- Per Amberdata, ETH might rally greater if the U.S. spot ETH ETF staking is accredited.

- The choices market is positioned for a $6K upside ETH goal by December 2025.

Ethereum’s [ETH] latest 70% run-up from April lows could be the starting of a bigger uptrend concentrating on $3.5K-$6K, based on crypto choices analytics agency Amberdata.

In its weekly market report, Amberdata’s Greg Magadini wrote,

“There’s a very good argument for ETH ‘catching-up’ as spot ETFs with staking rewards might be a catalyst for institutional participation and sentiment turns round. No cause to be ‘calling tops’ proper now.”

ETH catalysts

The SEC has postponed its resolution on staking purposes for spot ETH ETFs from Grayscale and Hashdex, pushing the overview interval to between June and October.

However most analysts, together with Magadini, imagine this additional staking yield (3% per 12 months) might be a key catalyst for demand for spot ETH ETFs, ultimately rallying ETH.

In reality, the manager pointed to latest robust bullish inflows concentrating on $3.5K and $6K by year-end, suggesting merchants are positioning for such a state of affairs.

“ETH block trades final week noticed some very bullish move in EOY December choices. $3,500 / $6,000 name spreads traded for 30,000x contracts via 10 distinct trades. The whole premium spent right here was a bit over $7 million.”

Name choices are bullish bets or safety for the upside, reflecting bullish sentiment for future worth motion. Places, quite the opposite, confer with the alternative and draw back safety, underscoring a bearish bias.

Merely put, merchants anticipated ETH to rally between $3.5K and $6K by December 2025.

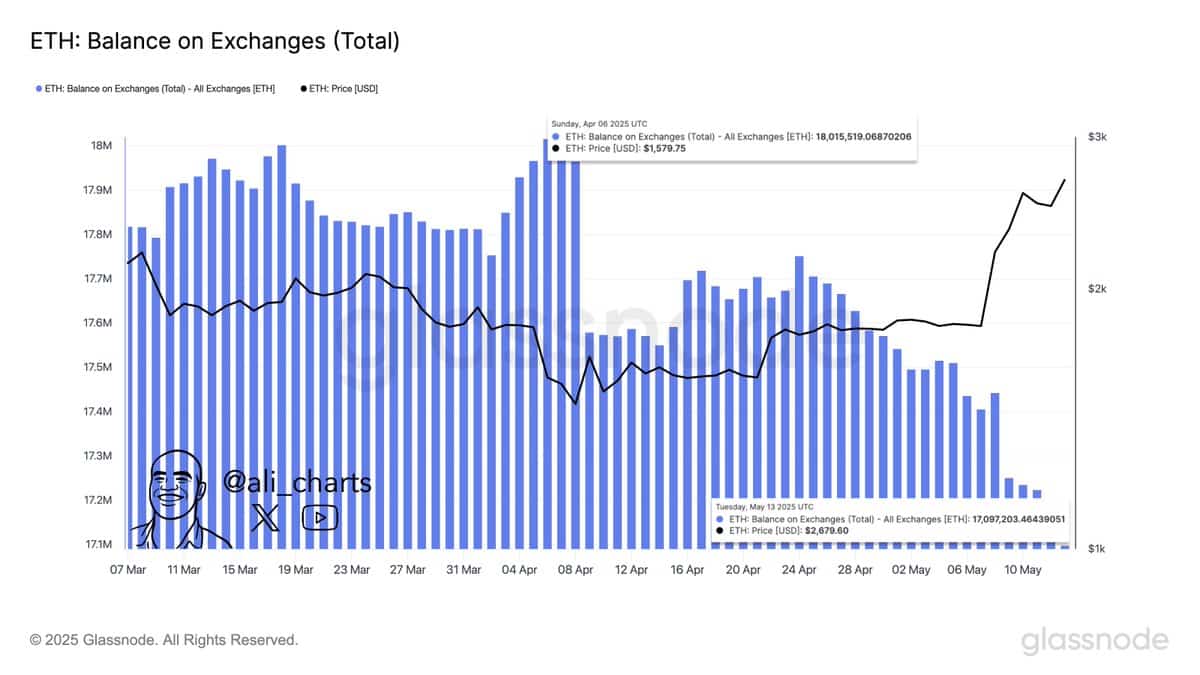

On-chain knowledge additionally supported the continued uptrend thesis. Since April, over 1 million ETH (about $2.38 billion) have been moved from exchanges between April and mid-Could.

This mirrored broader accumulation amid the renewed altcoin surge.

That’s a major discount in promoting strain that would additional enhance the rally. Regardless of the mid-term bullish outlook, ETH’s short-term momentum weakened barely at press time.

Based on crypto dealer and analyst, Income Sharks, ETH’s On Stability Quantity (OBV) retreated, suggesting decreased quantity that would drag the rally.

Apart from, he added that the formation of a bearish head and shoulder sample might drag ETH decrease if validated.

On the every day worth chart, nonetheless, ETH flashed a golden cross, a formation that typically precedes large rallies.