

- The build-up of liquidation ranges at $100k and decrease may pull costs decrease.

Bitcoin [BTC] reached an all-time excessive of $111,980 on Binance on Thursday, the twenty second of Could. It was reported that the Open Curiosity (OI) reached a file excessive of $74 billion. The inflow of capital into the derivatives market in current days signaled bullish conviction.

On the similar time, quite a few liquidations have constructed up below the $100k degree. This might appeal to the value southwards, since worth is drawn to liquidity. Ought to merchants count on a pullback within the quick time period?

Supply: Coinalyze

Knowledge from Coinalyze confirmed that the OI pattern has flattened out after BTC reached a brand new all-time excessive. The Funding Price had been strongly optimistic, however over the previous 24 hours, it has fallen to impartial ranges.

Merchants want to arrange for a short-term pullback

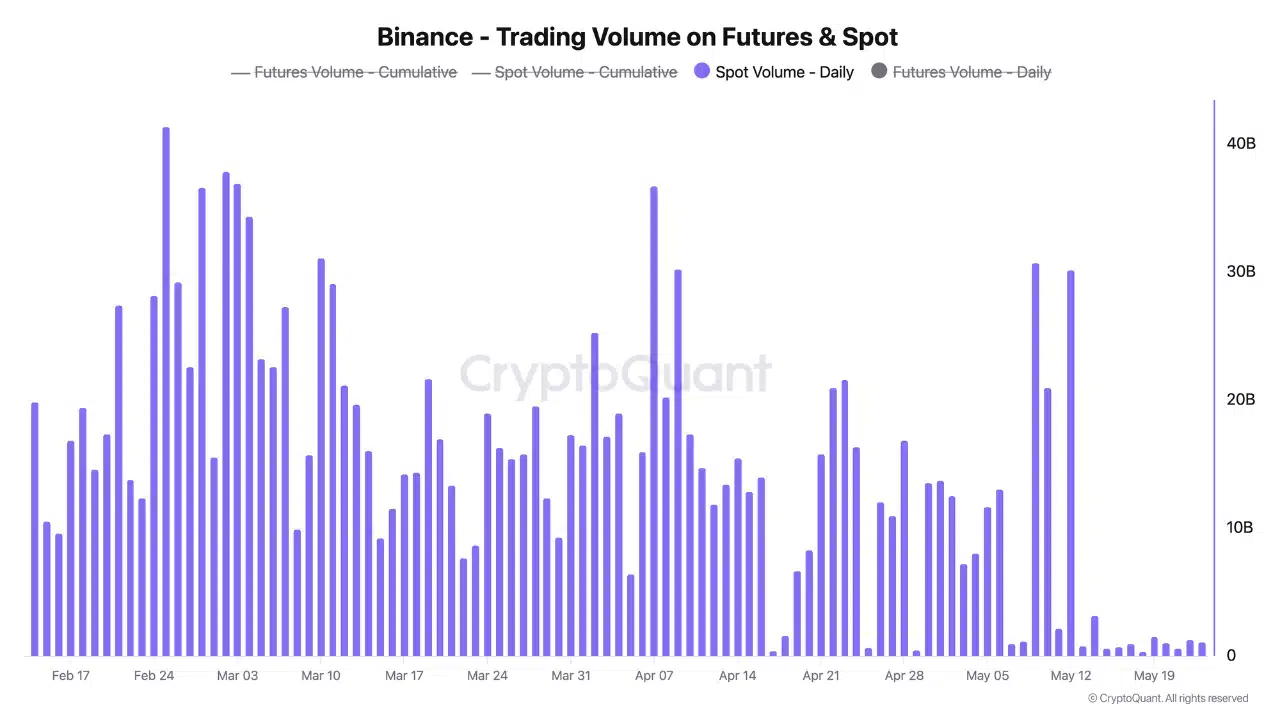

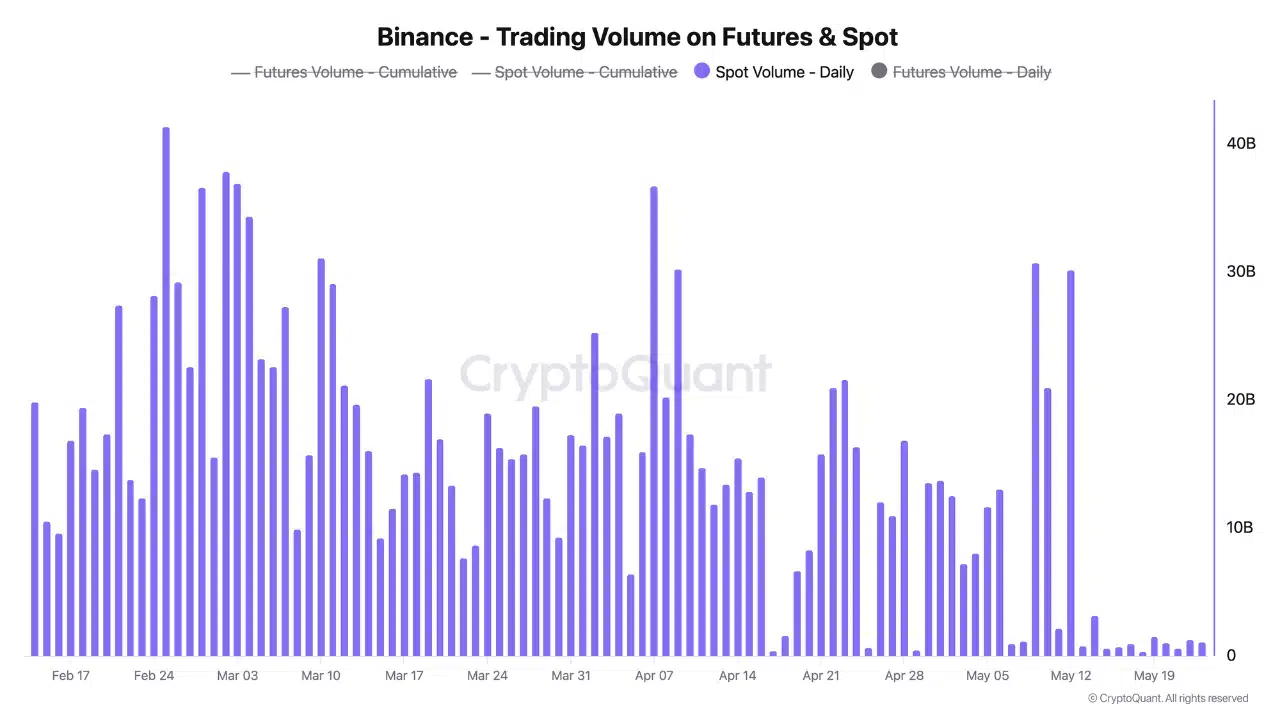

Supply: CryptoQuant

In a submit on CryptoQuant Insights, consumer Darkfost identified that the spot demand was dwindling. The futures buying and selling quantity was going robust, highlighting excessive speculative curiosity. But, the drop in spot quantity as Bitcoin entered its worth discovery part was a disappointment.

The dearth of spot demand urged traders had been cautious about shopping for BTC above the $94k-$96k space. This area served as resistance earlier in Could earlier than the value broke out to almost contact the $112k mark.

A rally led by the derivatives market may very well be vulnerable to heightened volatility and deeper pullbacks.

Zooming out to cowl the value motion of the previous six months, the 1-day chart of Bitcoin highlighted a potential vary formation (white). Two routes had been potential within the coming weeks- a sustained uptrend, or a reset to $100k and even $93k.

When ranges kind, worth motion inside the vary induces liquidation ranges to construct up across the extremes of the vary. The retracement to $77.5k in March and the next restoration noticed quick liquidations construct up at $99.6k, $108k, and $113k.

The primary two ranges have been swept. The dwindling spot demand urged a market reset was potential, and $113k is likely to be out of attain for now.

Supply: Coinglass

The three-month chart underlined the build-up of liquidation ranges at $100k and $92k as the following potential targets.

Relying on the profit-taking exercise and whether or not the bulls can discover their ft once more, Bitcoin would possibly cede $106k to the bears once more.