On-chain knowledge reveals the Ethereum investor profitability has seen a pointy turnaround following the newest rally within the asset’s worth.

Ethereum Holder Profitability Has Noticed A Dramatic Reversal Not too long ago

In a brand new post on X, the institutional DeFi options present Sentora (previously IntoTheBlock) has talked about how the profit-loss state of affairs has modified on the Ethereum community.

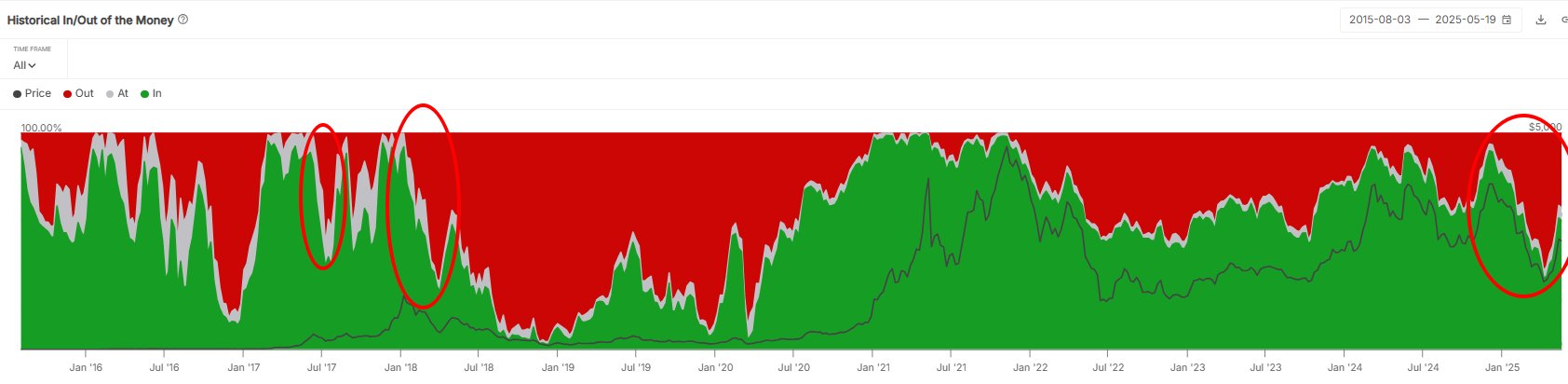

The on-chain indicator of relevance right here is the “Historical In/Out of the Money,” which tells us about what a part of the ETH userbase is in revenue (“within the cash”), loss (“out of the cash”) and simply breaking even (“on the cash”).

The metric works by going by means of the on-chain historical past of every deal with on the community to see what common worth it acquired its cash at. If this common price foundation is decrease than the spot worth for any pockets, then that individual person is taken into account to be within the cash. Equally, the deal with is assumed to be out of the cash within the reverse case and on the cash when the 2 costs are equal.

Now, here’s a chart that reveals the development within the Ethereum Historic In/Out of the Cash over the previous decade:

Appears like the quantity of inexperienced traders has gone up in current days | Supply: Sentora on X

As displayed within the above graph, the within the cash Ethereum traders had noticed a steep drop following the selloff that began in December 2024. Previous to this drawdown, the metric was sitting above 90%, implying the overwhelming majority of the customers have been holding unrealized good points. By April 2025, nonetheless, the state of affairs had fully flipped for the traders as this worth had come down to simply 32%.

Now, yet one more shift appears to have occurred for the cryptocurrency’s addresses, because the ETH worth has this time seen a pointy rally. Virtually 60% of the holders at the moment are again within the cash, which, whereas nonetheless not fairly close to the identical degree as late final 12 months, is considerably increased than the low.

Within the chart, the analytics agency has highlighted when Ethereum final noticed such sharp swings in profitability. “The asset hasn’t witnessed volatility on this scale because the 2017 cycle,” notes Sentora.

In another information, ETH has reclaimed two necessary on-chain ranges following its restoration run, because the analytics agency Glassnode has mentioned in its newest weekly report.

The value of the coin appears to have surpassed the True Market Imply | Supply: Glassnode's The Week Onchain - Week 20, 2025

From the chart, it’s obvious that Ethereum reclaimed the Realized Price early on within the run. The Realized Value represents the common price foundation of all traders on the ETH community. Presently, this degree is located at $1,900, that means that on the present trade charge, the holders can be in notable revenue.

The cryptocurrency has now additionally managed to surpass the True Market Imply positioned at $2,400, which is a mannequin is much like the Realized Value, apart from the truth that it goals to discover a extra correct common acquisition degree for the market by excluding long-lost dormant supply.

Ethereum now has only one extra degree left to reclaim: the Energetic Realized Value at $2,900, which is once more a mannequin that iterates on the Realized Value.

ETH Value

Ethereum has climbed to the $2,660 mark following a rally of about 4% within the final week.

The development within the ETH worth over the previous 5 days | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.