Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

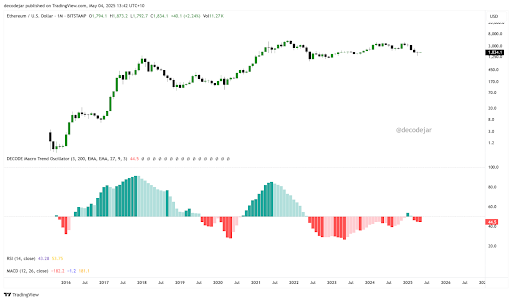

Ethereum’s worth motion may have struggled to achieve traction in current weeks, however an fascinating long-term macro indicator is exhibiting signs of early recovery beneath the surface. Notably, a macro development oscillator created by a crypto analyst referred to as Decode on social media platform X has begun to exhibit signs of a turnaround after an unusually extended stretch of bearish run. If confirmed, this could mark the start of a brand new part of energy for the second-largest cryptocurrency by market cap.

Shallow Purple Bars Start Turning On Ethereum’s Multi-Timeframe Development Evaluation

The oscillator’s month-to-month chart, overlaid with Ethereum’s worth information on the month-to-month candlestick timeframe, clearly exhibits how deep and sustained the current bearish momentum has been. The pink histogram bars reflecting macro weak spot continued effectively past typical durations, highlighting the broader financial drag that has weighed on the crypto market.

Associated Studying

Apparently, January of this 12 months briefly hinted at a return to bullish territory, however the inexperienced print turned out to be a false begin and rapidly light because the cryptocurrency kicked off one other downturn. Nevertheless, the magnitude of current pink bars is notably shallower in comparison with downturns in 2023 and 2024.

This refined shift is extra obvious on the decrease timeframes, significantly the 3-day chart, which exhibits a clear rejection from the damaging territory and the formation of a small inexperienced bar earlier than the present pullback. The analyst, Decode, interprets this as a doable early-stage turnaround. As soon as the oscillator turns inexperienced in a sustained trend, a fast upward transfer in Ethereum and broader crypto costs is more likely to observe, following comparable transitions previously.

Inexperienced Part Will Dominate Quickly

Looking beyond crypto, Decode’s oscillator additionally tracks the S&P 500 and broader macro developments, the place the identical sample holds: inexperienced phases will not be solely extra extended but additionally steeper and extra sturdy. This uneven distribution of momentum throughout time displays the true bias of belongings towards growth over contraction. Decode famous that this isn’t merely an indicator with arbitrary thresholds however a completely built-in macroeconomic index constructed from 17 metrics. These embody equities, bonds, commodities, foreign money flows, central financial institution liquidity (M2), and even sentiment information.

Associated Studying

Translating this into Ethereum, this gradual shift towards the inexperienced zone is seen as a sign of incoming worth energy. Though Ethereum has but to totally get better from its current correction to $1,400, the refined however constant enchancment in Decode’s macro development oscillator hints that the cryptocurrency could also be coming into right into a contemporary uptrend. Proper now, the main target is on inexperienced bars printing constantly once more, particularly throughout a number of timeframes.

On the time of writing, Ethereum is buying and selling at $1,830. The final 24 hours have been marked by a brief break below $1,800 earlier than bouncing at $1,785. This transfer prompted liquidations of roughly $35.92 million in ETH positions, with lengthy positions accounting for $28.38 million of that quantity.

Featured picture from Getty Photos, chart from Tradingview.com