Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin has spent the higher a part of three years digesting its 2021 blow-off-top, but the favored meme-coin could also be about to depart the consolidation vary behind, based on a contemporary weekly chart shared on X by the pseudonymous analyst Maelius (@MaeliusCrypto).

Dogecoin ‘Appears to be like Unbelievable’

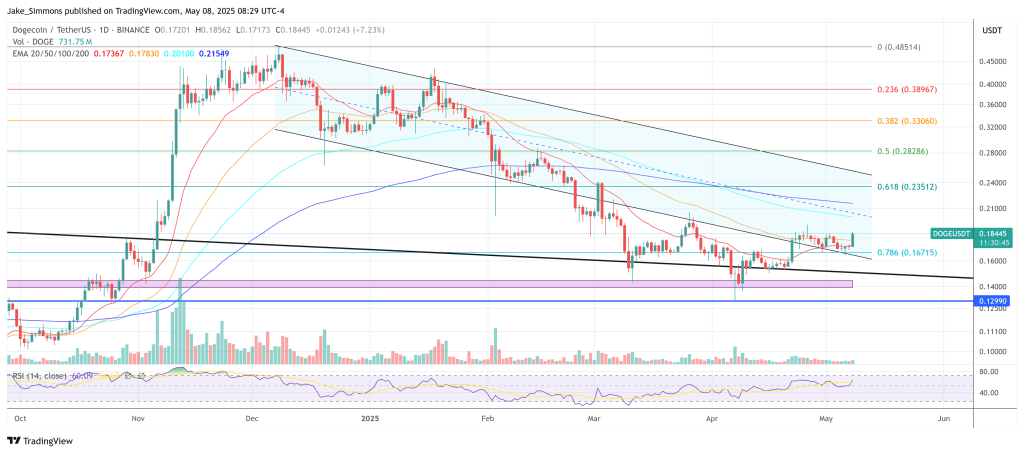

The DOGE/USDT pair on Binance is printing a weekly candle at $0.1828 (open 0.1705, excessive 0.1833, low 0.1643), up 7.2% on the week. Two long-term shifting averages body the present construction: the 50-week exponential shifting common (EMA-50) at $0.203 in blue and the rising 200-week EMA (EMA-200) at $0.138 in purple. Worth sliced beneath the EMA-50 earlier this 12 months, however—crucially in Maelius’ view—by no means misplaced the EMA-200, which now sits inside a broad, slate-coloured demand zone operating roughly from $0.11 to $0.20.

A second layer of assist comes from an ascending purple trend-line that hyperlinks the October 2023, August 2024 and April 2025 swing-lows. The newest pullback, labelled “2” on the chart, bounced nearly exactly the place that diagonal meets the EMA-200 and the decrease fringe of demand—an space of triple confluence that technicians typically see as a textbook springboard for the subsequent advance.

Associated Studying

Maelius’ major thesis rests on a nested 1-2, 1-2 Elliott Wave depend. The primary “1-2” sequence started with a thrust to ~$ 0.2288 in March 2024, retraced to $ 0.0805 in August the identical 12 months, after which ignited a bigger impulsive leg that topped close to $0.4843 in December final 12 months (labelled the second “1”). The corrective follow-through to $0.1298 in April accomplished the second “2”.

In Elliott terminology, two consecutive 1-2 buildings “wind the spring” for wave 3 of (3)—traditionally the longest and steepest portion of an impulse. Maelius locations the approaching third wave, its subsequent fourth-wave consolidation, and a remaining fifth wave within the clean space above present worth.

He predicts DOGE to achieve roughly $1 as a part of the third wave, adopted by a correctional fourth wave beneath $0.70. The fifth wave is forecasted to achieve its climax someplace between $1.30 and $1.70.

Associated Studying

Beneath the value motion sits the WaveTrend Oscillator (WTO), a momentum indicator intently associated to the TSI that measures the space between an asset’s worth and its personal smoothed values. The WTO prints two traces and a histogram; a bullish cycle begins when the quicker line crosses above the slower one from oversold territory (–60/–53 in the usual settings).

That cross has simply fired on the 1-week timeframe for the primary time because the August 2024 low. The histogram has shifted from deep purple to impartial gray, echoing related transitions that preceded Dogecoin’s previous vertical advances.

Put collectively, the chart describes a market that’s holding a multi-year demand block, buying and selling above its 200-week EMA, testing—although not but reclaiming—its 50-week EMA, and exhibiting a contemporary bullish momentum cross. From a pure-chart standpoint, these components fulfill lots of the situations technicians search for when searching the beginning of a major development leg.

Maelius concludes: “DOGE appears unbelievable right here, regardless of the very fact it went decrease as I initially anticipated (was anticipating EMA50 to carry).Respecting main demand space, EMA200 in addition to diagonal assist and it looks as if 1,2,1,2 is accomplished and now we head for third EW (inside bigger third). 1W WTO just lately crossed, which can be supportive of backside being in.”

At press time, DOGE traded at $0.18445.

Featured picture created with DALL.E, chart from TradingView.com