The Bitcoin (BTC) market was extremely bullish within the final week, with costs leaping by over 10%. Amidst this optimistic growth, there was notable investor exercise, which factors to an unyielding demand that would help a sustained worth uptrend.

BTC Provide Shake-Up: Lengthy-Time period Holders Enhance, New Consumers Step In Above $92K

In a latest X post, standard crypto pundit Axel Adler Jr. shared some fascinating on-chain insights on the Bitcoin market.

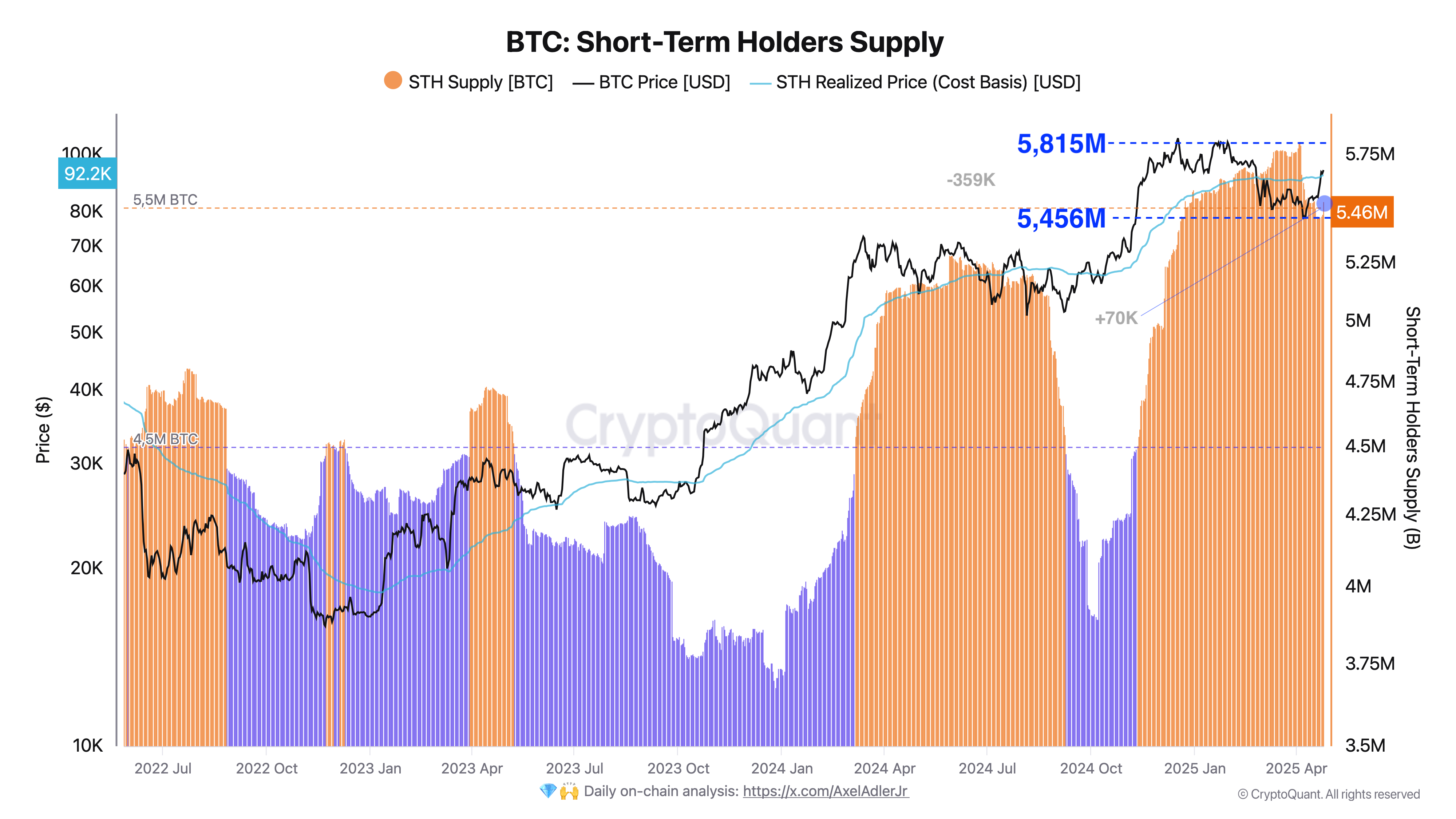

Utilizing information from CryptoQuant, Adler experiences that the market provide of short-term holders decreased by 359,000 BTC, valued at $33.84 billion, over 16 days between April 4-21. Apparently, this decline was not as a consequence of promoting strain however slightly coin maturation, leading to a transition to the long-term holders class.

This can be a optimistic market sign indicating that holders are assured in Bitcoin’s long-term prospects. By opting towards promoting, holders are strengthening the underlying market demand, offering a stable basis for future worth rallies.

In one other fascinating growth, Axel Adler Jr additionally famous that BTC short-term holders’ provide grew by 70,000 BTC, valued at $6.59 billion, within the final two days following Bitcoin’s newest worth rally.

The analyst explains that this improve resulted from profit-taking by long-term holders by way of redistribution as costs climbed. Importantly, short-term holders have successfully absorbed this new provide, signaling sturdy demand within the Bitcoin market.

This demand is very mirrored in Bitcoin’s capacity to stay above $92,200, the short-term holders’ price foundation, representing the common acquisition worth for his or her holdings. This means a sturdy market confidence as new consumers are aggressively getting into the market, increasing the STH cohort.

General, the mixture of serious coin maturation, wholesome redistribution, and Bitcoin’s resilience above the short-term holders’ price foundation highlights a structurally sturdy market demand. With long-term holders demonstrating confidence and new demand successfully absorbing provide, BTC seems well-positioned for sustained upward momentum within the close to to mid-term.

Bitcoin Value Overview

On the time of writing, Bitcoin trades at $94,408, reflecting a 0.78% decline within the final day. Nonetheless, each day asset buying and selling quantity is down by 55.53%, suggesting a waning market participation.

Nonetheless, BTC appears to be like set to take care of its worth uptrend, having moved previous the major resistance level at $91,000, supported by different bullish developments, together with a revival in ETF inflows totaling roughly $3.06 billion over the previous week.

The subsequent resistance lies at $96,000, shifting previous which may pave the way in which for an extra worth rise to round $100,000. Nonetheless, a worth rejection may power a return to round $92,000, successfully making a range-bound motion.

Featured picture from The Financial Instances, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.