Traditionally, the Bitcoin value is an indicator of the blockchain’s well being, with excessive exercise typically correlating with sturdy and optimistic value motion. Nevertheless, the most important cryptocurrency market appears to have witnessed a major shift, with costs now much less conscious of modifications in on-chain activity.

As an illustration, the Bitcoin value continues to carry above $95,000 and appears set to reclaim the $100,000 stage regardless of the sustained dip in blockchain exercise. An on-chain analytics agency has weighed in on how and why that is doable for the flagship cryptocurrency.

Why BTC Value Is Much less Correlated To On-Chain Exercise

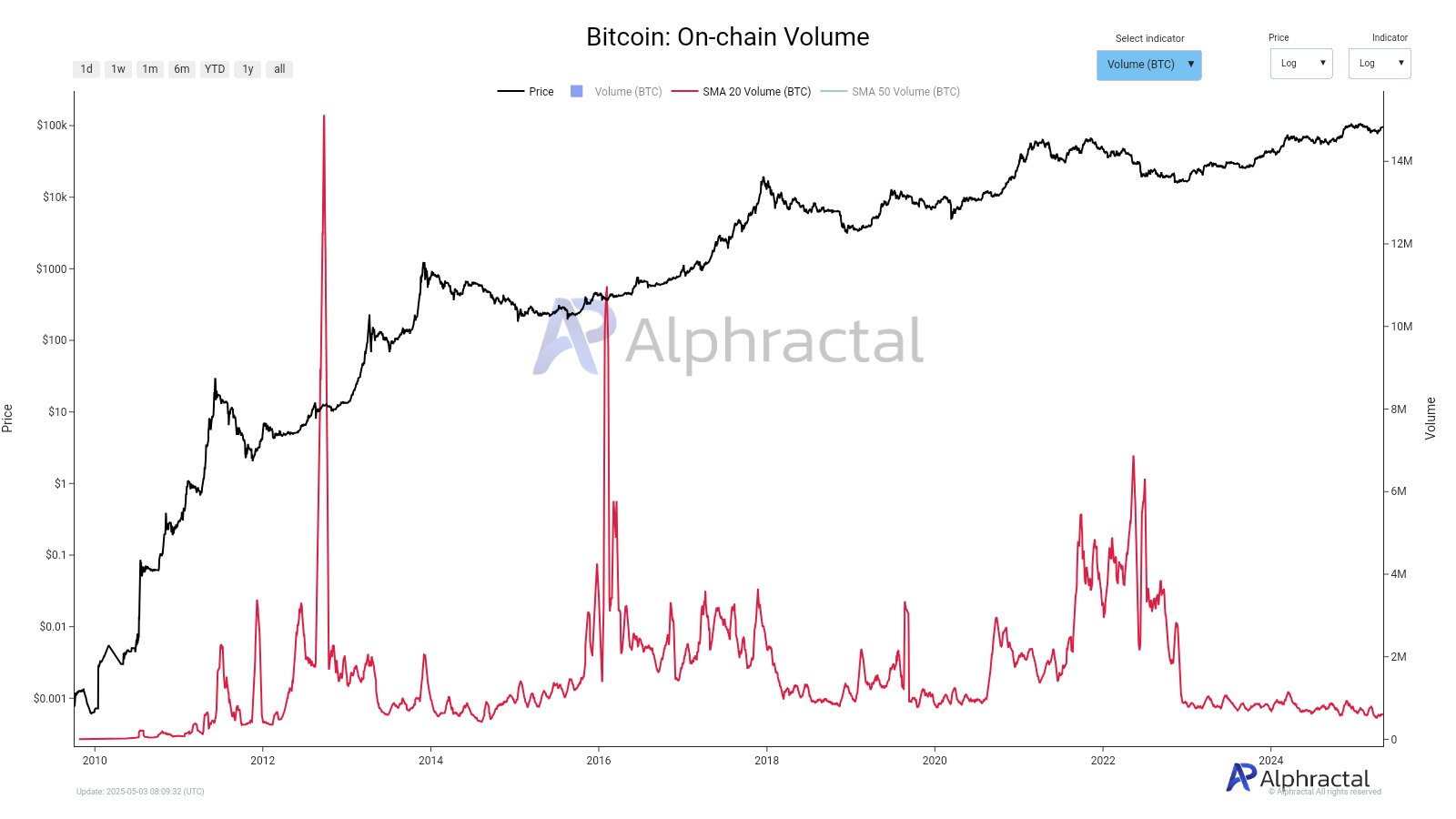

Crypto analytics platform Alphractal shared in a brand new publish on X the key the explanation why the Bitcoin value has managed to remain afloat regardless of transaction quantity and energetic addresses being at low ranges. In line with the agency, BTC’s value rise doesn’t essentially correlate to elevated blockchain utilization.

Firstly, Alphractal acknowledged that the Bitcoin market skilled a dynamic shift when the US spot exchange-traded funds (ETFs) had been authorised in January 2024. The worth of BTC is now being pushed by capital inflows by these monetary merchandise slightly than blockchain exercise.

Supply: @Alphractal on X

The on-chain agency additionally talked about that the historically low volatility out there has had a serious half to play within the low Bitcoin community exercise. With comparatively little value motion, merchants are much less incentivized to take new positions, resulting in decrease on-chain exercise.

Moreover, Alphractal talked about that the Bitcoin value has been stored afloat largely by the actions of speculative merchants by derivatives and different monetary devices. Because of this, there was a diminished on a regular basis adoption and restricted sensible demand for the Bitcoin community.

Alphractal additionally alluded to the macroeconomic uncertainty that has clouded the worldwide monetary markets in current weeks. In line with the on-chain analytics agency, this market situation, regardless that enhancing, has most traders ready for clearer bullish indicators earlier than making any transfer.

Lastly, Alphractal highlighted synthetic alternate volumes amongst the principle causes for the Bitcoin price staying afloat. “Some alternate quantity could also be inflated, making a deceptive sense of exercise whereas actual community utilization stays modest,” the on-chain platform added.

Bitcoin Value At A Look

As of this writing, the price of BTC stands at round $96,150, reflecting an over 1% decline previously 24 hours. Regardless of the uneven value motion this weekend, the premier cryptocurrency continues to be up by almost 2% on the weekly timeframe, in keeping with knowledge from CoinGecko.

The worth of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.