Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

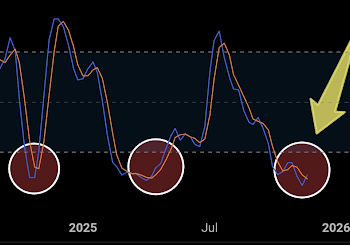

XRP’s value motion has been highlighted by a rejection at $2.35, followed by a bounce at $2.15. This preliminary rejection follows a short rally within the final week of April, which, apparently, noticed it break above a downward-sloping resistance trendline that has outlined its construction since early January 2025. Nevertheless, the rejection has since been adopted by a retest of this trendline, however this pullback is seen as a setup for a possible breakout to ranges above $4 slightly than an outright rejection.

Trendline Breakout In Focus With Swing Failure Sample

In response to a technical analysis on the TradingView platform, XRP/USDT is now urgent in opposition to the zone of a major descending trendline on the every day candlestick timeframe chart. This trendline, which has guided the broader bearish construction since January 2025, was beforehand answerable for notable value rejections in February and March. Nevertheless, the latest interplay with this trendline seems totally different, and XRP could also be shifting from a sample of decrease highs to a breakout and retest formation.

Associated Studying

The notable improvement right here is the sequence resulting in the breakout try. XRP first surged upward in late April and moved above the trendline. However as a substitute of collapsing again into the earlier vary, the worth briefly retraced and shaped the next low, which is a crucial structural change within the bullish model of a swing failure sample (SFP).

On this case, the failed low shaped after the breakout hints at a reversal of the prior downtrend, and this reversal was validated when XRP closed on April 30. As proven within the chart beneath, this swing failure sample has now flipped bullish with quantity rising, an early signal of a rebound and rally.

Including to this outlook, the trendline has been touched a number of occasions over the previous 5 months, making a confirmed shut above it essential. The white arrow drawn on the chart signifies the anticipated route of the XRP value if the bounce is sustained.

$3.00 Resistance Is Essential For Subsequent Worth Explosion

A bullish every day shut above this trendline would break the bearish structure that has outlined XRP’s value because the begin of the 12 months. If profitable, this could open the XRP value to an eventual run above $4 if everything goes right.

Associated Studying

Nevertheless, in line with the analyst, probably the most quick degree to watch is the $3.00 resistance. A every day shut above this spherical psychological degree, mixed with a quantity spike, might open the way in which for XRP to surge towards the subsequent key zones.

These zones embody $3.31, which coincides with the excessive on January 16, which is the subsequent clear liquidity degree. The following zone could be round its present all-time excessive. Past that, $4.6209 is the subsequent longer-term breakout target.

On the time of writing, XRP is buying and selling at $2.20.

Featured picture from Adobe Inventory, chart from Tradingview.com