- The Ethereum market is front-running prefer it’s already priced in alpha.

- Whether or not it fuels the subsequent leg up or triggers a reset will depend on whether or not the bid can take up the unlock.

Ethereum’s [ETH] Pectra improve is sort of right here, and the market’s transferring prefer it is aware of one thing large is brewing.

Whale wallets are quietly stacking, underwater holders are staying glued to their baggage, and the estimated leverage ratio is creeping up. In brief, basic indicators of a shift towards risk-on habits.

Nonetheless, is that this a textbook accumulation section or only a “hype cycle” with a brief fuse? If HODLers begin offloading as soon as the worth flips above their value foundation, we might see a liquidity squeeze.

Both method, Pectra may simply be the catalyst that decides it.

Conviction capital underpins Ethereum’s risk-on rally

Ethereum’s whale handle depend (1k – 10k ETH) has been defying value motion since ETH broke $4,000 on the seventh of December.

At that value, 4,643 whale addresses have been within the recreation. Quick-forward to at this time, and at the same time as ETH dips to $1,843, the whale depend has surged to 4,953.

What’s occurring?

These whales are holding their floor, sitting on unrealized losses, ready for ETH’s spot value to flip their value foundation. CryptoQuant data tells the story: ETH holders aren’t budging. As an alternative, they’re accumulating extra.

On the tenth of March, they held 15.5356 million ETH, and by the third of Might, that had jumped to 19.0378 million ETH – a 22.54% enhance.

This habits is textbook structural conviction, with whales betting on short-term upside. If Pectra delivers, count on these sidelined baggage to rotate into realized good points – a long-awaited payoff for his or her persistence.

Market leaning bullish, but hedged

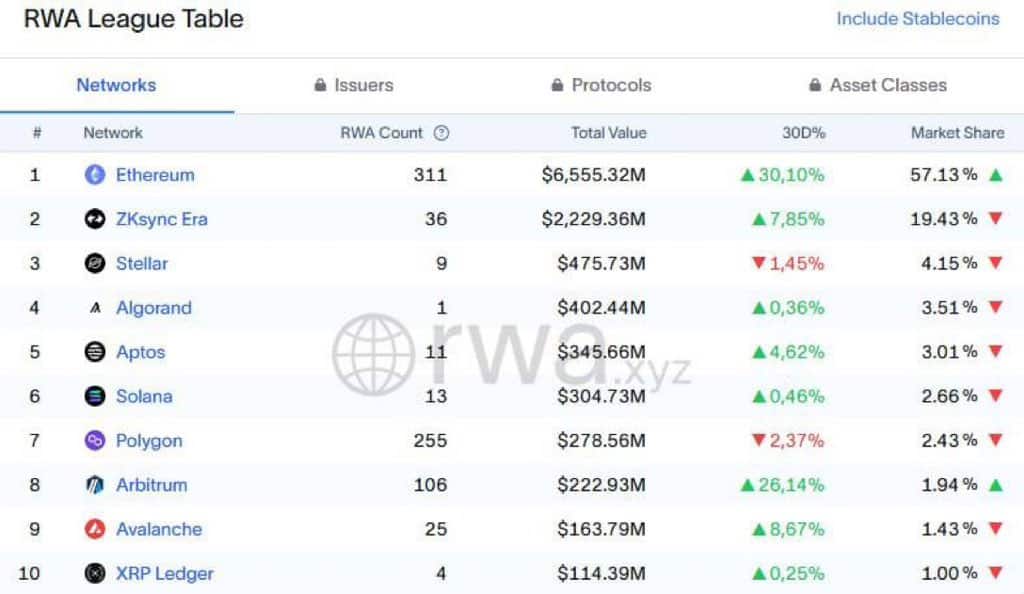

Ethereum is flexing its on-chain dominance with $6.5 billion in real-world asset (RWA) TVL – far outpacing the remainder of the L1 pack. The hole isn’t shut both – ZKsync Period trails with simply $2.2 billion locked.

Little doubt, with regards to real-world asset adoption, Ethereum stands unmatched. Pair that with whale conviction, and its fundamentals are wanting rock strong.

However value motion? Nonetheless caught beneath $2,000. It’s like Ethereum’s bought all the fitting wiring, however the gentle’s simply not flickering on but.

Enter Pectra. That is the place the subsequent spark might come from, and why the market’s watching so intently. If Pectra lives up to the “hype”, we may simply see ETH lastly flip the lights on.

The countdown’s on: Can the hype flip into good points?

Warning persists. Ethereum’s Exchange Reserves have been unstable, spiking from 19.10 million to 19.8 million ETH in April, signaling hesitation out there.

For ETH to kick off an actual rally, it must crack $2,000 with reserves on a gradual decline. With out that, a strong surge remains to be within the “possibly” zone.

In the meantime, futures merchants are feeling extra assured. The Estimated Leverage Ratio (ELR) has been climbing since November, displaying they’re gearing up for a possible transfer.

Consequently, liquidity squeezes are prone to tag together with any bullish momentum.

That stated, present market indicators level to a hype-driven cycle, with restricted upside potential, until there’s a shift in structural demand. Due to this fact, whales could have to wait a bit longer for their rewards.