- U.S. — China tensions are driving a long-term shift in international commerce dependencies.

- Bitcoin reveals bullish potential amid rising geopolitical and financial uncertainty.

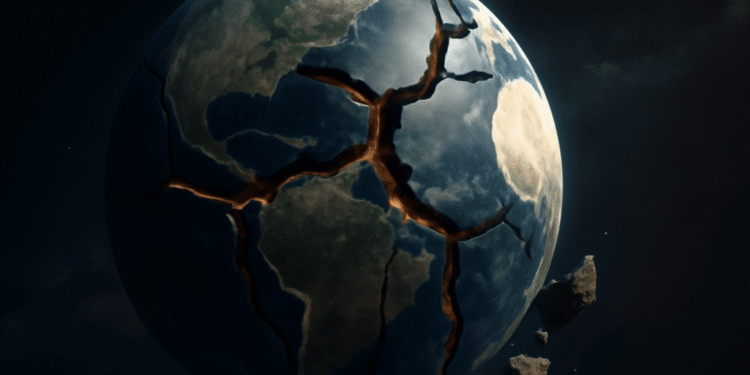

International commerce is present process a profound transformation as U.S.-China tensions, initially triggered by tariff insurance policies.

This has additional developed right into a deeper and doubtlessly irreversible shift in worldwide financial dynamics.

Ray Dalio stays optimistic about crypto’s future

Nonetheless, Ray Dalio, founding father of Bridgewater Associates, suggests that whereas some stay optimistic that future negotiations might restore stability.

He believes {that a} rising variety of stakeholders, significantly these on the frontlines of commerce, are getting ready for a long-term decoupling.

Companies throughout sectors are reassessing their dependencies on the U.S. and redirecting their methods in anticipation of a fragmented international system.

This sentiment is unfolding in opposition to a backdrop of deteriorating financial frameworks, rising political volatility, and escalating geopolitical divisions that echo historic patterns of systemic collapse.

Seeing this prediction, an X person replied,

“@grok what property will profit from this adjustments?”

Which property profit most from this modification?

Due to this fact, as the worldwide crypto market experiences minor fluctuations, with Bitcoin [BTC] hovering close to $95,160 and broader capitalization dipping barely, analysts stay centered on deeper undercurrents shaping market path.

Technical indicators like RSI and CMF trace at bullish momentum quietly constructing beneath the floor.

Moreover, market analyst Willy Woo believes Bitcoin might quickly try a decisive breakout, doubtlessly pushing previous the $96K mark if present patterns maintain.

But, past value motion, there’s a rising name for strategic foresight.

Consultants like Ray Dalio emphasize that resolving as we speak’s financial and geopolitical imbalances requires greater than reactive insurance policies, it calls for calm, coordinated efforts that deal with structural challenges head-on.

Due to this fact, as time runs out for considerate motion, traders, and policymakers are urged to concentrate on deeper monetary adjustments, not short-term market swings.